Interest rates for new mortgages in January climbed to a seven-year high of 1.953 percent at the nation’s five major state-run banks, while new house loans fell to a four-year low, as rising borrowing costs cooled the property market, the central bank said.

The monetary policymaker announced its observations after compiling mortgage loan data from the Bank of Taiwan (臺灣銀行), Land Bank of Taiwan (土地銀行), Taiwan Cooperative Bank (合作金庫銀行), Hua Nan Commercial Bank (華南銀行) and First Commercial Bank (第一銀行).

As private lenders usually take cues from the state-run banks when setting interest rates and risk premiums, their interest rates for mortgages could have already exceeded the 2 percent mark and might climb higher if the central bank raises interest rates again this month.

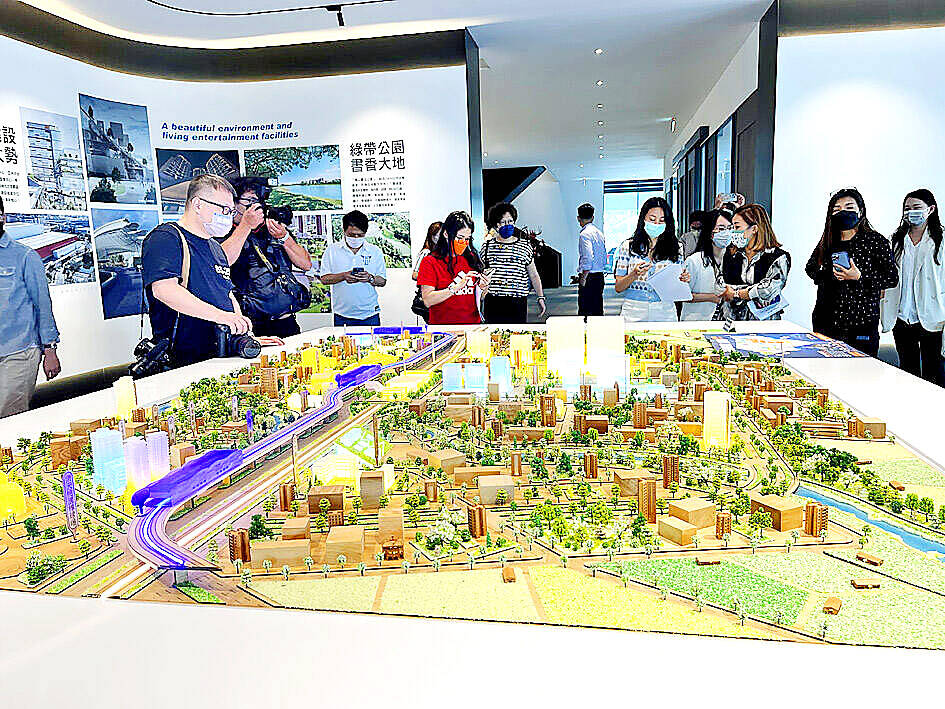

Photo: Hsu Yi-ping, Taipei Times

The five state-run lenders, which account for 40 percent of housing loans in Taiwan, charged higher borrowing costs following the central bank’s 0.125 percentage point rate hike in December last year, it said.

New house loans totaled NT$36.95 billion (US$1.21 billion) in January, the lowest since March 2019 and a 42.7 percent slump from December, the central bank said, attributing the drop to a weakening market and fewer working days.

The number of working days dropped to 16, compared with 22 days in December and 21 days a year earlier, due to the timing of the Lunar New Year holiday, it said.

The central bank declined to speculate on the trend last month, citing poor sentiment and continued holiday disruptions due to the 228 Memorial Day long weekend.

It is better to combine the data from January and last month to eliminate the holiday effect and gain a better understanding of market movements, it said.

Major property brokers have reported a decline in transactions last month, although buying interest rose slightly after the Lunar New Year holiday.

Housing transactions in the nation’s six special municipalities sank 47.5 percent year-on-year in January and plunged 38.4 percent from a month earlier.

The influence of interest rate hikes likely persisted last month, as some banks make adjustments on a quarterly basis, the central bank said.

State-run lenders are conservative about mortgage operations this year on concern that an upcoming ban on transfers of presale housing purchase agreements would restrain potential buyers and sellers.

Interest rates for new consumer loans in January gained 30.1 basis points to a 10-year high of 3.063 percent, after the seasonal effect of student loans faded, the central bank said.

Student loans have low borrowing costs and weigh on the interest rates of consumer loans in November and December, the central bank said.

MULTIFACETED: A task force has analyzed possible scenarios and created responses to assist domestic industries in dealing with US tariffs, the economics minister said The Executive Yuan is tomorrow to announce countermeasures to US President Donald Trump’s planned reciprocal tariffs, although the details of the plan would not be made public until Monday next week, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. The Cabinet established an economic and trade task force in November last year to deal with US trade and tariff related issues, Kuo told reporters outside the legislature in Taipei. The task force has been analyzing and evaluating all kinds of scenarios to identify suitable responses and determine how best to assist domestic industries in managing the effects of Trump’s tariffs, he

TIGHT-LIPPED: UMC said it had no merger plans at the moment, after Nikkei Asia reported that the firm and GlobalFoundries were considering restarting merger talks United Microelectronics Corp (UMC, 聯電), the world’s No. 4 contract chipmaker, yesterday launched a new US$5 billion 12-inch chip factory in Singapore as part of its latest effort to diversify its manufacturing footprint amid growing geopolitical risks. The new factory, adjacent to UMC’s existing Singapore fab in the Pasir Res Wafer Fab Park, is scheduled to enter volume production next year, utilizing mature 22-nanometer and 28-nanometer process technologies, UMC said in a statement. The company plans to invest US$5 billion during the first phase of the new fab, which would have an installed capacity of 30,000 12-inch wafers per month, it said. The

Taiwan’s official purchasing managers’ index (PMI) last month rose 0.2 percentage points to 54.2, in a second consecutive month of expansion, thanks to front-loading demand intended to avoid potential US tariff hikes, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. While short-term demand appeared robust, uncertainties rose due to US President Donald Trump’s unpredictable trade policy, CIER president Lien Hsien-ming (連賢明) told a news conference in Taipei. Taiwan’s economy this year would be characterized by high-level fluctuations and the volatility would be wilder than most expect, Lien said Demand for electronics, particularly semiconductors, continues to benefit from US technology giants’ effort

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his