Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) remained the world’s largest contract chipmaker in the second quarter of the year with a 53.4 percent share of the global pure-play foundry market, the Taipei-based market information advisory firm TrendForce Corp (集邦科技) said in a research report on Tuesday.

Despite TSMC’s market share dipping slightly from 53.6 percent in the first quarter, it was still far ahead of its rivals, TrendForce said.

TSMC continued to benefit from emerging technologies, such as high-performance computing devices, the Internet of Things and automotive electronics, as it posted US$18.15 billion in sales in the second quarter, up 3.5 percent from a quarter earlier, it said.

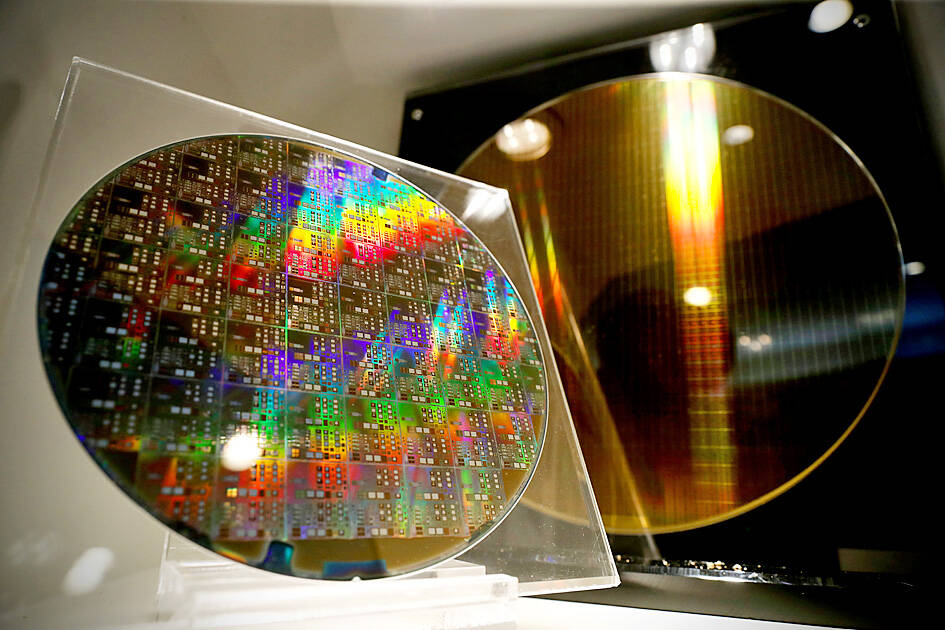

Photo: Ritchie B. Tongo, EPA-EFE

The mild quarter-on-quarter sales growth during the period from April to June reflected a relatively high comparison base in the first quarter, when TSMC raised chip prices amid a global supply shortage, TrendForce said.

South Korea’s Samsung Electronics Co placed second with a 16.5 percent global market share, as it posted US$5.59 billion in sales, up 4.9 percent from a quarter earlier, the report showed.

Taiwan’s United Microelectronics Corp (UMC, 聯電) took third spot with US$2.45 billion in sales and a 7.2 percent global share in the second quarter, TrendForce said.

UMC’s second-quarter sales rose 8.1 percent from a quarter earlier on the back of support from its 22 and 28 nanometer processes, it added.

US-based GlobalFoundries Inc was the fourth-largest contract chipmaker with a 5.9 percent global market share after posting US$1.99 billion.

China’s Semiconductor Manufacturing International Corp (SMIC, 中芯國際), which posted US$1.90 billion in sales and held a 5.6 percent global market share, placed fifth, TrendForce said.

China’s Hua Hong Semiconductor Ltd (華虹半導體) came in sixth with a 3.1 percent global market share after posting US$1.06 billion in sales, followed by Taiwan’s Powerchip Semiconductor Manufacturing Corp (力積電) with US$656 million in sales and 1.9 percent in market share, Taiwan’s Vanguard International Semiconductor Corp (世界先進) with US$520 million in sales and 1.5 percent in market share, South Korea’s Nextchip Co with US$463 million in sales and 1.4 percent in market share, and Israel’s Tower Semiconductor Ltd with US$426 million in sales and 1.3 percent in market share, TrendForce said.

The top 10 contract chipmakers posted US$33.2 billion in combined sales in the second quarter, up 3.9 percent from a quarter earlier, accounting for 98 percent of global revenue, it said.

Sales growth momentum of the 10 largest contract chipmakers showed signs of slowing in the second quarter, as global demand for consumer electronics gadgets weakened, it added.

Inventory adjustments are expected to continue to affect the pure-play foundry business in the third quarter, TrendForce said, adding that Apple Inc’s launch of a new iPhone model is expected to lend support to the sector in the third quarter.

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors