European shares rose on Thursday, heading into a long Easter weekend break, as real estate and travel stocks helped outweigh concerns over a US economic slowdown that were triggered by lacklustre data.

The pan-European STOXX 600 index rose 0.51 percent to 458.94, up 0.24 percent from Friday last week, with banking stocks among the biggest boosts.

After a strong start to the year, European equities remained under selling pressure from last month as the recent banking turmoil kept the risk sentiment fragile, with skittish investors fretting about mixed economic data and a looming recession.

RATE HIKES FORECAST

Markets still expect the European Central Bank (ECB) to continue its rate hikes in the next policy meeting.

“With ECB Chief Economist Philip Lane warning that food price inflation in the EU was still rising, the pressure is building for further rate hikes from the ECB in the coming weeks,” CMC Markets UK chief market analyst Michael Hewson said.

In the eurozone, German industrial production rose significantly more than expected in February, partially due to vehicle manufacturing, up 2 percent from the previous month. Real-estate shares led sectoral gains, rising 2.7 percent.

COMPANY STOCKS

Among individual stocks, Shell was up 2.3 percent as the oil and gas giant expects higher liquefied natural gas output in the first quarter after outages at its Australian plants last year.

Credit Suisse edged 0.7 percent higher after Switzerland instructed the bank to cancel or reduce all outstanding bonus payments for the top three levels of management.

UNITED KINGDOM

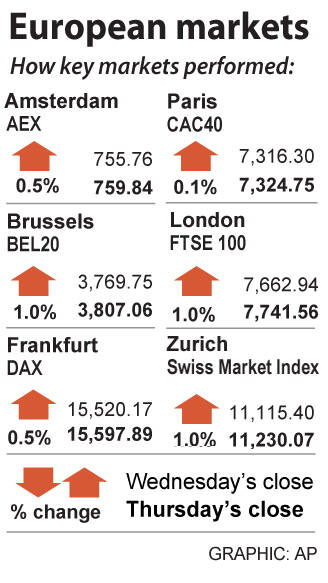

In London, the FTSE 100 rose 1.03 percent to 7,741.56 — its highest level in more than three weeks. The index gained 1.44 percent from Friday last week, with support from gains in oil and gas, financial and healthcare stocks.

“Markets are getting more relaxed about where interest rates might peak, and a number of sector-specific factors is helping the UK, particularly the banks recovering and the oils [stocks’ seeing profit upgrades,” Witan Investment Trust chief executive Andrew Bell said.

TRADE WAR: Tariffs should also apply to any goods that pass through the new Beijing-funded port in Chancay, Peru, an adviser to US president-elect Donald Trump said A veteran adviser to US president-elect Donald Trump is proposing that the 60 percent tariffs that Trump vowed to impose on Chinese goods also apply to goods from any country that pass through a new port that Beijing has built in Peru. The duties should apply to goods from China or countries in South America that pass through the new deep-water port Chancay, a town 60km north of Lima, said Mauricio Claver-Carone, an adviser to the Trump transition team who served as senior director for the western hemisphere on the White House National Security Council in his first administration. “Any product going

TECH SECURITY: The deal assures that ‘some of the most sought-after technology on the planet’ returns to the US, US Secretary of Commerce Gina Raimondo said The administration of US President Joe Biden finalized its CHIPS Act incentive awards for Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), marking a major milestone for a program meant to bring semiconductor production back to US soil. TSMC would get US$6.6 billion in grants as part of the contract, the US Department of Commerce said in a statement yesterday. Though the amount was disclosed earlier this year as part of a preliminary agreement, the deal is now legally binding — making it the first major CHIPS Act award to reach this stage. The chipmaker, which is also taking up to US$5 billion

High above the sparkling surface of the Athens coastline, the cranes for building the 50-floor luxury tower centerpiece of Greece’s future “smart city” look out over the Saronic Gulf. At their feet, construction machinery stirs up dust. Its backers say the 8 billion euro (US$8.43 billion) project financed by private funds is a symbol of Greece’s renaissance after the years of financial stagnation that saw investors flee the country. However, critics see it more as a future “ghetto for the rich.” It is hard to imagine that 10km from the Acropolis, a new city “three times the size of Monaco”

STRUGGLING BUSINESS: South Korea’s biggest company and semiconductor manufacturer’s buyback fuels concerns that it could be missing out on the AI boom Samsung Electronics Co plans to buy back about 10 trillion won (US$7.2 billion) of its own stock over the next year, putting in motion one of the larger shareholder return programs in its history. South Korea’s biggest company would repurchase the stock in stages over the coming 12 months, it said in a regulatory filing on Friday. As a first step, it would buy back about 3 trillion won of paper starting today up until February next year, all of which it would cancel. The board would deliberate on how best to effect the remaining 7 trillion won of buybacks. The move