Russia has found itself in an unequal relationship with China since intensifying its pivot toward Beijing after the assault on Ukraine.

Since Western countries imposed sanctions on Moscow, bilateral trade between the two neighbors has reached a record US$190 billion, and the proportion of Russian foreign trade carried out in yuan has gone from 0.5 percent to 16 percent.

“It’s absolutely critical for Russia to be close to China, because Russia doesn’t have many trade friends,” Institute of International Finance deputy chief economist Elina Ribakova said.

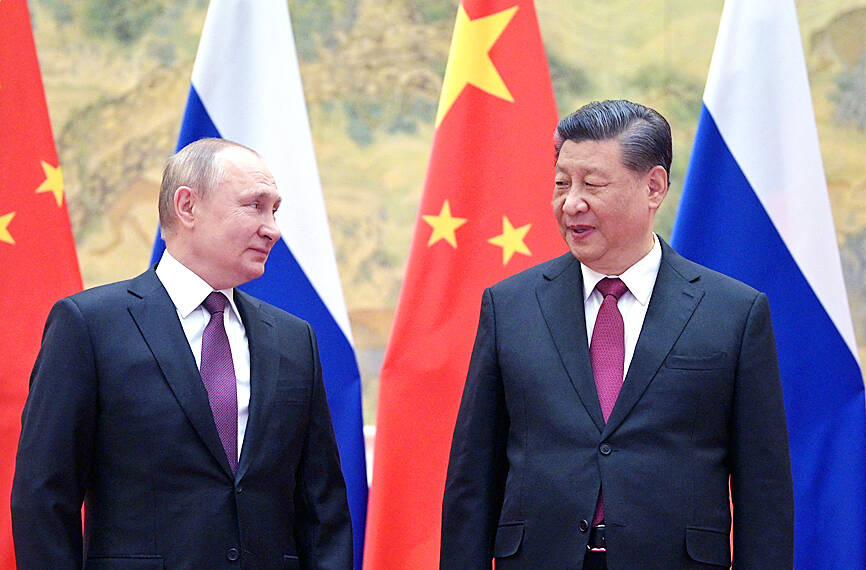

Photo: AFP

Russian President Vladimir Putin is preparing to host Chinese President Xi Jinping (習近平) this week.

The two last met when Putin visited Beijing three weeks before launching the invasion of Ukraine.

Ties between the two countries are particularly strong in the energy sector, which has been heavily targeted by Western sanctions.

“China and India have replaced the European Union as Russia’s most important [oil] export market,” a group of economists from the Institute of International Finance said in a report.

Along with Turkey, China and India accounted for two-thirds of Russia’s crude oil exports in the fourth quarter of last year.

“Chinese companies took over the niches that were freed by Western companies that exited Russia,” said Sergey Tsyplakov, an expert at the Moscow Higher School of Economics.

That was a view shared by Anna Kireeva, a research fellow at the Moscow State Institute of International Relations.

“It was necessary to find alternative sources of import as well, especially in machinery, electronics, various parts and components, automobiles and other vehicles,” Kireeva said.

However, she said most big Chinese companies that are well-integrated into Western markets opted to pause their activities in Russia for fear of potential sanctions.

Time will tell if the alliance of convenience turns into a long-term sustainable partnership.

“Putin wants an even relationship with China, like with a twin brother, but it’s not the case,” said Timothy Ash, a senior emerging market sovereign strategist at BlueBay Asset Management LLC.

“Russia has no other option” than to turn to China, he added.

Temur Umarov, a fellow at the Carnegie Endowment for International Peace, said Russia’s economic stability “depends on China.”

“It gives Beijing another tool, another instrument to influence Russia from domestically,” he said.

The Kremlin denies any disparity.

“There is neither a leader nor a follower in relations between Russia and China, because both parties trust each other equally,” Russian presidential aide Yuri Ushakov told journalists.

Some logistical problems hinder trade development between Beijing and Moscow. Railway routes in Russia’s eastern regions are saturated, Kireeva said.

Infrastructure in those far eastern regions, including the main oil port of Kozmino in the Sea of Japan, are also congested.

Russia has had to sell its oil at cheaper prices than usual to China or India to maintain sales volumes. Its budget reflects the consequences of the forced discounts.

Oil export revenue sank by 42 percent year-on-year last month, the International Energy Agency said.

Having fewer partners leaves Russia in a vulnerable position compared with China, which remains a competitor, Ash said.

“Beijing has an interest in keeping Russia as an ally that is independent to the West, while it also likes Russia to be weakened so it can exploit it,” he said.

Russia’s economic dependency on China is still in its early stages, Umarov said.

“In years or decades, this economic leverage could turn into some bigger political leverage,” he added.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

WARNING SHOT: The US president has threatened to impose 25 percent tariffs on all imported vehicles, and similar or higher duties on pharmaceuticals and semiconductors US President Donald Trump on Wednesday suggested that a trade deal with China was “possible” — a key target in the US leader’s tariffs policy. The US in 2020 had already agreed to “a great trade deal with China” and a new deal was “possible,” Trump said. Trump said he expected Chinese President Xi Jinping (習近平) to visit the US, without giving a timeline for his trip. Trump also said that he was talking to China about TikTok, as the US seeks to broker a sale of the popular app owned by Chinese firm ByteDance Ltd (字節跳動). Trump last week said that he had

STRUGGLING TO SURVIVE: The group is proposing a consortium of investors, with Tesla as the largest backer, and possibly a minority investment by Hon Hai Precision Nissan Motor Co shares jumped after the Financial Times reported that a high-level Japanese group has drawn up plans to seek investment from Elon Musk’s Tesla Inc to aid the struggling automaker. The group believes the electric vehicle (EV) maker is interested in acquiring Nissan’s plants in the US, the newspaper reported, citing people it did not identify. The proposal envisions a consortium of investors, with Tesla as the largest backer, but also includes the possibility of a minority investment by Hon Hai Precision Industry Co (鴻海精密) to prevent a full takeover by the Apple supplier, the report said. The group is