Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday reported revenue of NT$508.63 billion (US$16.7 billion) for last quarter, falling short of its estimate after sluggish demand for 7-nanometer chips used in smartphones and computers drove down last month’s revenue to the weakest level in about 17 months.

Revenue last month contracted 15.4 percent year-on-year and 10.9 percent month-on-month to NT$145.41 billion, the company said in a statement.

Based on TSMC’s foreign exchange rate assumption of NT$30.7 per US dollar, last quarter’s revenue amounted to US$16.56 billion, lower than its estimated range of US$16.7 billion to US$17.5 billion.

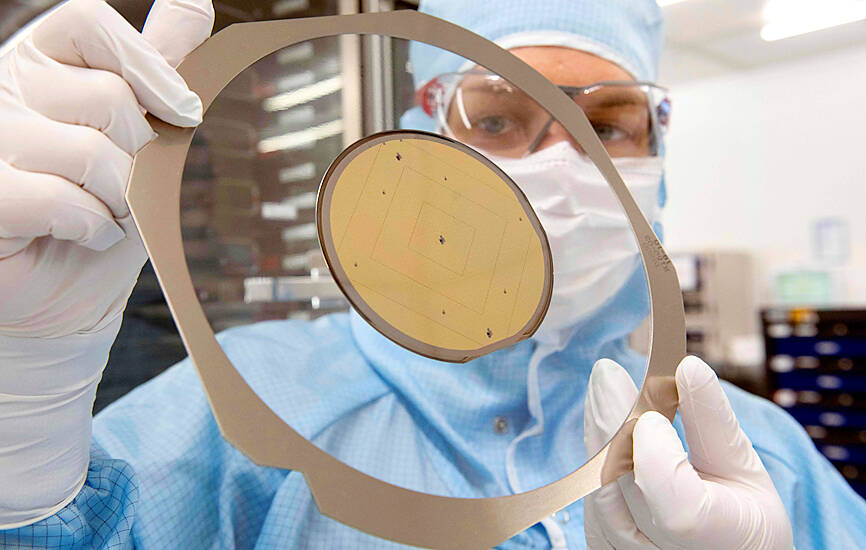

Photo: AFP

The world’s biggest contract chipmaker in January said the utilization rates of its 7-nanometer and 6-nanometer technologies would be greater than it had estimated a quarter earlier, due to end-market weakness in smartphones and PCs, as well as a delay in a customer’s scheduled product launch.

TSMC is expected to present detailed financial figures and its business outlook during a quarterly investors’ conference on Thursday next week. Company executives would also answer investors’ questions, which could include queries regarding the company’s investments in Arizona.

TSMC chairman Mark Liu (劉德音) has said that some clauses in application guidelines for chip investment subsidies under the US’ CHIPS and Science Act are unacceptable.

He said the company would discuss the matter with US authorities.

TSMC has pledged to invest US$40 billion on building advanced fabs in the US.

Minister of Economic Affairs Wang Mei-hua (王美花) yesterday said the ministry is closely watching the issue.

The ministry hopes that the US’ demands will not affect the cost of chip capacity buildup in the US, or industrial cooperation between Taiwan and US.

Separately, United Microelectronics Corp (UMC, 聯電), the world’s No. 3 contract chipmaker, yesterday posted revenue of NT$17.69 billion for last month, down 20.11 percent annually, but up 4.49 percent monthly.

During the first quarter, revenue dropped about 20 percent sequentially to NT$54.21 billion.

UMC had expected its revenue to shrink by about 18 to 19 percent, due mostly to declines in wafer shipments, as customer demand dwindled amid inventory corrections. Three months ago, the company told investors that average selling prices would remain flat.

UMC has expressed the hope that the first quarter will be a trough in terms of revenue and factory utilization.

MediaTek Inc (聯發科), the world’s largest 5G chip designer and one of TSMC’s customers, said revenue last quarter fell about 33 percent annually and 11.6 percent quarterly to NT$95.65 billion.

The figure matches MediaTek’s forecast of revenue of between NT$93 billion and NT$101.7 billion, as customers were conservative about their business outlook and have been managing inventory cautiously.

Revenue last month shrank 27.41 percent annually to NT$42.96 billion, but rose 41.73 percent from February’s NT$30.31 billion.

MediaTek said the first quarter would be the trough for this year, as inventory levels at its customers and channels are expected to fall substantially.

Zhang Yazhou was sitting in the passenger seat of her Tesla Model 3 when she said she heard her father’s panicked voice: The brakes do not work. Approaching a red light, her father swerved around two cars before plowing into a sport utility vehicle and a sedan, and crashing into a large concrete barrier. Stunned, Zhang gazed at the deflating airbag in front of her. She could never have imagined what was to come: Tesla Inc sued her for defamation for complaining publicly about the vehicles brakes — and won. A Chinese court ordered Zhang to pay more than US$23,000 in

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said that its investment plan in Arizona is going according to schedule, following a local media report claiming that the company is planning to break ground on its third wafer fab in the US in June. In a statement, TSMC said it does not comment on market speculation, but that its investments in Arizona are proceeding well. TSMC is investing more than US$65 billion in Arizona to build three advanced wafer fabs. The first one has started production using the 4-nanometer (nm) process, while the second one would start mass production using the

A TAIWAN DEAL: TSMC is in early talks to fully operate Intel’s US semiconductor factories in a deal first raised by Trump officials, but Intel’s interest is uncertain Broadcom Inc has had informal talks with its advisers about making a bid for Intel Corp’s chip-design and marketing business, the Wall Street Journal reported, citing people familiar with the matter. Nothing has been submitted to Intel and Broadcom could decide not to pursue a deal, according to the Journal. Bloomberg News earlier reported that Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is in early talks for a controlling stake in Intel’s factories at the request of officials at US President Donald Trump’s administration, as the president looks to boost US manufacturing and maintain the country’s leadership in critical technologies. Trump officials raised the

From George Clooney to LeBron James, celebrities in the US have cashed in on tequila’s soaring popularity, but in Mexico, producers of the agave plant used to make the country’s most famous liquor are nursing a nasty hangover. Instead of bringing a long period of prosperity for farmers of the spiky succulent, the tequila boom has created a supply glut that sent agave prices slumping. Mexican tequila exports surged from 224 million liters in 2018 to a record 402 million last year, according to the Tequila Regulatory Council, which oversees qualification for the internationally recognized denomination of origin label. The US, Germany, Spain,