The Ministry of Economic Affairs (MOEA) yesterday said reports of global tech firms cutting dependence on Taiwan-made chips were inaccurate, after chip designer MediaTek Inc (聯發科) issued a clarification emphasizing it would expand its business based on Taiwan’s semiconductor supply chain.

“The recent reports on the global supply chain shifting away from Taiwan are inaccurate and MediaTek Inc has pointed out the mistake in a filing,” the ministry said, responding to news reports that global tech firms would require their chip suppliers to have multiple sources to cut dependence on Taiwan amid rising US-China trade tensions.

The reports cited MediaTek chief executive officer Rick Tsai (蔡力行).

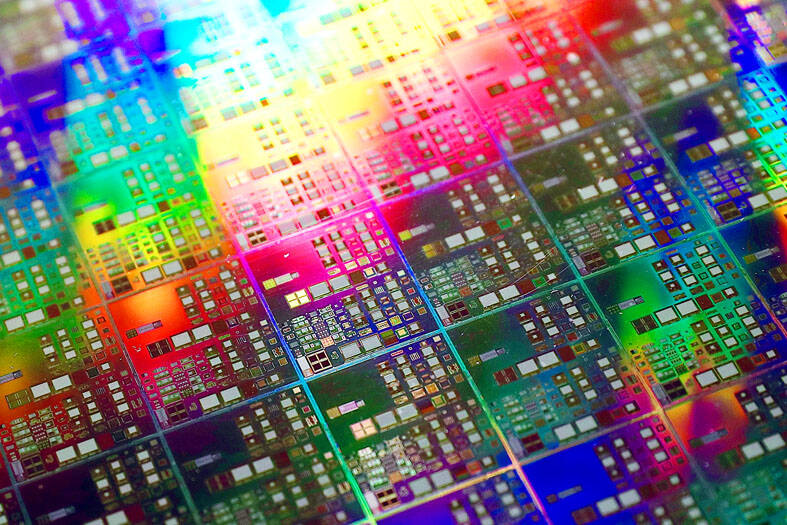

Photo: Ritchie B. Tongo, EPA-EFE

The Hsinchu-based company, which designs chips used in smartphones, laptops and other technology applications, said in the filing that it has no intention of moving away from Taiwan in any way, but would continue to invest in the nation and work with existing partners in its bid to expand in overseas markets.

As the world’s fourth-largest chip company, MediaTek always has multiple suppliers to serve a global clientele, it said, adding that its investment and procurement spending in Taiwan amounts to NT$300 billion (US$9.64 billion) a year.

MediaTek would seek to gain customers and business globally based on Taiwan’s robust semiconductor supply chain, it said.

The ministry said that Taiwan has a well-established and irreplaceable semiconductor ecosystem that encompasses upstream, midstream and downstream players, and has cultivated semiconductor talent for more than 40 years.

The investment environment in Taiwan is safe and built upon a democratic legal system that would continue to attract companies from global semiconductor supply chains, the ministry said.

Taiwan Semiconductor Manufacturing Co (台積電), the world’s largest chipmaker, whose clients include Apple Inc, MediaTek, Advanced Micro Devices Inc, Nvidia Corp and Intel Corp, has reiterated its commitment to keeping advanced manufacturing technologies in Taiwan after announcing plans to add capacity in Hsinchu and Kaohsiung, the ministry said.

International firms have followed suit.

US semiconductor equipment manufacturer Applied Materials Inc in 2019 set up a manufacturing center and a research lab in the Southern Taiwan Science Park (南部科學園區), while Dutch semiconductor equipment manufacturer ASML Holding NV in 2020 launched a global extreme ultraviolet training center for engineers in the same park, the ministry said.

Entegris Inc, a supplier of advanced materials and process solutions for the semiconductor industry and other high-tech sectors, is expanding its investment in a new advanced manufacturing facility in Kaohsiung to about US$500 million in three years, while German science and technology company Merck Group has unveiled plans to spend US$600 million expanding its manufacturing and research investment in Taiwan over the next five to seven years, the ministry said.

Taiwan will prioritize the development of silicon photonics by taking advantage of its strength in the semiconductor industry to build another shield to protect the local economy, National Development Council (NDC) Minister Paul Liu (劉鏡清) said yesterday. Speaking at a meeting of the legislature’s Economics Committee, Liu said Taiwan already has the artificial intelligence (AI) industry as a shield, after the semiconductor industry, to safeguard the country, and is looking at new unique fields to build more economic shields. While Taiwan will further strengthen its existing shields, over the longer term, the country is determined to focus on such potential segments as

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down