Asia’s top chip stocks tumbled yesterday, ensnared in an escalating US-China tech race that has erased more than US$240 billion from the sector’s global market value.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, plunged a record 8.3 percent, while Samsung Electronics Co and Tokyo Electron Ltd also declined.

The selloff spread to the foreign-exchange market as investors tally up the damage from the sweeping curbs the US is imposing on companies that conduct technology business with China.

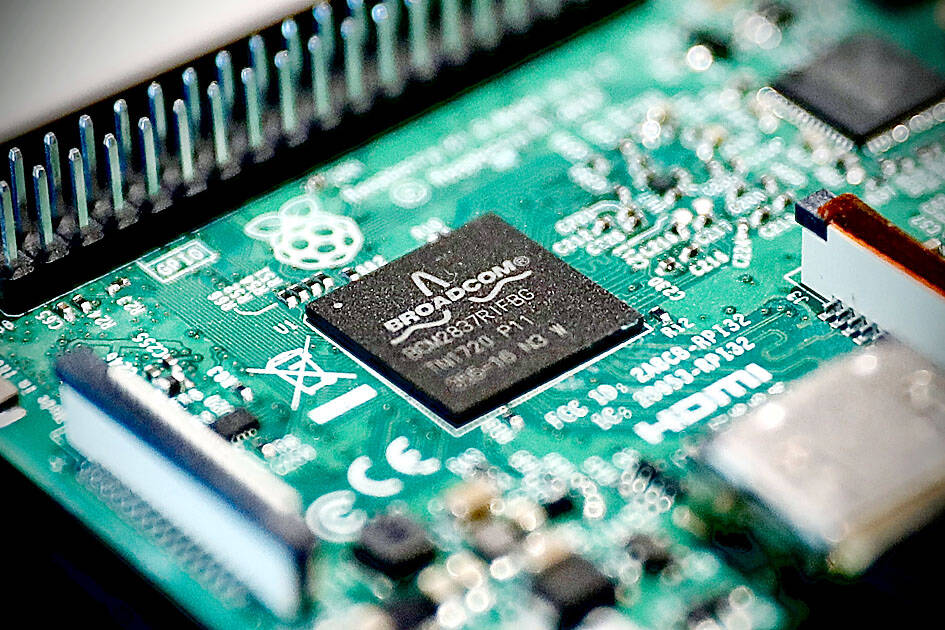

Photo: RITCHIE B. TONGO, EPA-EFE

The measures imposed by the administration of US President Joe Biden erect barriers of entry to China’s market by limiting the ability of US firms to sell equipment and tech to their Chinese counterparts. There are concerns that the restrictions could spread if Washington widens the initiative to include other countries, while questions also remain over the scope and final impact of the moves.

“It is difficult to call a bottom on the performance of the chip sector,” Global CIO Office chief executive officer Gary Dugan said. “The big story is that the West is becoming profoundly more concerned about security around any form of technology. We see no reason to re-enter the sector for the moment despite the profound poor performance.”

US chip stocks were on track to decline for a third day, with Nvidia Corp, Advanced Micro Devices Inc, Qualcomm Inc and Texas Instruments Inc all down more than 1 percent yesterday before the bell.

Chip toolmaker ASML Holding NV traded down 2.3 percent in Amsterdam, bringing three-day losses to more than 11 percent.

The US announced the export curbs on Friday and there have been suggestions that similar actions might be deployed in other countries to ensure international cooperation.

The announcement spurred a two-day rout of more than 9 percent in the Philadelphia Stock Exchange Semiconductor Index, which closed on Monday at its lowest level since November 2020.

Samsung lost as much as 3.9 percent, the most in a year, while SK Hynix Inc, one of the world’s largest makers of memory chips that has facilities in China, slid 3.5 percent before paring losses.

In Tokyo, Renesas Electronics Co shed almost 6 percent, with Tokyo Electron losing a similar amount.

The current rout has already wiped out more than US$240 billion from chip stocks worldwide since Thursday’s close, data compiled by Bloomberg showed.

The selloff extended to currency markets, with the South Korean won sliding as much as 1.8 percent versus the greenback while the New Taiwan dollar declined 0.7 percent.

The curbs are a “big setback to China” and “bad news” for global semiconductors, Nomura Holdings Inc analyst David Wong (黃作慶) wrote in a note on Monday.

China’s localization efforts might also be “at risk as it may not be able to use advanced foundries in Taiwan and [South] Korea,” Wong wrote.

Shares of Chinese chipmakers extended their recent losses yesterday, with Morgan Stanley saying that the broader restrictions around supercomputers and multinational capital investment in China could be “disruptive.”

Semiconductor business between Taiwan and the US is a “win-win” model for both sides given the high level of complementarity, the government said yesterday responding to tariff threats from US President Donald Trump. Home to the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Taiwan is a key link in the global technology supply chain for companies such as Apple Inc and Nvidia Corp. Trump said on Monday he plans to impose tariffs on imported chips, pharmaceuticals and steel in an effort to get the producers to make them in the US. “Taiwan and the US semiconductor and other technology industries

SMALL AND EFFICIENT: The Chinese AI app’s initial success has spurred worries in the US that its tech giants’ massive AI spending needs re-evaluation, a market strategist said Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) eponymous AI assistant rocketed to the top of Apple Inc’s iPhone download charts, stirring doubts in Silicon Valley about the strength of the US’ technological dominance. The app’s underlying AI model is widely seen as competitive with OpenAI and Meta Platforms Inc’s latest. Its claim that it cost much less to train and develop triggered share moves across Asia’s supply chain. Chinese tech firms linked to DeepSeek, such as Iflytek Co (科大訊飛), surged yesterday, while chipmaking tool makers like Advantest Corp slumped on the potential threat to demand for Nvidia Corp’s AI accelerators. US stock

The US Federal Reserve is expected to announce a pause in rate cuts on Wednesday, as policymakers look to continue tackling inflation under close and vocal scrutiny from US President Donald Trump. The Fed cut its key lending rate by a full percentage point in the final four months of last year and indicated it would move more cautiously going forward amid an uptick in inflation away from its long-term target of 2 percent. “I think they will do nothing, and I think they should do nothing,” Federal Reserve Bank of St Louis former president Jim Bullard said. “I think the

Cryptocurrencies gave a lukewarm reception to US President Donald Trump’s first policy moves on digital assets, notching small gains after he commissioned a report on regulation and a crypto reserve. Bitcoin has been broadly steady since Trump took office on Monday and was trading at about US$105,000 yesterday as some of the euphoria around a hoped-for revolution in cryptocurrency regulation ebbed. Smaller cryptocurrency ether has likewise had a fairly steady week, although was up 5 percent in the Asia day to US$3,420. Bitcoin had been one of the most spectacular “Trump trades” in financial markets, gaining 50 percent to break above US$100,000 and