The arranged marriage of UBS Group AG and Credit Suisse Group AG would create the biggest bank Switzerland has ever seen, with some wondering if the superbank might be too big for its own good.

The deal struck late on Sunday prevented the collapse of the country’s second-biggest lender by folding it into the largest.

Even before last week’s dramatic events, the two firms were already among the 30 around the world deemed of strategic importance to the global banking system and therefore too big to fail.

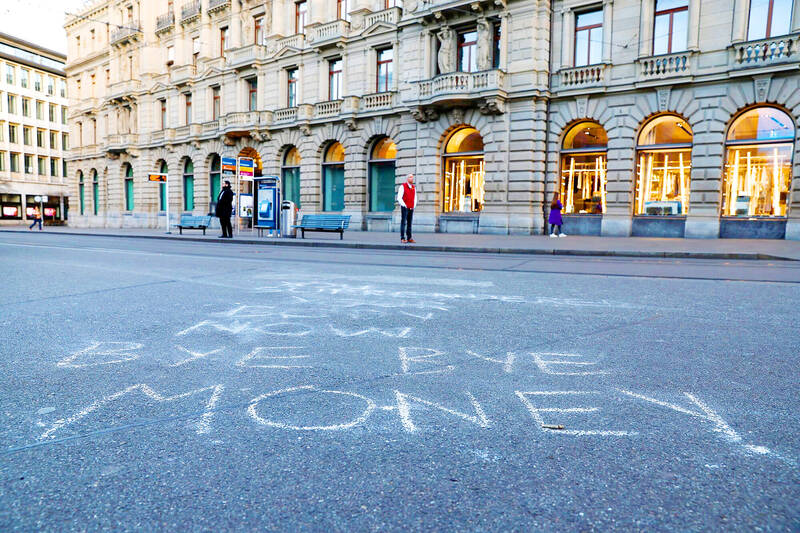

Photo: Bloomberg

Some in business, industry and politics are not convinced that one even bigger bank would turn out for the better.

“Credit Suisse was really the bank of the economy and industry,” said Philippe Cordonier, managing director of Swissmem, the Swiss national association representing the engineering industry.

For exporting companies, Credit Suisse offered a range of services essential for international transactions, “payments abroad, credits, leasing or currency hedging,” he said.

“This is where the question arises of what skills will be kept,” Cordonier said, adding that the profiles of the two banks, although close, are not identical.

So far, many questions remain unanswered.

Such a takeover would normally need months of negotiations, but UBS only had a couple of days, under some serious arm-twisting by Swiss authorities.

UBS chief executive officer Ralph Hamers told an analysts’ conference that he did not yet have all the details of the takeover.

Cordonier said the alternative could be to turn from the national banks to Switzerland’s 26 cantonal banks.

However, many do not have the skills to help companies export to far-off markets such as Asia, and would have to develop them.

The other option is to turn to foreign banks, although they would not possess “in-depth knowledge” of the Swiss market, Cordonier said.

“If there is only one major bank that has the capacity to work abroad, this will restrict the choice of solutions for companies,” he said, adding that he is also concerned about the repercussions on costs “if there is less competition.”

Founded in 1856 by Alfred Escher, a central figure in developing Switzerland’s railways, Credit Suisse was closely linked to the country’s economic development.

The bank financed the expansion of the rail network, the construction of the Gotthard Tunnel beneath the main ridge of the Alps, and the start-up of Swiss companies that went on to become leaders in their sector.

“Twenty-five years ago, there were four big Swiss banks,” said the Swiss Federation of Companies, which represents small and medium-sized enterprises (SMEs).

The banking sector has already seen major convergence in 1998 when Swiss Bank Corp merged with the Union Bank of Switzerland to form the modern UBS.

“The concentration into a smaller number of banks reduces competition and makes it more difficult to obtain good financing conditions for SMEs,” the federation said in a statement.

The orchestrated takeover has also triggered virulent criticism among Swiss political circles, of all stripes.

Politicians have called for the further tightening of regulations — which are already strict in Switzerland — in the face of this new giant, which would dominate the nation’s banking sector.

A partial nationalization could “at least” have been considered, the Berner Zeitung daily quoted University of Zurich economic history professor Tobias Straumann as saying.

Carlo Lombardini, a lawyer and professor of banking law at the University of Lausanne, said the UBS takeover “was surely the only swift and feasible solution.”

However, he would have preferred another outcome, such as a takeover “by a foreign bank,” he said. “But a large foreign group doesn’t do acquisitions in a weekend.”

The other solution would have been to nationalize Credit Suisse “to enhance the good bank” and consolidate the poor assets into a “bad bank” to be liquidated, he said.

However, it is too late for such what-ifs, Lombardini said.

“It’s like wondering what would have happened if Napoleon had not lost at Waterloo,” he said, referring to the French emperor’s loss in the 1815 Battle of Waterloo in modern-day Belgium. “The real problem is we are going to have an even more too-big-to-fail bank.”

MULTIFACETED: A task force has analyzed possible scenarios and created responses to assist domestic industries in dealing with US tariffs, the economics minister said The Executive Yuan is tomorrow to announce countermeasures to US President Donald Trump’s planned reciprocal tariffs, although the details of the plan would not be made public until Monday next week, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. The Cabinet established an economic and trade task force in November last year to deal with US trade and tariff related issues, Kuo told reporters outside the legislature in Taipei. The task force has been analyzing and evaluating all kinds of scenarios to identify suitable responses and determine how best to assist domestic industries in managing the effects of Trump’s tariffs, he

TIGHT-LIPPED: UMC said it had no merger plans at the moment, after Nikkei Asia reported that the firm and GlobalFoundries were considering restarting merger talks United Microelectronics Corp (UMC, 聯電), the world’s No. 4 contract chipmaker, yesterday launched a new US$5 billion 12-inch chip factory in Singapore as part of its latest effort to diversify its manufacturing footprint amid growing geopolitical risks. The new factory, adjacent to UMC’s existing Singapore fab in the Pasir Res Wafer Fab Park, is scheduled to enter volume production next year, utilizing mature 22-nanometer and 28-nanometer process technologies, UMC said in a statement. The company plans to invest US$5 billion during the first phase of the new fab, which would have an installed capacity of 30,000 12-inch wafers per month, it said. The

Taiwan’s official purchasing managers’ index (PMI) last month rose 0.2 percentage points to 54.2, in a second consecutive month of expansion, thanks to front-loading demand intended to avoid potential US tariff hikes, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. While short-term demand appeared robust, uncertainties rose due to US President Donald Trump’s unpredictable trade policy, CIER president Lien Hsien-ming (連賢明) told a news conference in Taipei. Taiwan’s economy this year would be characterized by high-level fluctuations and the volatility would be wilder than most expect, Lien said Demand for electronics, particularly semiconductors, continues to benefit from US technology giants’ effort

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his