The climate monitor for Taiwan’s manufacturing industry last month showed a depressed economy amid weakened demand, suppressed selling prices and dampened operating conditions, the Taiwan Institute of Economic Research (TIER, 台灣經濟研究院) said yesterday.

The TIER business composite index was 9.7, shedding 1.18 points from a month earlier, heading into a recessionary zone for the first time since August 2020.

The Taipei-based think tank attributed the retreat mainly to continued monetary tightening in the US and Europe intended to fight inflation, which has curtailed demand for goods and services.

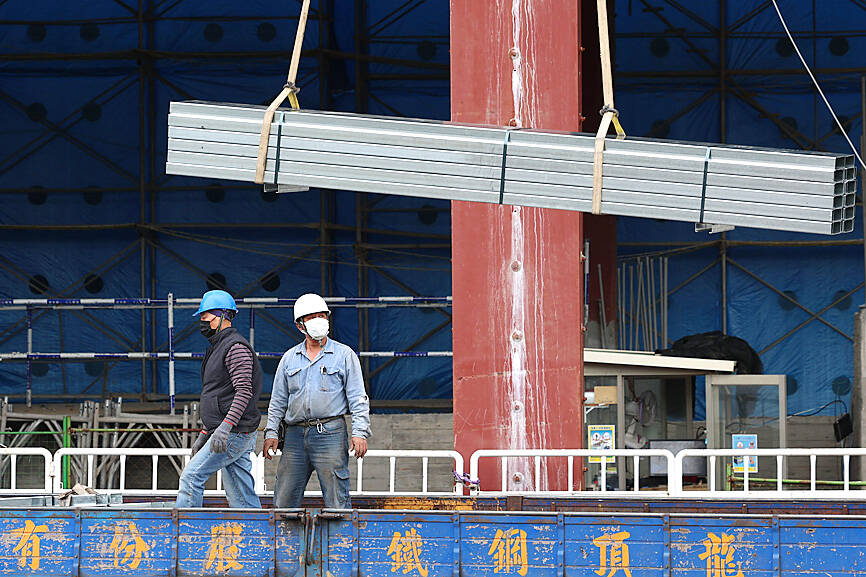

Photo: Sean Chao, Taipei Times

China’s surge in COVID-19 infections has also lent uncertainty to an ongoing slowdown previously induced by oppressive disease control measures and other disruptions.

Export orders and manufacturing growth are expected to continue to contract over the next few months amid inventory adjustments, government data showed.

The largest decrease was in demand, with a drop of 0.67 points, followed by a 0.27 point decline in operating conditions, TIER’s monthly survey showed.

Input and selling price measures edged down 0.19 points and 0.11 points respectively, while the cost reading gained 0.06 points, it showed.

Local manufacturers are the mainstay of exports, which account for 60 percent of the nation’s GDP.

About 72.4 percent of companies experienced a business downturn, swelling from 41.2 percent in October, TIER said, adding that 27 percent described their operations as “sluggish,” and less than 1 percent managed to hold steady. No respondent posted growth.

Textile and pulp suppliers took a hit from slumping demand in the US and Europe, despite resilient sales at home, the institute said.

Similarly, makers of petrochemical and plastic products remained weighed by inventory corrections, although the entry of more players helped reduce cost burdens, it said.

Base metal product vendors are tightening their belts to cope with conservative purchasing strategies by upstream and downstream clients, it said.

The global economic slowdown is hitting non-tech manufacturers harder than tech firms, given that demand for chips used in 5G and high-performance computing remains strong, TIER said.

However, sales of smartphones, computers, wearables and peripheral products tumbled, as people assign prefer in-person experiences in the post-COVID-19 era, it said.

Transportation tool makers reported soft business as inflation affected vehicle purchases, it said.

TECH CLUSTER: The US company’s new office is in the Shalun Smart Green Energy Science City, a new AI industry base and cybersecurity hub in southern Taiwan US chip designer Advanced Micro Devices Inc (AMD) yesterday launched an office in Tainan’s Gueiren District (歸仁), marking a significant milestone in the development of southern Taiwan’s artificial intelligence (AI) industry, the Tainan City Government said in a statement. AMD Taiwan general manager Vincent Chern (陳民皓) presided over the opening ceremony for the company’s new office at the Shalun Smart Green Energy Science City (沙崙智慧綠能科學城), a new AI industry base and cybersecurity hub in southern Taiwan. Facilities in the new office include an information processing center, and a research and development (R&D) center, the Tainan Economic Development Bureau said. The Ministry

ADVERSARIES: The new list includes 11 entities in China and one in Taiwan, which is a local branch of Chinese cloud computing firm Inspur Group The US added dozens of entities to a trade blacklist on Tuesday, the US Department of Commerce said, in part to disrupt Beijing’s artificial intelligence (AI) and advanced computing capabilities. The action affects 80 entities from countries including China, the United Arab Emirates and Iran, with the commerce department citing their “activities contrary to US national security and foreign policy.” Those added to the “entity list” are restricted from obtaining US items and technologies without government authorization. “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives,” US Secretary of Commerce Howard Lutnick said. The entities

Minister of Finance Chuang Tsui-yun (莊翠雲) yesterday told lawmakers that she “would not speculate,” but a “response plan” has been prepared in case Taiwan is targeted by US President Donald Trump’s reciprocal tariffs, which are to be announced on Wednesday next week. The Trump administration, including US Secretary of the Treasury Scott Bessent, has said that much of the proposed reciprocal tariffs would focus on the 15 countries that have the highest trade surpluses with the US. Bessent has referred to those countries as the “dirty 15,” but has not named them. Last year, Taiwan’s US$73.9 billion trade surplus with the US

The Taipei International Cycle Show (Taipei Cycle) yesterday opened at the Taipei Nangang Exhibition Center, with the event’s organizer expecting a steady recovery in the industry this year following a tough last year. This year, 980 companies from 35 countries are participating in the annual bicycle trade show, showcasing technological breakthroughs and market development trends of the bicycle industry at 3,600 booths, the Taiwan External Trade Development Council (TAITRA, 外貿協會) said in a statement. Under the theme “Ride the Revolution,” the exhibition has attracted more than 3,500 international buyers from 80 countries to preregister for the four-day event, which is expected to