ASML Holding NV gave a bullish revenue outlook, citing strong demand for its machines that make advanced semiconductors and said it would buy back 12 billion euros (US$12.2 billion) of its own stock.

The Dutch chip production equipment supplier said growth in semiconductor markets and the need for more advanced production would drive demand for its products and services, resulting in annual revenue of as much as 40 billion euros by 2025. That compares with an average analyst estimate of 32 billion euros.

ASML’s confidence in longer-term growth comes amid a sharp downturn in demand for its customers’ products that is causing many of them to rein in their spending on new plants and equipment.

Photo: Reuters

The Dutch company said increasing competition in outsourced chipmaking and efforts in Europe and the US to nurture domestic production are contributing to the industry’s need to add more capacity.

ASML’s buyback program is to run through 2025, it said in a regulatory filing on Thursday.

The company will use about 2 million shares to cover employee plans and cancel the remainder.

ASML’s bullishness about the future is growing. Last year, it had predicted sales would be between 24 billion euros and 30 billion euros by 2025. That target is now 30 billion euros to 40 billion euros, it said in the filing.

By 2030, revenue would expand further to as much as 60 billion euros, it said.

“While the current macroenvironment creates near-term uncertainties, we expect longer-term demand and capacity showing healthy growth,” the company said.

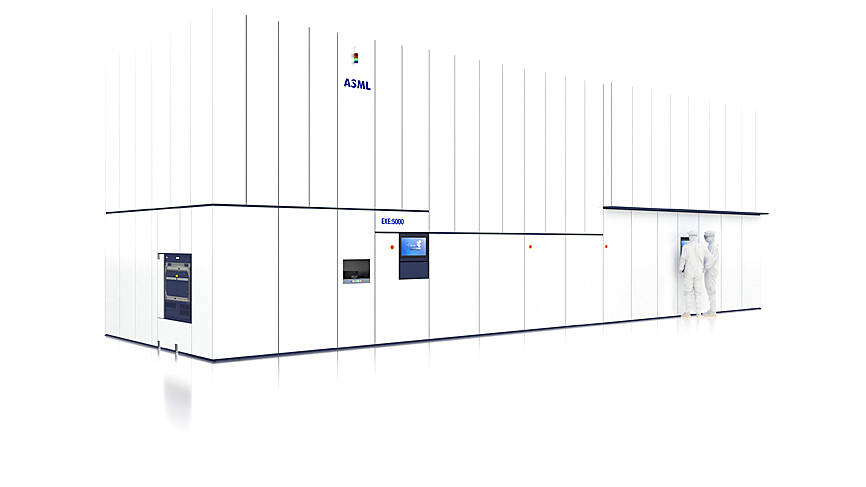

In line with its projection of increasing demand, the company is raising output to 90 of its extreme ultraviolet lithography machines and 600 deep-ultraviolet machines by 2025 to 2026.

ASML’s gear performs the crucial function of burning patterns into materials deposited on wafers off silicon that make up the circuits that give chips their function.

Even though the global chip industry is now facing a severe downturn, countries including the US and Japan have not slowed their pace in readying new plants to prepare for the next boom cycle.

Taiwan Semiconductor Manufacturing Co (台積電) is even now considering adding another advanced facility next to a US$12 billion plant that is under construction in the US state of Arizona.

ASML has not been able to sell its most advanced extreme ultraviolet lithography machines to China, as the Dutch government refused to give it a license to do so, but it has been able to sell its other machinery to the country.

ASML sees the total impact from the new US measures to be about 5% of its backlog, it said on a call with investors last month.

Nvidia Corp’s demand for advanced packaging from Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) remains strong though the kind of technology it needs is changing, Nvidia CEO Jensen Huang (黃仁勳) said yesterday, after he was asked whether the company was cutting orders. Nvidia’s most advanced artificial intelligence (AI) chip, Blackwell, consists of multiple chips glued together using a complex chip-on-wafer-on-substrate (CoWoS) advanced packaging technology offered by TSMC, Nvidia’s main contract chipmaker. “As we move into Blackwell, we will use largely CoWoS-L. Of course, we’re still manufacturing Hopper, and Hopper will use CowoS-S. We will also transition the CoWoS-S capacity to CoWos-L,” Huang said

Nvidia Corp CEO Jensen Huang (黃仁勳) is expected to miss the inauguration of US president-elect Donald Trump on Monday, bucking a trend among high-profile US technology leaders. Huang is visiting East Asia this week, as he typically does around the time of the Lunar New Year, a person familiar with the situation said. He has never previously attended a US presidential inauguration, said the person, who asked not to be identified, because the plans have not been announced. That makes Nvidia an exception among the most valuable technology companies, most of which are sending cofounders or CEOs to the event. That includes

TARIFF TRADE-OFF: Machinery exports to China dropped after Beijing ended its tariff reductions in June, while potential new tariffs fueled ‘front-loaded’ orders to the US The nation’s machinery exports to the US amounted to US$7.19 billion last year, surpassing the US$6.86 billion to China to become the largest export destination for the local machinery industry, the Taiwan Association of Machinery Industry (TAMI, 台灣機械公會) said in a report on Jan. 10. It came as some manufacturers brought forward or “front-loaded” US-bound shipments as required by customers ahead of potential tariffs imposed by the new US administration, the association said. During his campaign, US president-elect Donald Trump threatened tariffs of as high as 60 percent on Chinese goods and 10 percent to 20 percent on imports from other countries.

INDUSTRY LEADER: TSMC aims to continue outperforming the industry’s growth and makes 2025 another strong growth year, chairman and CEO C.C. Wei says Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), a major chip supplier to Nvidia Corp and Apple Inc, yesterday said it aims to grow revenue by about 25 percent this year, driven by robust demand for artificial intelligence (AI) chips. That means TSMC would continue to outpace the foundry industry’s 10 percent annual growth this year based on the chipmaker’s estimate. The chipmaker expects revenue from AI-related chips to double this year, extending a three-fold increase last year. The growth would quicken over the next five years at a compound annual growth rate of 45 percent, fueled by strong demand for the high-performance computing