Gudeng Precision Industrial Co (家登精密) expects revenue to expand at an annual pace of more than 10 percent this year to NT$5 billion (US$164.18 million) as Chinese chipmakers turn to the company for supplies of wafer pods in the wake of the US-China technology war.

Longer term, the company sees revenue growing to NT$10 billion within three years.

Gudeng is a beneficiary of Washington’s tightening export controls on advanced semiconductor technologies and equipment to China to slow Beijing’s progress.

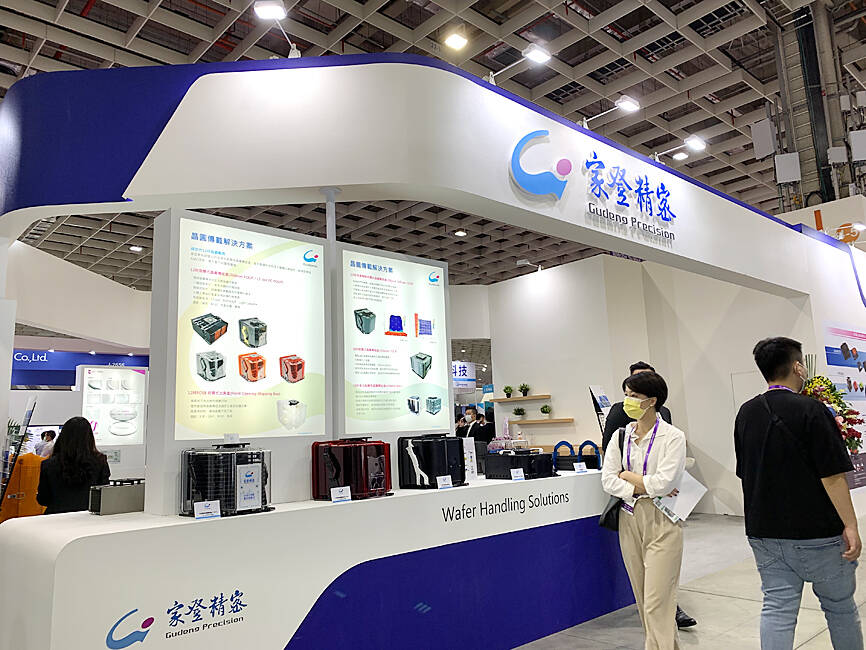

Photo: Grace Hung, Taipei Times

The US curbs have limited Chinese companies’ access to key components, Gudeng said yesterday.

“Since late last year, many Chinese companies have replaced US and European suppliers with Gudeng. That has been reflected in the company’s revenue growth,” Gudeng chairman Bill Chiu (邱銘乾) told reporters at the company’s headquarters in New Taipei City’s Tucheng District (土城).

“We have seen a constant flow of orders from China because of geopolitical factors,” Chiu said. “We are struggling to keep up with the demand.”

Revenue skyrocketed 54 percent annually last month to NT$426.53 million. That brought the company’s revenue in the first two months to NT$740.05 million, growing 20.54 percent from NT$614 million during the same period last year.

Last year, Gudeng’s revenue soared 44 percent year-on-year to NT$4.5 billion.

The new Chinese orders are mostly for Gudeng’s wafer pods, which are box-like front-opening unified pods (FOUP) used to ship, transport and store wafers. Wafers are unloaded from the FOUP within processing equipment to keep the wafers sterile.

Chinese clients — including Semiconductor Manufacturing International Corp (SMIC, 中芯) and ChangXin Memory Technologies Inc (長鑫) — contributed about 19 percent to Gudeng’s revenue last year.

To cope with the growing demand from China, Gudeng has inked a letter of intent to acquire Golden Dragon Global Ltd for 107.5 million yuan (US$15.64 million) to facilitate its expansion in China.

Taiwan is the biggest revenue source for Gudeng, accounting for 70 percent last year. Gudeng is the world’s largest extreme ultraviolet (EUV) pod supplier, with a market share of 80 percent.

EUV pods are used to carry reticles when EUV tools are utilized to produce chips. The company is Taiwan Semiconductor Manufacturing Co’s (台積電) sole supplier of EUV pods.

Taiwan will prioritize the development of silicon photonics by taking advantage of its strength in the semiconductor industry to build another shield to protect the local economy, National Development Council (NDC) Minister Paul Liu (劉鏡清) said yesterday. Speaking at a meeting of the legislature’s Economics Committee, Liu said Taiwan already has the artificial intelligence (AI) industry as a shield, after the semiconductor industry, to safeguard the country, and is looking at new unique fields to build more economic shields. While Taiwan will further strengthen its existing shields, over the longer term, the country is determined to focus on such potential segments as

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down