Powerchip Semiconductor Manufacturing Corp (力積電), which makes DRAM chips and driver ICs on a contract basis, expects revenue to decline up to 5 percent sequentially this quarter, extending a downtrend from the past three quarters as customers digest excessive inventory.

Although customers remain conservative about placing new orders, they have been more willing to engage in price negotiations, a sign that demand for some applications has started to recover, Powerchip said yesterday.

“We do not expect major changes in the second quarter in terms of revenue,” Powerchip president Brian Shieh (謝再居) told an online investors’ conference. “We believe the first and second quarters will be the trough of this cycle.”

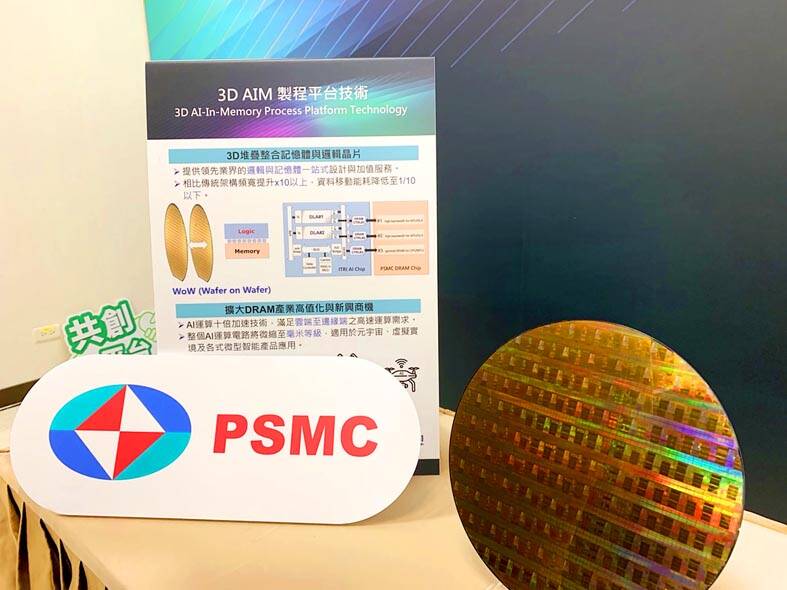

Photo: Grace Hung, Taipei Times

Powerchip expects business to pick up in the second half, Shieh said.

Demand outlook remains bleak this quarter, except some rush orders and insignificant demand for display driver ICs and CMOS image sensors used in smartphone and surveillance devices following two to three quarters of inventory digestion, Powerchip executive vice president Martin Chu (朱憲國) said.

Demand for power management chips is expected to fall further this quarter, as customers entered an inventory correction cycle later than customers in other segments, Chu said.

Factory utilization this quarter might stay below 60 percent, similar to last quarter, the company said.

Last quarter’s utilization rate fell short of the chipmaker’s estimate of 60 to 65 percent.

Powerchip said the lower utilization rate led to high idle capacity costs last quarter and caused gross margin to drop to 18.7 percent, from 34.8 percent in the fourth quarter of last year.

Another drag on its gross margin last quarter was older-generation DRAM chips, the company said.

Gross margin for the chips slipped into negative territory, due to drastic price declines, it said.

The prices are likely to drop mildly this quarter, it added.

Powerchip’s net profit in the first quarter of this year plummeted 90.3 percent to NT$187 million (US$6.13 million) from NT$1.92 billion in the fourth quarter of last year. Earnings per share fell to NT$0.05 from NT$0.48 in the prior quarter.

In response to an investor’s concern about building up new capacity during the downcycle, Powerchip said it does not plan to halt the construction of a new 12-inch factory in Miaoli County’s Tongluo Science Park (銅鑼科學園區).

Powerchip plans to spend NT$1.89 billion on new facilities and manufacturing equipment this year, mostly for the new fab.

The chipmaker expects manufacturing equipment to be installed by the end of this year, allowing it to begin producing chips by early next year.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

EARLY TALKS: Measures under consideration include convincing allies to match US curbs, further restricting exports of AI chips or GPUs, and blocking Chinese investments US President Donald Trump’s administration is sketching out tougher versions of US semiconductor curbs and pressuring key allies to escalate their restrictions on China’s chip industry, an early indication the new US president plans to expand efforts that began under former US president Joe Biden to limit Beijing’s technological prowess. Trump officials recently met with their Japanese and Dutch counterparts about restricting Tokyo Electron Ltd and ASML Holding NV engineers from maintaining semiconductor gear in China, people familiar with the matter said. The aim, which was also a priority for Biden, is to see key allies match China curbs the US

The popular Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) arbitrage trade might soon see a change in dynamics that could affect the trading of the US listing versus the local one. And for anyone who wants to monetize the elevated premium, Goldman Sachs Group Inc highlights potential trades. A note from the bank’s sales desk published on Friday said that demand for TSMC’s Taipei-traded stock could rise as Taiwan’s regulator is considering an amendment to local exchange-traded funds’ (ETFs) ownership. The changes, which could come in the first half of this year, could push up the current 30 percent single-stock weight limit

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International