Taiwan needs to diversify its trade away from China, Minister of Finance Su Jain-rong (蘇建榮) said, citing uncertainties created by China’s “zero COVID-19” policy, and rising geopolitical tensions between Washington and Beijing.

The recent US technology curbs imposed on China have “increased the uncertainty of the market,” Su said in an interview on Friday, after the APEC finance ministers’ meetings in Bangkok.

He added that one of Taiwan’s goals is to “try to diversify our trade partners, our trade market, so that we are not going to put all our eggs in one basket.”

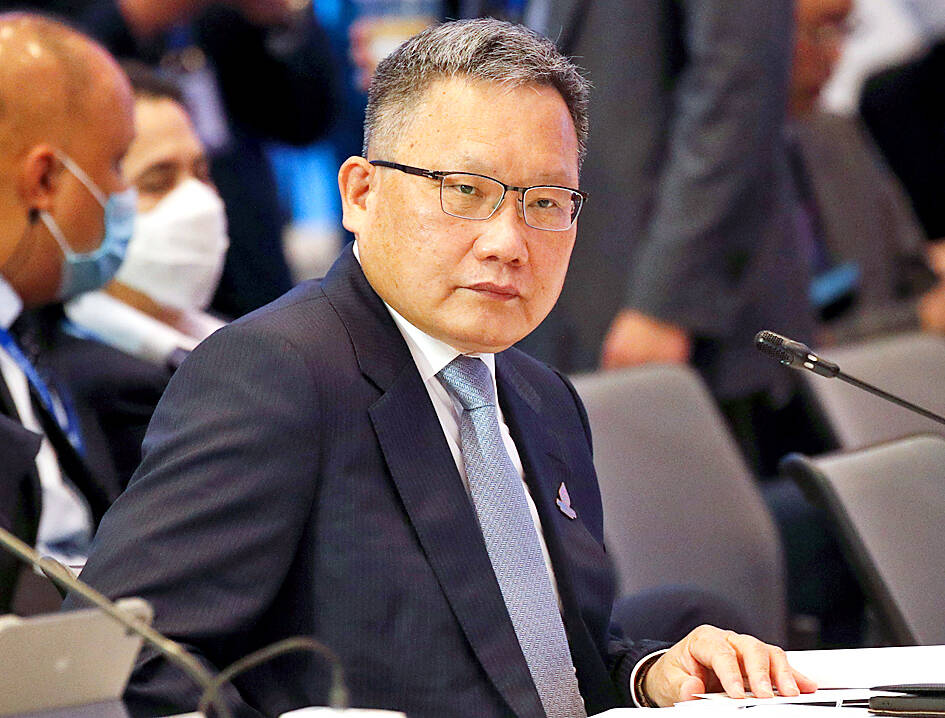

Photo: EPA-EFE

Taiwan’s trade has been pressured this year by waning demand from China and around the world, which has weighed on the export-dependent economy. Overseas shipments contracted last month for the first time since 2020, while export orders declined for the third time this year.

Officials have largely attributed the drop-off to China as COVID-19 restrictions and a property slump are depressing consumer and business confidence there.

Escalating US-China tensions have further clouded Taiwan’s outlook and rattled the global semiconductor industry. After the US announced tighter controls over chip exports to China this month, shares in Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) fell the most in 28 years. TSMC makes chips for major companies that rely on the Chinese market for much of their business, while also taking in about 10 percent of its own revenue from China-based customers.

Su said he had not talked formally last week with US Deputy Secretary of the Treasury Wally Adeyemo, but said he thinks both sides are looking at the US-China relationship.

“The United States is concerned about the supply chains of advanced chips,” he added.

Taiwan’s exports to China and Hong Kong have declined over the past couple of years due to COVID-19 restrictions and US-China disputes, slipping below 40 percent of Taiwan’s total exports, the minister said.

Su said Taiwanese businesses have already started relocating factories from China to Southeast Asia — not so much in the semiconductor industry, but in machinery and other labor-intensive sectors.

Vietnam and Thailand are targets, he added.

Taiwan has been looking to diminish its dependence on China in the past few years, and has explored ways to bolster trade and investment with Southeast Asia, India, Australia and New Zealand.

Taipei last year asked to join one of the Asia-Pacific’s biggest working trade deals, although its application is still pending.

The minister also said Taiwan is looking “very carefully” at how to manage financial stability, as the New Taiwan dollar has weakened this year and as the benchmark TAIEX has tumbled nearly 30 percent so far this year.

The TAIEX closed up 0.29 percent yesterday after gaining as much as 1.6 percent earlier, the first gain in four days, after short-selling curbs were implemented.

Global funds have pulled a net US$47 billion from local equities this year, putting Taiwan on track for its biggest annual outflow in more than two decades.

The US Federal Reserve’s interest rate hikes cause “a lot of problems for financial markets around the world, not just Taiwan,” Su said.

Another issue is the increasing costs of imports — as Taiwan brings in a lot of its raw materials from abroad, imported inflation is another risk, he said.

Should the Fed continue raising rates, the “Taiwanese dollar and financial stability may be affected significantly,” Su said. “It’s not easy to handle it, but we have to face it.”

AI TALENT: No financial details were released about the deal, in which top Groq executives, including its CEO, would join Nvidia to help advance the technology Nvidia Corp has agreed to a licensing deal with artificial intelligence (AI) start-up Groq, furthering its investments in companies connected to the AI boom and gaining the right to add a new type of technology to its products. The world’s largest publicly traded company has paid for the right to use Groq’s technology and is to integrate its chip design into future products. Some of the start-up’s executives are leaving to join Nvidia to help with that effort, the companies said. Groq would continue as an independent company with a new chief executive, it said on Wednesday in a post on its Web

GROWING OWINGS: While Luxembourg and China swapped the top three spots, the US continued to be the largest exposure for Taiwan for the 41st consecutive quarter The US remained the largest debtor nation to Taiwan’s banking sector for the 41st consecutive quarter at the end of September, after local banks’ exposure to the US market rose more than 2 percent from three months earlier, the central bank said. Exposure to the US increased to US$198.896 billion, up US$4.026 billion, or 2.07 percent, from US$194.87 billion in the previous quarter, data released by the central bank showed on Friday. Of the increase, about US$1.4 billion came from banks’ investments in securitized products and interbank loans in the US, while another US$2.6 billion stemmed from trust assets, including mutual funds,

RESPONSE: The Japanese Ministry of Finance might have to intervene in the currency markets should the yen keep weakening toward the 160 level against the US dollar Japan’s chief currency official yesterday sent a warning on recent foreign exchange moves, after the yen weakened against the US dollar following Friday last week’s Bank of Japan (BOJ) decision. “We’re seeing one-directional, sudden moves especially after last week’s monetary policy meeting, so I’m deeply concerned,” Japanese Vice Finance Minister for International Affairs Atsushi Mimura told reporters. “We’d like to take appropriate responses against excessive moves.” The central bank on Friday raised its benchmark interest rate to the highest in 30 years, but Bank of Japan Governor Kazuo Ueda chose to keep his options open rather than bolster the yen,

Even as the US is embarked on a bitter rivalry with China over the deployment of artificial intelligence (AI), Chinese technology is quietly making inroads into the US market. Despite considerable geopolitical tensions, Chinese open-source AI models are winning over a growing number of programmers and companies in the US. These are different from the closed generative AI models that have become household names — ChatGPT-maker OpenAI or Google’s Gemini — whose inner workings are fiercely protected. In contrast, “open” models offered by many Chinese rivals, from Alibaba (阿里巴巴) to DeepSeek (深度求索), allow programmers to customize parts of the software to suit their