BANKING

Central banks cut Fed swaps

From Monday next week, the world’s top central banks will reduce the frequency of their US dollar operations with the US Federal Reserve after volatility in financial markets receded, the banks said in a joint statement yesterday. The European Central Bank (ECB) the Bank of Japan, the Bank of England and the Swiss National Bank have been conducting daily US dollar swaps with the Fed for the past month, but will revert to weekly tenders, given improvements in US dollar funding conditions, they said. The daily tenders were made available after the failure of Silicon Valley Bank and the sale of Credit Suisse sent jitters across financial markets, raising the risk of liquidity shortages in case confidence falls further. However, the facility was barely used and the takeup was at or near zero on most days since the facility was announced on March 19. “These central banks stand ready to re-adjust the provision of US dollar liquidity as warranted by market conditions,” the ECB said in a statement.

FOOD

Price hikes lift Nestle sales

Nestle SA’s sales growth unexpectedly accelerated, bolstered by Purina and Friskies petfood and as the maker of Nescafe coffee raised prices further. Sales rose 9.3 percent on an organic basis in the first quarter, Nestle said yesterday. Demand was more resilient than expected, as the maker of KitKat bars kept boosting prices near the highest rate in decades. Nestle said pet owners helped drive an increase of 16 percent in petcare revenue. The next biggest gains were in confectionery and coffee, it said. Despite very strong headline numbers, individual units betrayed some weaknesses: Sales declined at Nespresso and Nestle’s vitamins, supplements and minerals business. Capacity constrains also weighed on the water brand Perrier, the company said.

PHARMACEUTICALS

Novartis raises profit outlook

Parmaceutical giant Novartis AG yesterday said it was increasing its full-year sales and profits outlook after strong earnings in the first quarter on the back of a handful of new drugs. The Swiss drugmaker said that its medicines for heart disease, cancer and multiple sclerosis had buoyed earnings in the quarter. The group reported a 3 percent increase in net profit in the first quarter to nearly US$2.3 billion, while sales also rose 3 percent compared with the previous three months to almost US$13 billion. Novartis said that its operating profit would likely increase in the high single-digits this year on the back of strong momentum at the start of the year, while group sales are expected to grow in mid-single digits.

INDUSTRIALS

ABB raises sales forecast

ABB Ltd yesterday raised its guidance for the year after a surge of new orders added to its backlog and higher prices drove better-than-expected results. The Swiss industrial manufacturer now expects comparable revenue to increase more than 10 percent this year, after estimating about 5 percent in February, it said in a statement. New customer orders reached US$9.5 billion in the first quarter, an increase of 1 percent from a year earlier and exceeding an average analyst estimate of US$8.3 billion, it said. ABB added that it plans to delist its American depositary receipts from the New York Stock Exchange, saying it is no longer necessary that investors can trade digitally on multiple platforms. The delisting is expected to take effect on or around May 23.

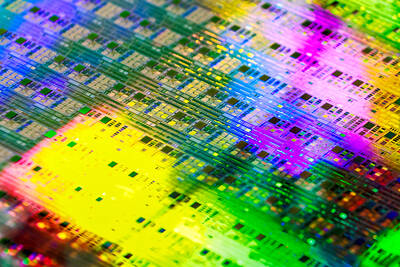

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It

EXPORT GROWTH: The AI boom has shortened chip cycles to just one year, putting pressure on chipmakers to accelerate development and expand packaging capacity Developing a localized supply chain for advanced packaging equipment is critical for keeping pace with customers’ increasingly shrinking time-to-market cycles for new artificial intelligence (AI) chips, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday. Spurred on by the AI revolution, customers are accelerating product upgrades to nearly every year, compared with the two to three-year development cadence in the past, TSMC vice president of advanced packaging technology and service Jun He (何軍) said at a 3D IC Global Summit organized by SEMI in Taipei. These shortened cycles put heavy pressure on chipmakers, as the entire process — from chip design to mass

People walk past advertising for a Syensqo chip at the Semicon Taiwan exhibition in Taipei yesterday.

NO BREAKTHROUGH? More substantial ‘deliverables,’ such as tariff reductions, would likely be saved for a meeting between Trump and Xi later this year, a trade expert said China launched two probes targeting the US semiconductor sector on Saturday ahead of talks between the two nations in Spain this week on trade, national security and the ownership of social media platform TikTok. China’s Ministry of Commerce announced an anti-dumping investigation into certain analog integrated circuits (ICs) imported from the US. The investigation is to target some commodity interface ICs and gate driver ICs, which are commonly made by US companies such as Texas Instruments Inc and ON Semiconductor Corp. The ministry also announced an anti-discrimination probe into US measures against China’s chip sector. US measures such as export curbs and tariffs