AFP, COLORADO SPRINGS, Colorado

The US company Orbit Fab is aiming to produce the go-to “gas stations” in space, its CEO said, hoping its refueling technology will make the surging satellite industry more sustainable — and profitable.

The solar panels typically attached to satellites can generate energy for their onboard systems such as cameras and radios, but cannot help the orbiting objects adjust their positions, said Daniel Faber, who cofounded the company in 2018.

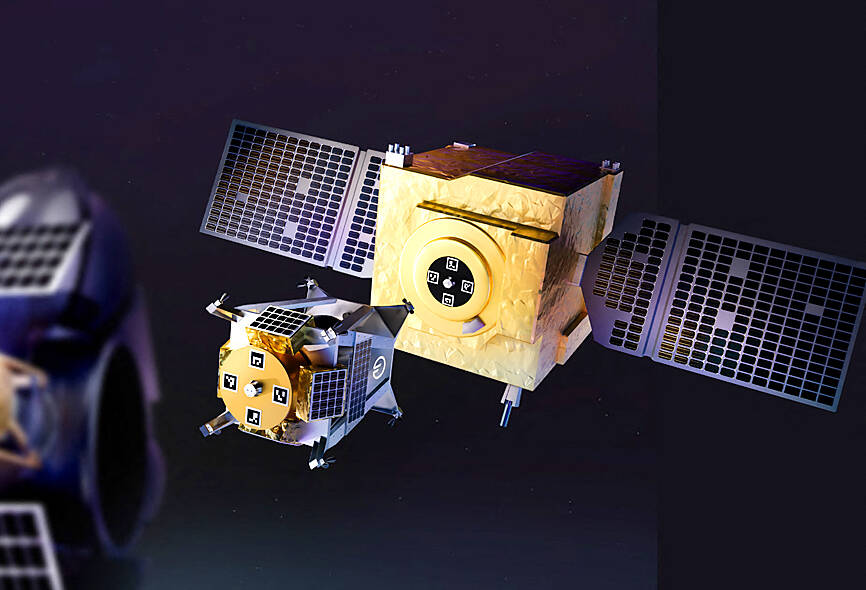

Photo: AFP / handout / Orbit Fab

“Everything always drifts, and so very quickly, you’re not where you needed to be — so you need to keep adjusting, which means you need to keep using up propellant,” he said at the space industry’s annual gathering in Colorado Springs, Colorado.

Satellites’ lives are therefore limited by how much fuel they can carry along with them — at least for now.

“If you can refuel satellites in orbit, you can stop them having to be thrown away,” which is “crazy” due to their high cost to manufacture and launch, Faber said.

His company envisions sending several large tanks into orbit, each containing up to several tons of fuel.

Then smaller, more easily maneuverable vessels would shuttle back and forth between the tanks and satellites — like robotic pump attendants.

Asked what the risks associated with operating such a system in orbit are, Faber responded candidly.

“Everything you might imagine,” he said.

However, with lots of testing on the ground, and in orbit, “it’s going to be safe,” he added.

Like cars, satellites hoping to receive additional propellant from Orbit Fab would have to have compatible fuel ports.

Faber said that between 200 and 250 satellites are already being designed to use his company’s system.

It is a market with room to grow, as about 24,500 satellites have been scheduled for launch between last year and 2031, space and satellite consultancy Euroconsult Group said.

Orbit Fab, which employs about 60 people and is looking to hire 25 more, has already launched one tank into orbit and plans to conduct fuel transfer tests.

In 2019, it proved the feasibility of the system with water-transfer tests at the International Space Station.

“Our first contract with the US government is to deliver them fuel in 2025” to Space Force satellites, Faber said.

He said they are planning to launch only a couple fuel shuttles to geostationary orbit, where satellites mostly lie in “a single plane around the equator” at a high altitude of about 36,000km.

Satellites in low Earth orbit have much different trajectories, and more fuel shuttles would be needed.

Another added benefit of refueling in orbit is the possibility of freeing up the key metric in rocket launches: weight.

Projects which were previously deemed infeasible for being too heavy might therefore see the light of day.

But above all, extending the life of satellites makes them more profitable in the long run.

Apart from refueling, companies are also looking at other ways of servicing satellites, with Faber saying that about 130 companies have recently popped up in the sector.

These include in-orbit “tow trucks” that can approach satellites in trouble and make repairs, such as helping deploy a solar panel or reorienting an antenna.

Orbit Fab, which recently announced it had raised US$28.5 million, has a “symbiotic” relationship with these start-ups, Faber said.

Their machines would need refueling and in return could “be doing things that we want, services we want, maybe repair our spacecraft, if there’s a problem,” he said.

They have already struck an agreement to refuel craft launched by Astroscale Holdings Inc, a Japanese company seeking to clear space debris, among other services.

Orbit Fab also aims to serve private space stations currently under development.

It is also looking toward a possible market on and around the moon, focusing not on extracting materials, but transforming them into propellant and delivering that to clients.

“At the moment, there’s nothing there” on the moon, Faber said. “In five, 10, 20 years’ time, we expect that will change dramatically.”

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to