Burberry Group PLC’s new leadership plans a return to “Britishness” after a revamp by an Italian executive duo failed to keep the UK brand abreast of its luxury rivals.

The new team of chief executive officer Jonathan Akeroyd and creative head Daniel Lee want to increase accessories to more than 50 percent of sales in the long term, banking on high-margin products in their overhaul of the trench-coat maker.

Comparable store sales rose by double digits in the three months ended in September as US tourists took advantage of a strong US dollar to snap up luxury goods in Europe.

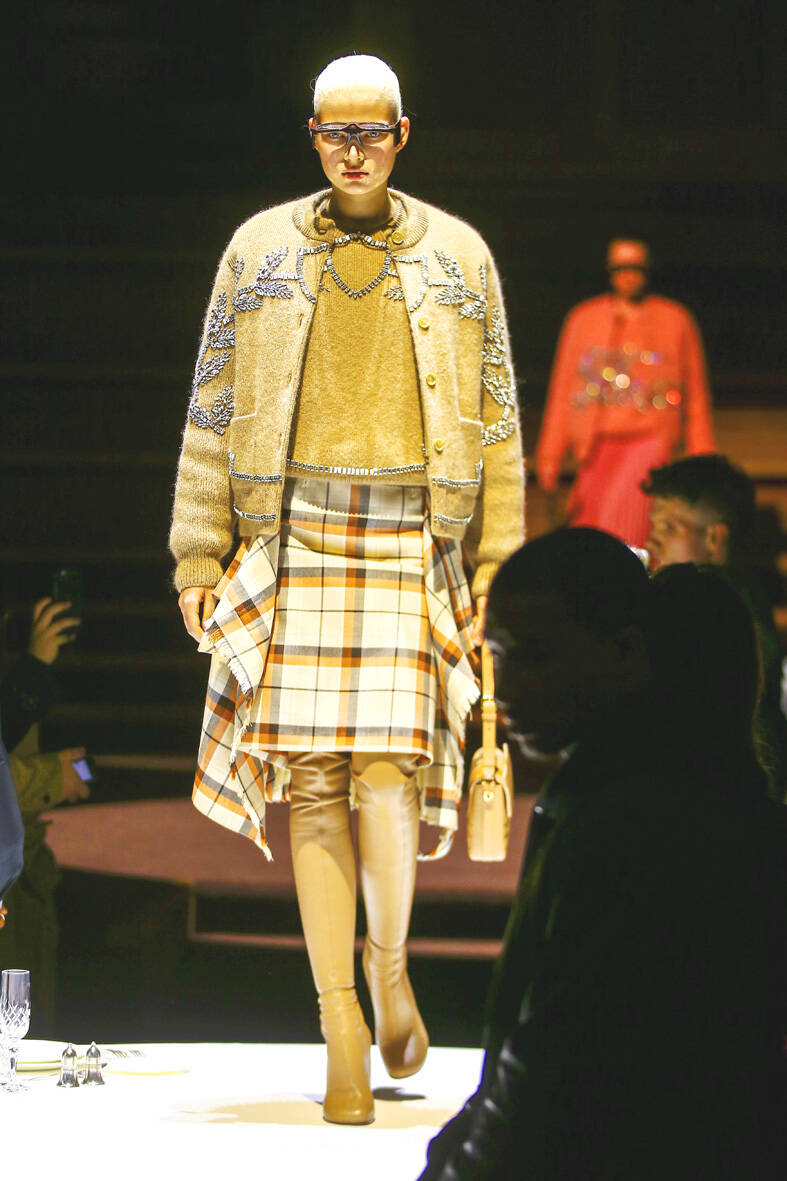

Photo: AP

Still, growth fell short of the high bar set by rivals such as LVMH SE and Hermes International.

In a first step toward shaking up the brand, the Versace veteran, who took charge in March, in September named Lee to succeed Riccardo Tisci as creative director.

Akeroyd succeeded previous CEO Marco Gobbetti, who was midway through an effort to take the Burberry brand further upmarket when he left to head Italian competitor Salvatore Ferragamo SpA.

Yorkshire-born Lee was previously head designer at Bottega Veneta, where he helped reinvigorate the Kering SA brand before leaving for undisclosed reasons a year ago.

He is due to present his first collection for Burberry during London Fashion Week in February.

Among a slew of new goals announced yesterday, the UK firm said it is aiming to generate £4 billion (US$4.7 billion) of sales in the medium term and hopes to add another £1 billion in the long term. To do so, it plans to roughly double sales of leather goods, shoes and women’s ready to wear, as well as grow outer wear by 50 percent in the medium term.

It would also seek to boost the share of e-commerce to 15 percent of retail sales over that time frame.

The new strategic plan comes as the outlook for the global economy darkens. UK inflation last month hit the highest level in more than four decades on soaring energy prices, figures on Wednesday showed.

There are signs of faltering demand, especially for lower-priced luxury products in the US.

Revenue in the Americas fell 3 percent in the quarter, following a 4 percent drop in the preceding three months, the company said.

“Burberry is one of the most exposed brands to aspirational consumers,” Luca Solca, analyst at Sanford C. Bernstein, wrote by e-mail.

“Aspirational consumers are far more exposed to energy and food price inflation, as they have a more limited discretionary spend capacity. Hence the weakness,” he added.

SELL-OFF: Investors expect tariff-driven volatility as the local boarse reopens today, while analysts say government support and solid fundamentals would steady sentiment Local investors are bracing for a sharp market downturn today as the nation’s financial markets resume trading following a two-day closure for national holidays before the weekend, with sentiment rattled by US President Donald Trump’s sweeping tariff announcement. Trump’s unveiling of new “reciprocal tariffs” on Wednesday triggered a sell-off in global markets, with the FTSE Taiwan Index Futures — a benchmark for Taiwanese equities traded in Singapore — tumbling 9.2 percent over the past two sessions. Meanwhile, the American depositary receipts (ADRs) of Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the most heavily weighted stock on the TAIEX, plunged 13.8 percent in

A wave of stop-loss selling and panic selling hit Taiwan's stock market at its opening today, with the weighted index plunging 2,086 points — a drop of more than 9.7 percent — marking the largest intraday point and percentage loss on record. The index bottomed out at 19,212.02, while futures were locked limit-down, with more than 1,000 stocks hitting their daily drop limit. Three heavyweight stocks — Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Hon Hai Precision Industry Co (Foxconn, 鴻海精密) and MediaTek (聯發科) — hit their limit-down prices as soon as the market opened, falling to NT$848 (US$25.54), NT$138.5 and NT$1,295 respectively. TSMC's

TARIFFS: The global ‘panic atmosphere remains strong,’ and foreign investors have continued to sell their holdings since the start of the year, the Ministry of Finance said The government yesterday authorized the activation of its NT$500 billion (US$15.15 billion) National Stabilization Fund (NSF) to prop up the local stock market after two days of sharp falls in reaction to US President Donald Trump’s new import tariffs. The Ministry of Finance said in a statement after the market close that the steering committee of the fund had been given the go-ahead to intervene in the market to bolster Taiwanese shares in a time of crisis. The fund has been authorized to use its assets “to carry out market stabilization tasks as appropriate to maintain the stability of Taiwan’s

In a small town in Paraguay, a showdown is brewing between traditional producers of yerba mate, a bitter herbal tea popular across South America, and miners of a shinier treasure: gold. A rush for the precious metal is pitting mate growers and indigenous groups against the expanding operations of small-scale miners who, until recently, were their neighbors, not nemeses. “They [the miners] have destroyed everything... The canals, springs, swamps,” said Vidal Britez, president of the Yerba Mate Producers’ Association of the town of Paso Yobai, about 210km east of capital Asuncion. “You can see the pollution from the dead fish.