CTBC Financial Holding Co (中信金控) on Wednesday was given a National Sustainable Development Award for its efforts in promoting sustainable business practices.

The awards, organized by the National Council for Sustainable Development, were presented by Premier Su Tseng-chang (蘇貞昌), chairman of the council, at a ceremony in Taipei.

CTBC Bank (中國信託銀行) vice chairman Austin Chan (詹庭禎) was in attendance to receive the award.

CTBC Financial won in the corporate category for its active adoption of sustainable development goals (SDGs) and climate governance as guiding management principles, as well as connecting with other stakeholders to fulfill its corporate social responsibility.

The company uses a complete implementation structure to produce diverse, specific and data-driven results, the judges said.

The firm incorporates priority SDG projects into its operating strategy, and comprehensively improves corporate environmental, social and governance (ESG) management and risk resilience, they said.

The council recognized CTBC Financial’s five major SDG-linked public welfare initiatives.

They include the “Light Up a Life” national fundraising campaign; establishment of the CTBC Charity Foundation; the “Taiwan Dream Project” creating local community centers for disadvantaged children; the microloan “CTBC Poverty Alleviation Program”; and more to help improve the lives of disadvantaged people.

The judges also commended the CTBC Anti-drug Educational Foundation’s touring educational exhibition “Breaking the Habit: Unlocking the Distance between You and Addiction” for its implementation of Taiwan’s third SDG — to “promote healthy lives and well-being for all at all ages.”

Its environmental and climate initiatives were also viewed highly by the judges.

In 2020, CTBC Financial was Taiwan’s first financial institution to join the Partnership for Carbon Accounting Financials. It was also the first in the industry to use scenarios provided by the Network for Greening the Financial System in its climate risk assessment report.

After last year becoming Taiwan’s first firm to join the Taskforce on Nature-related Financial Disclosures (TNFD), CTBC Financial was invited to participate in the TNFD Forum.

In October, the firm joined Business for Nature in calling on countries to adopt stringent policies, attach importance to biodiversity and reverse the biodiversity loss crisis at the UN Biodiversity Conference.

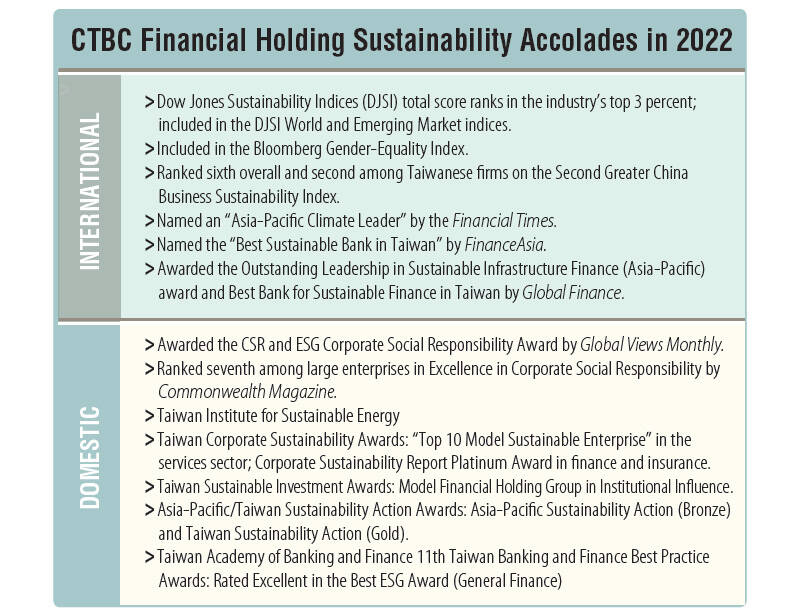

CTBC Financial — which was selected to the Dow Jones Sustainability Indices (DJSI) World Index for the fourth time this year and has been a constituent of the DJSI Emerging Market Index for seven consecutive years — has also achieved excellent results in domestic and foreign sustainability-related evaluations, showing that its strength in sustainable governance has garnered global recognition.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

EARLY TALKS: Measures under consideration include convincing allies to match US curbs, further restricting exports of AI chips or GPUs, and blocking Chinese investments US President Donald Trump’s administration is sketching out tougher versions of US semiconductor curbs and pressuring key allies to escalate their restrictions on China’s chip industry, an early indication the new US president plans to expand efforts that began under former US president Joe Biden to limit Beijing’s technological prowess. Trump officials recently met with their Japanese and Dutch counterparts about restricting Tokyo Electron Ltd and ASML Holding NV engineers from maintaining semiconductor gear in China, people familiar with the matter said. The aim, which was also a priority for Biden, is to see key allies match China curbs the US

STRUGGLING TO SURVIVE: The group is proposing a consortium of investors, with Tesla as the largest backer, and possibly a minority investment by Hon Hai Precision Nissan Motor Co shares jumped after the Financial Times reported that a high-level Japanese group has drawn up plans to seek investment from Elon Musk’s Tesla Inc to aid the struggling automaker. The group believes the electric vehicle (EV) maker is interested in acquiring Nissan’s plants in the US, the newspaper reported, citing people it did not identify. The proposal envisions a consortium of investors, with Tesla as the largest backer, but also includes the possibility of a minority investment by Hon Hai Precision Industry Co (鴻海精密) to prevent a full takeover by the Apple supplier, the report said. The group is