Flat-panel maker AUO Corp (友達) plans to retire an older, less competitive plant in Taoyuan, which produces panels used in notebook computers and monitors, to enhance the company’s operational efficiency, it said yesterday.

AUO plans to allocate manufacturing capacity at the factory, named the 5A Fab, in the city’s Longtan District (龍潭) to the company’s other plants, it said in a statement.

It is not shutting down the plant, but would better utilize the facility for new products and new technologies to cater to market demand, it said, adding that new technologies and products usually deliver better margins.

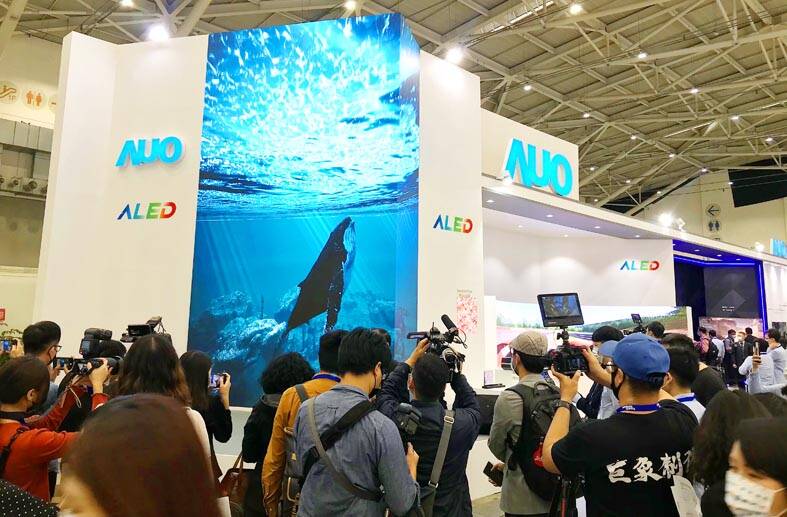

Photo: Chen Mei-ying, Taipei Times

The 5A Fab is a fifth-generation plant with an installed capacity of 62,000 units a month, AUO said.

The facility primarily produces notebook computers and monitor panels as well as some touch panels, it said.

Plant employees would be relocated to other manufacturing sites this year, it said.

The Hsinchu-based panel maker has been broadening its business beyond commodity panels used in TVs and PCs, diversifying into non-panel businesses to escape the “crystal cycle” of the past few years.

AUO is expanding into high-margin panels such as those used in vehicles, medical devices and industrial devices, it said.

The company also expanded into other sectors, such as solar power plant construction and water recycling solutions.

AUO’s non-panel businesses accounted for 10 percent of the company’s total revenue last year, it said.

Local peer Innolux Corp (群創) yesterday also said it did not rule out making similar changes.

Innolux would only allocate manufacturing capacity for the purpose of improving the company’s operational efficiency and sustainable growth, it said.

Such changes would only be pursued when the interests of its employees and stakeholders are ensured, it added.

The New Taiwan dollar is on the verge of overtaking the yuan as Asia’s best carry-trade target given its lower risk of interest-rate and currency volatility. A strategy of borrowing the New Taiwan dollar to invest in higher-yielding alternatives has generated the second-highest return over the past month among Asian currencies behind the yuan, based on the Sharpe ratio that measures risk-adjusted relative returns. The New Taiwan dollar may soon replace its Chinese peer as the region’s favored carry trade tool, analysts say, citing Beijing’s efforts to support the yuan that can create wild swings in borrowing costs. In contrast,

Nvidia Corp’s demand for advanced packaging from Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) remains strong though the kind of technology it needs is changing, Nvidia CEO Jensen Huang (黃仁勳) said yesterday, after he was asked whether the company was cutting orders. Nvidia’s most advanced artificial intelligence (AI) chip, Blackwell, consists of multiple chips glued together using a complex chip-on-wafer-on-substrate (CoWoS) advanced packaging technology offered by TSMC, Nvidia’s main contract chipmaker. “As we move into Blackwell, we will use largely CoWoS-L. Of course, we’re still manufacturing Hopper, and Hopper will use CowoS-S. We will also transition the CoWoS-S capacity to CoWos-L,” Huang said

Nvidia Corp CEO Jensen Huang (黃仁勳) is expected to miss the inauguration of US president-elect Donald Trump on Monday, bucking a trend among high-profile US technology leaders. Huang is visiting East Asia this week, as he typically does around the time of the Lunar New Year, a person familiar with the situation said. He has never previously attended a US presidential inauguration, said the person, who asked not to be identified, because the plans have not been announced. That makes Nvidia an exception among the most valuable technology companies, most of which are sending cofounders or CEOs to the event. That includes

INDUSTRY LEADER: TSMC aims to continue outperforming the industry’s growth and makes 2025 another strong growth year, chairman and CEO C.C. Wei says Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), a major chip supplier to Nvidia Corp and Apple Inc, yesterday said it aims to grow revenue by about 25 percent this year, driven by robust demand for artificial intelligence (AI) chips. That means TSMC would continue to outpace the foundry industry’s 10 percent annual growth this year based on the chipmaker’s estimate. The chipmaker expects revenue from AI-related chips to double this year, extending a three-fold increase last year. The growth would quicken over the next five years at a compound annual growth rate of 45 percent, fueled by strong demand for the high-performance computing