The local housing market might experience a soft landing in the first half of next year, after months of declining transactions caused by unfavorable policy measures and economic changes, central bank Governor Yang Chin-long (楊金龍) said yesterday.

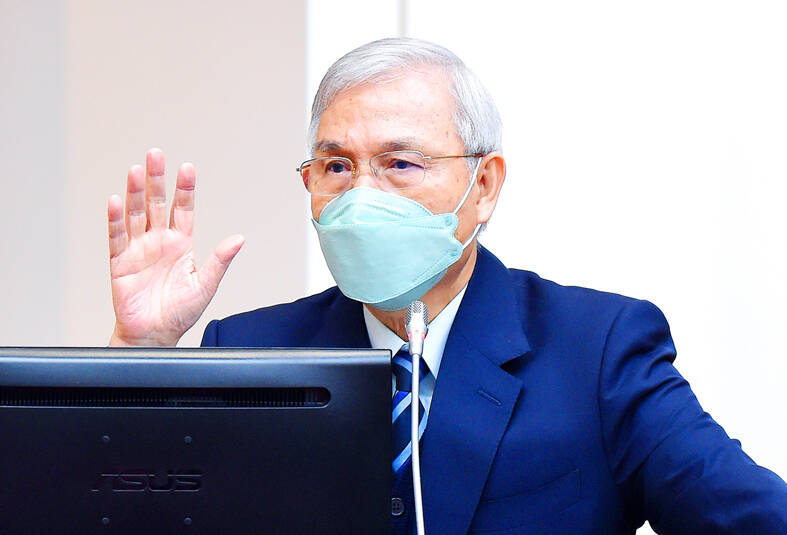

Yang made the remarks while responding to lawmakers’ questions about the property market, monetary policy and inflation at a meeting of the legislature’s Finance Committee.

“The property market might need more time to assimilate the previous three rate hikes, which were intended to tame inflation but help cool property transactions,” Yang said.

Photo: Liao Chen-hui, Taipei Times

A drop in transactions usually precedes price corrections, he said.

Unaffordable housing is the public’s biggest complaint, especially among young people, surveys have shown.

The number of housing transfers in the nation’s six special municipalities shrunk by double-digit percentage points in the second half of this year, with the pace of retreat accelerating each month, government statistics showed.

Yang has favored a moderate approach to tackling inflation and housing price hikes, while other central bank board directors have pushed for more drastic monetary tightening.

The governor refused to comment on whether interest rates would be raised again on Thursday, saying that all central bank board members are required to say nothing 10 days ahead of a board meeting.

Inflation and the economic outlook would dominate policy discussions, Yang said, adding that consumer price increases of within 2 percent would be acceptable in his opinion.

Research organizations have said that Taiwan’s inflation rate is expected be below target for next year, thanks to tax cuts on imported raw materials and the absence of supply chain disruptions that have plagued the US and Europe.

The central bank must also weigh how seriously the worsening global economic slowdown would affect Taiwan’s GDP growth, Yang said.

Taiwan’s GDP is expected to expand a slight 2.5 percent next year, driven mainly by government and consumer expenditure, as exports slip into contraction this quarter and in the coming six months.

There is no need for Taiwan to copy advanced economies’ monetary policies, and the central bank would deal with the matter based on the nation’s best interests, Yang said.

Analysts generally expect another 0.125 percentage rate hike to narrow Taiwan’s rate gap with the US, as the US Federal Reserve could raise the interest rate by 0.5 percentage points later this week.

Yang said he has reservations about Taiwan Semiconductor Manufacturing Co ( 台積電) founder Morris Chang’s (張忠謀) statement that globalization is dead.

“I don’t agree that globalization is dead, although its content has shifted... That is an extreme statement,” Yang said.

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

Taiwan will prioritize the development of silicon photonics by taking advantage of its strength in the semiconductor industry to build another shield to protect the local economy, National Development Council (NDC) Minister Paul Liu (劉鏡清) said yesterday. Speaking at a meeting of the legislature’s Economics Committee, Liu said Taiwan already has the artificial intelligence (AI) industry as a shield, after the semiconductor industry, to safeguard the country, and is looking at new unique fields to build more economic shields. While Taiwan will further strengthen its existing shields, over the longer term, the country is determined to focus on such potential segments as

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors