US President Joe Biden aims to sign an executive order in the coming weeks that would limit investment in key parts of China’s economy by US businesses, people familiar with the internal deliberations said.

The administration, which has been debating the measure for almost two years, plans to take action around the time of a summit of the G7 advanced economies that is due to start on May 19 in Japan.

The US has been briefing its G7 partners on the investment curbs for high-tech industries, and hopes to get an endorsement at next month’s meeting, even though the other countries are not expected to announce similar restrictions at the same time, the people said.

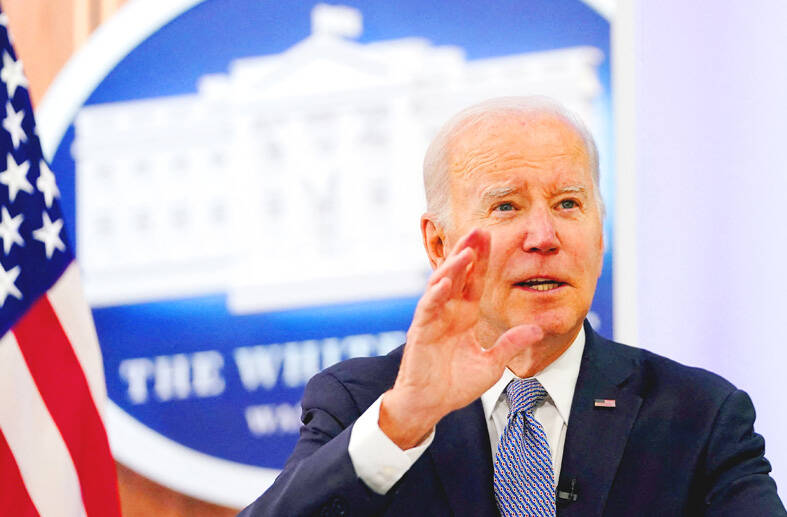

Photo: Reuters

The likeliest sequence is for the executive order to be signed soon after that expression of international support, one of the people said.

The move marks a new phase in the years-long economic campaign against China that has already seen the US impose tariffs on Chinese imports under former US president Donald Trump, and more recently seek to restrict exports of key US technologies. Now, capital flows between the world’s two biggest economies are in the crosshairs.

Investors largely shrugged off concerns of more restrictions, saying they would do little to impact actual business because US investments in some of China’s high-tech sectors have already been receding.

“The US has been working towards this for awhile and US investments in sensitive areas has already been declining,” Bloomberg Intelligence analyst Marvin Chen said. “Nonetheless, China tech will become more reliant on domestic capital pool and state support, as foreign investment continues to withdraw.”

The US says it is imposing the curbs on national security grounds — a point US Secretary of the Treasury Janet Yellen reiterated in a speech Thursday — rather than in an effort to hold back the development of a rival superpower, as Beijing has argued.

Tensions have escalated since Russia’s invasion of Ukraine, a conflict in which the US and China effectively find themselves on opposite sides, and there is growing concern about a new Cold War that could fracture the world economy into rival blocs.

The executive order would cover the fields of semiconductors, artificial intelligence and quantum computing – focusing on investments where US firms play an active role in management. That includes venture capital and private equity, as well as certain forms of technology transfer and joint ventures. Officials involved in drafting the order say it targets potential new investments, not existing ones.

Some types of investment would be barred outright, while others would require companies to notify the government. Details are set to be outlined in a set of regulations to follow the executive order, and companies would have some time to offer feedback before the order goes into effect.

US officials say the investment limits are intended to choke off critical funding and know-how that could advance China’s military capabilities.

In a speech delivered in Washington on Thursday that addressed US-China economic ties, Yellen said the curbs on outbound investment would affect “specific sensitive technologies with significant national security implications.”

“These national security actions are not designed for us to gain a competitive economic advantage, or stifle China’s economic and technological modernization,” Yellen said.

The US will pursue its security concerns regarding China “even when they force trade-offs with our economic interests,” and will “engage and coordinate with our allies and partners” over the policies, she said.

US officials have made it clear that a unilateral measure would not fulfill the national security goals, because investments in China by other countries could just take the place of the US ones that the administration is about to block.

US Department of the Treasury officials this week briefed their European counterparts on the measure, and the administration has begun sharing information with business leaders, too. Once the order takes effect, Treasury would be administering a one-year pilot program that could later be expanded.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) last week recorded an increase in the number of shareholders to the highest in almost eight months, despite its share price falling 3.38 percent from the previous week, Taiwan Stock Exchange data released on Saturday showed. As of Friday, TSMC had 1.88 million shareholders, the most since the week of April 25 and an increase of 31,870 from the previous week, the data showed. The number of shareholders jumped despite a drop of NT$50 (US$1.59), or 3.38 percent, in TSMC’s share price from a week earlier to NT$1,430, as investors took profits from their earlier gains

AI TALENT: No financial details were released about the deal, in which top Groq executives, including its CEO, would join Nvidia to help advance the technology Nvidia Corp has agreed to a licensing deal with artificial intelligence (AI) start-up Groq, furthering its investments in companies connected to the AI boom and gaining the right to add a new type of technology to its products. The world’s largest publicly traded company has paid for the right to use Groq’s technology and is to integrate its chip design into future products. Some of the start-up’s executives are leaving to join Nvidia to help with that effort, the companies said. Groq would continue as an independent company with a new chief executive, it said on Wednesday in a post on its Web

CHINA RIVAL: The chips are positioned to compete with Nvidia’s Hopper and Blackwell products and would enable clusters connecting more than 100,000 chips Moore Threads Technology Co (摩爾線程) introduced a new generation of chips aimed at reducing artificial intelligence (AI) developers’ dependence on Nvidia Corp’s hardware, just weeks after pulling off one of the most successful Chinese initial public offerings (IPOs) in years. “These products will significantly enhance world-class computing speed and capabilities that all developers aspire to,” Moore Threads CEO Zhang Jianzhong (張建中), a former Nvidia executive, said on Saturday at a company event in Beijing. “We hope they can meet the needs of more developers in China so that you no longer need to wait for advanced foreign products.” Chinese chipmakers are in

POLICY REVERSAL: The decision to allow sales of Nvidia’s H200 chips to China came after years of tightening controls and has drawn objections among some Republicans US House Republicans are calling for arms-sale-style congressional oversight of artificial intelligence (AI) chip exports as US President Donald Trump’s administration moves to approve licenses for Nvidia Corp to ship its H200 processor to China. US Representative Brian Mast, the Republican chairman of the US House Committee on Foreign Affairs, which oversees export controls, on Friday introduced a bill dubbed the AI Overwatch Act that would require the US Congress to be notified of AI chips sales to adversaries. Any processors equal to or higher in capabilities than Nvidia’s H20 would be subject to oversight, the draft bill says. Lawmakers would have