Evertrust Rehouse Co (永慶房屋), Taiwan’s largest property broker by number of offices, expects up to a 23 percent annual decline in housing transactions in the first half of this year, as its first-quarter results are worse than expected so far, high-ranking officials said yesterday.

While buying interest has picked up slightly from a quarter earlier, most buyers are hesitant to close deals due to expectations that prices will decline amid financial and economic woes, Evertrust general manager Yeh Ling-chi (葉凌棋) told a news conference in Taipei.

Property deals for this year are likely to total 132,000 to 140,000 units by June — a retreat of 18 to 23 percent from the same period last year, Yeh said.

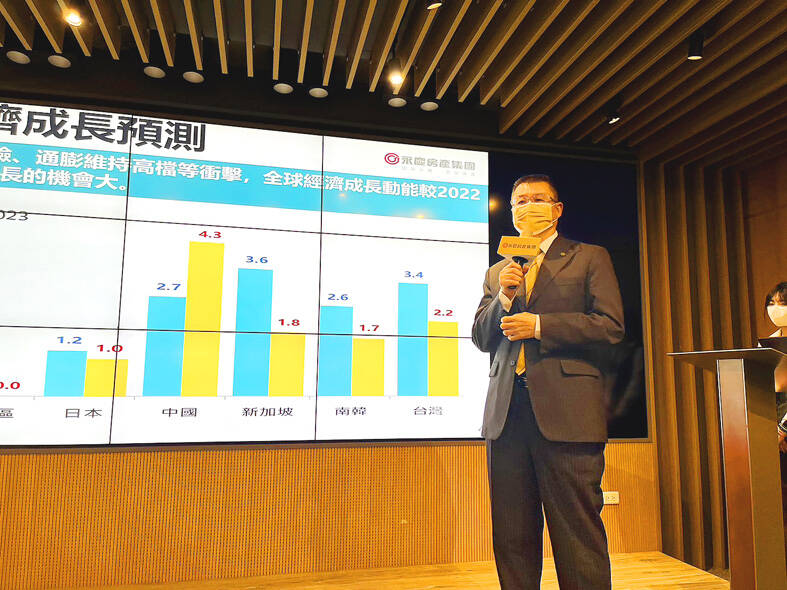

Photo: Hsu Yi-ping, Taipei Times

The conservative forecast came after transactions nationwide in the first two months of the year slumped 28.8 percent annually to 37,048 units, he said, adding that the retreat grew to 29.4 percent in Taipei, New Taipei City, Taoyuan, Hsinchu City, Taichung, Tainan and Kaohsiung.

“An economic slowdown at home and abroad fueled expectations of price concessions, but sellers generally refused to concede, thereby slowing transactions,” Yeh said, adding that recent bank collapses in the US and Europe have encouraged caution and patience.

However, inflation and continued monetary tightening have given sellers reason to hold firm, Evertrust’s quarterly survey showed.

The poll found that 40 percent of respondents were expecting price declines, down 6 percentage points from three months earlier, while 31 percent had a neutral view.

That is because things become more expensive in times of inflation and interest rate hikes, Evertrust research manager Daniel Chen (陳賜傑) said.

About 64 percent of respondents expected the central bank to raise interest rates this year to curb inflation and account for the difference in interest rates between Taiwan and the US, Chen said.

A rapid recovery from the COVID-19 pandemic among retailers and restaurants has bolstered the occupancy rates of storefronts and dining spaces, he said.

Of the survey’s respondents, 64 percent expected vacancy rates to drop, while 74 percent expressed an interest in resuming social gatherings and eating out, Chen said.

He said 86 percent supported the government’s ban on the transfer of presale house purchase agreements, saying that the practice would help limit property speculation.

Fifty percent of people said the ban would not affect their plans to buy presale housing, he said.

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not

TARIFF CONCERNS: The chipmaker cited global uncertainty from US tariffs and a weakening economic outlook, but said its Singapore expansion remains on track Vanguard International Semiconductor Corp (世界先進), a foundry service provider specializing in producing power management and display driver chips, yesterday withdrew its full-year revenue projection of moderate growth for this year, as escalating US tariff tensions raised uncertainty and concern about a potential economic recession. The Hsinchu-based chipmaker in February said revenues this year would grow mildly from last year based on improving supply chain inventory levels and market demand. At the time, it also anticipated gradual quarter revenue growth. However, the US’ sweeping tariff policy has upended the industry’s supply chains and weakened economic prospects for the world economy, it said. “Now

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced