Micron Technology Inc, the largest US maker of memory chips, said the worst industry glut in more than a decade would make it difficult to return to profitability next year.

The company on Wednesday announced a host of cost-cutting measures, including a 10 percent workforce reduction, aimed at helping it weather a rapid drop in revenue.

Micron also projected a steep sales decline and a wider loss than analysts had estimated for the current quarter.

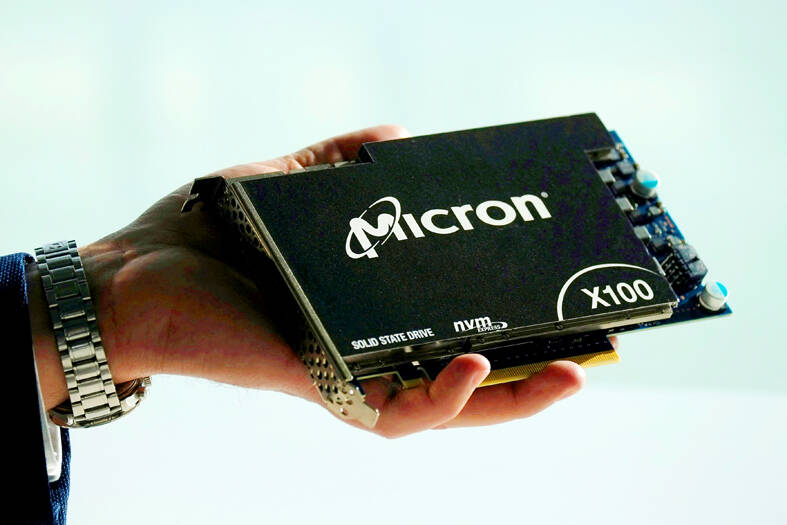

Photo: Reuters

The industry is experiencing its worst imbalance between supply and demand in 13 years, Micron chief executive officer Sanjay Mehrotra said.

Inventory should peak in the current period, then decline, he said.

Customers would move to more healthy inventory levels by about the middle of next year, and the chipmaker’s revenue would improve in the second half of the year, Mehrotra said.

“Profitability will be challenged throughout 2023 because of the oversupply that exists in the industry,” he said in an interview. “The rate and pace of the recovery in terms of profitability depends on how fast supply is brought into line.”

Mehrotra said a unique convergence of circumstances — the war in Ukraine, a surge in inflation, COVID-19 and supply disruptions — has thrust the memorychip industry into a repeat of past cycles when prices plummeted and wiped out profits. Micron has responded aggressively to try to quickly get through the difficult period.

Once the downturn is over, the industry would resume profitable growth helped by demand for artificial intelligence computing and automation of various industries, he said.

Micron, which last month said that it was cutting production by about 20 percent, is cutting its budget for new plants and equipment, and now expects to spend from US$7 billion to US$7.5 billion for the fiscal year, a decline from an earlier target of as much as US$12 billion.

The company is slowing the introduction of more advanced manufacturing techniques and predicts that spending on new production will fall throughout the industry.

Micron’s pledge to reduce output from its factories and slow expansion projects would not ease the glut of chips available unless rivals, including Samsung Electronics Co and SK Hynix Inc, follow suit. That step can help support prices, but comes with the penalty of running expensive plants at less than full capacity, something that can weigh heavily on profitability.

In addition to its planned workforce reductions, the company has suspended share repurchases, is cutting executive salaries and would skip company-wide bonus payments, executives said on a conference call after its results were released.

Micron said sales would be about US$3.8 billion in the fiscal second quarter. That compares with analysts’ average estimate of US$3.88 billion, according to data compiled by Bloomberg.

The company projected a loss of about US$0.62 a share, excluding certain items, in the period ending in February, compared with a loss of US$0.29 expected by analysts.

In the three months ended Dec. 1, Micron’s revenue declined 47 percent to US$4.09 billion. The company had a loss of US$0.04 a share, excluding certain items. That compares with an average estimate of a loss of US$0.01 a share on sales of US$4.13 billion.

Micron’s shares declined about 2 percent in extended trading after closing at US$51.19 in New York.

The stock has dropped 45 percent this year, a worst decline than most chip-related equities. The Philadelphia Stock Exchange Semiconductor Index is down 33 percent this year.

Micron Memory Taiwan Co (台灣美光), a subsidiary of US memorychip maker Micron Technology Inc, has been granted a NT$4.7 billion (US$149.5 million) subsidy under the Ministry of Economic Affairs A+ Corporate Innovation and R&D Enhancement program, the ministry said yesterday. The US memorychip maker’s program aims to back the development of high-performance and high-bandwidth memory chips with a total budget of NT$11.75 billion, the ministry said. Aside from the government funding, Micron is to inject the remaining investment of NT$7.06 billion as the company applied to participate the government’s Global Innovation Partnership Program to deepen technology cooperation, a ministry official told the

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s leading advanced chipmaker, officially began volume production of its 2-nanometer chips in the fourth quarter of this year, according to a recent update on the company’s Web site. The low-key announcement confirms that TSMC, the go-to chipmaker for artificial intelligence (AI) hardware providers Nvidia Corp and iPhone maker Apple Inc, met its original roadmap for the next-generation technology. Production is currently centered at Fab 22 in Kaohsiung, utilizing the company’s first-generation nanosheet transistor technology. The new architecture achieves “full-node strides in performance and power consumption,” TSMC said. The company described the 2nm process as

POTENTIAL demand: Tesla’s chance of reclaiming its leadership in EVs seems uncertain, but breakthrough in full self-driving could help boost sales, an analyst said Chinese auto giant BYD Co (比亞迪) is poised to surpass Tesla Inc as the world’s biggest electric vehicle (EV) company in annual sales. The two groups are expected to soon publish their final figures for this year, and based on sales data so far this year, there is almost no chance the US company led by CEO Elon Musk would retain its leadership position. As of the end of last month, BYD, which also produces hybrid vehicles, had sold 2.07 million EVs. Tesla, for its part, had sold 1.22 million by the end of September. Tesla’s September figures included a one-time boost in

Shares in Taiwan closed at a new high yesterday, the first trading day of the new year, as contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) continued to break records amid an artificial intelligence (AI) boom, dealers said. The TAIEX closed up 386.21 points, or 1.33 percent, at 29,349.81, with turnover totaling NT$648.844 billion (US$20.65 billion). “Judging from a stronger Taiwan dollar against the US dollar, I think foreign institutional investors returned from the holidays and brought funds into the local market,” Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺) said. “Foreign investors just rebuilt their positions with TSMC as their top target,