UBS Group AG yesterday said that it would likely complete its takeover of stricken rival Credit Suisse Group AG in the second quarter, as the bank posted an underwhelming first-quarter net profit of US$1 billion, down from US$2.1 billion a year earlier.

Net income for the first quarter was reduced by an increase in litigation provisions of US$665 million to settle an old dispute linked to the subprime crisis in the US.

The bank said it was in advanced discussions with the US Department of Justice and reported progress toward settling the case.

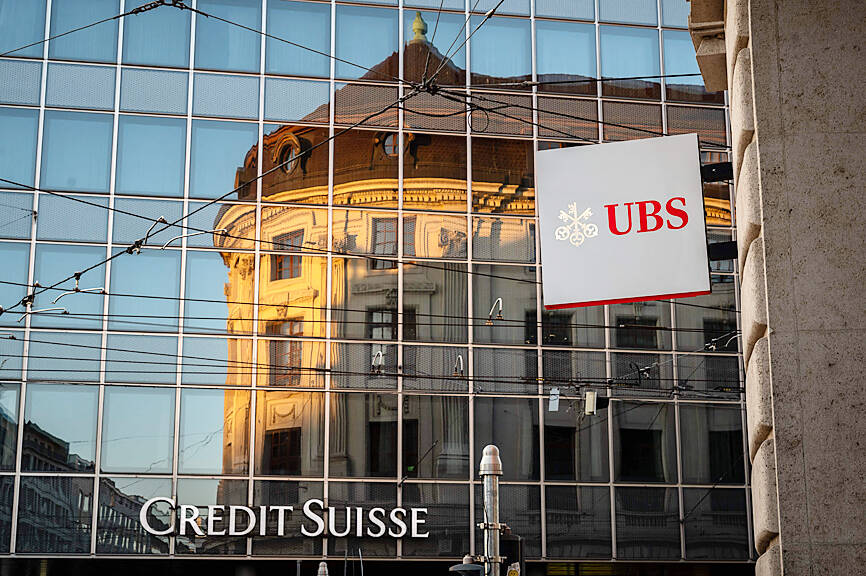

Photo: AFP

UBS said it saw a net inflow of new money into its global wealth management division of US$28 billion, of which US$7 billion came in the last 10 days of last month, following the takeover announcement.

On Monday, Credit Suisse said that 61.2 billion Swiss francs (US$69 billion) had been withdrawn from the bank in the first three months of the year, following on the heels of SF110.5 billion in withdrawals in the fourth quarter last year.

Most of the withdrawals were made in panic around the March 19 announcement that UBS had been strongarmed by Swiss authorities into a US$3.25 billion shotgun marriage to ensure its smaller, but still “too-big-to-fail” rival, did not go bankrupt.

“We are focused on completing the acquisition of Credit Suisse, most likely in the second quarter of 2023,” UBS said.

“While acknowledging the magnitude of, and complexity associated with, the integration and restructuring of Credit Suisse, we believe that this combination presents a unique opportunity to bring significant, long-term value to all of our stakeholders,” it said.

Returning chief executive Sergio Ermotti said the transaction would help to “reinforce the leading position of the Swiss financial center and will be of benefit to the entire economy.”

Vontobel AG analyst Andreas Venditti said UBS client activity levels could be subdued in the second quarter, though net interest income was likely to be up year-on-year.

“UBS’ investment case has changed, from a capital-generative firm with high returns of capital to shareholders, to a complex restructuring story. At least, UBS has secured a reasonable price and significant loss protections,” he said.

UBS has created a special risk management post focused exclusively on the merger and on Monday said that its current head of overall risk management would prolong his mandate to help usher through the extremely delicate operation.

Ermotti yesterday said the lender’s share buyback plans are temporarily suspended and not canceled, as it grapples with the huge integration of Credit Suisse.

It is still too early to say when buybacks will resume, and UBS needs more visibility on the numbers and plans related to the deal, he said in a Bloomberg TV interview.

“We are reiterating our intention to have a progressive cash dividend increase every year and we definitely have an intention to resume share buybacks when its appropriate,” Ermotti said.

The solidity of the balance sheet and liquidity are critical in its considerations for resuming buybacks, he said.

Additional reporting by Bloomberg

CHIP WAR: Tariffs on Taiwanese chips would prompt companies to move their factories, but not necessarily to the US, unleashing a ‘global cross-sector tariff war’ US President Donald Trump would “shoot himself in the foot” if he follows through on his recent pledge to impose higher tariffs on Taiwanese and other foreign semiconductors entering the US, analysts said. Trump’s plans to raise tariffs on chips manufactured in Taiwan to as high as 100 percent would backfire, macroeconomist Henry Wu (吳嘉隆) said. He would “shoot himself in the foot,” Wu said on Saturday, as such economic measures would lead Taiwanese chip suppliers to pass on additional costs to their US clients and consumers, and ultimately cause another wave of inflation. Trump has claimed that Taiwan took up to

A start-up in Mexico is trying to help get a handle on one coastal city’s plastic waste problem by converting it into gasoline, diesel and other fuels. With less than 10 percent of the world’s plastics being recycled, Petgas’ idea is that rather than letting discarded plastic become waste, it can become productive again as fuel. Petgas developed a machine in the port city of Boca del Rio that uses pyrolysis, a thermodynamic process that heats plastics in the absence of oxygen, breaking it down to produce gasoline, diesel, kerosene, paraffin and coke. Petgas chief technology officer Carlos Parraguirre Diaz said that in

SUPPORT: The government said it would help firms deal with supply disruptions, after Trump signed orders imposing tariffs of 25 percent on imports from Canada and Mexico The government pledged to help companies with operations in Mexico, such as iPhone assembler Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), shift production lines and investment if needed to deal with higher US tariffs. The Ministry of Economic Affairs yesterday announced measures to help local firms cope with the US tariff increases on Canada, Mexico, China and other potential areas. The ministry said that it would establish an investment and trade service center in the US to help Taiwanese firms assess the investment environment in different US states, plan supply chain relocation strategies and

Japan intends to closely monitor the impact on its currency of US President Donald Trump’s new tariffs and is worried about the international fallout from the trade imposts, Japanese Minister of Finance Katsunobu Kato said. “We need to carefully see how the exchange rate and other factors will be affected and what form US monetary policy will take in the future,” Kato said yesterday in an interview with Fuji Television. Japan is very concerned about how the tariffs might impact the global economy, he added. Kato spoke as nations and firms brace for potential repercussions after Trump unleashed the first salvo of