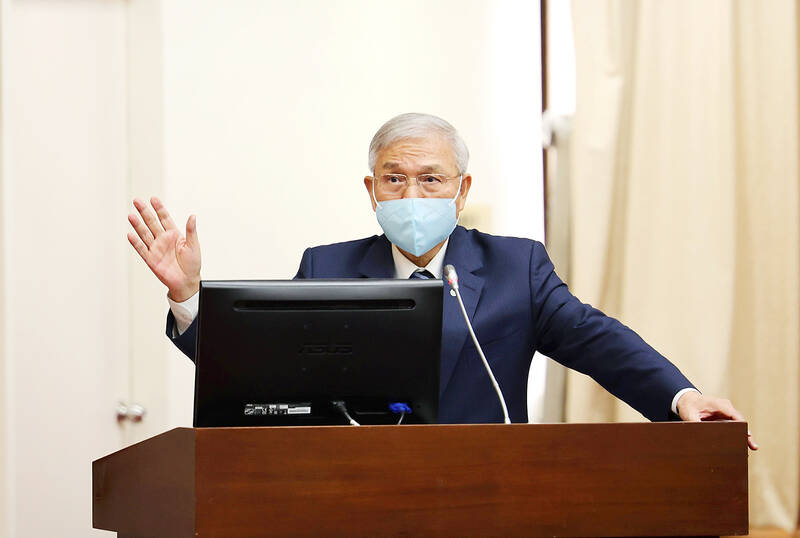

Central bank Governor Yang Chin-long (楊金龍) yesterday said the bank would not impose foreign-exchange controls to curb capital outflows before his tenure ends in February next year.

Yang made the announcement during a question-and-answer session at the legislature after his comments on foreign capital management on Tuesday sparked fears that the bank could take drastic measures to limit capital outflows.

The bank has not adopted capital controls since 1997, when the Asian financial crisis broke out.

Photo: CNA

Foreign investors have remitted NT$40 billion to NT$50 billion (US$1.26 billion to US$1.57 billion) after unloading their local stock holdings, Yang told Chinese Nationalist Party (KMT) Legislator Lin Te-fu (林德福) during the session.

“It is impossible to resist floods. Dredging would work better [to reduce flooding],” Yang said, referring to foreign capital flows. “When you face headwinds, you have to make use of your strength.”

Asked by KMT Legislator Lai Shyh-bao (賴士葆) whether the bank would impose capital controls, Yang said: “Not during my tenure.”

The bank would not impose capital controls in the near term, given Taiwan’s healthy financial fundamentals, including strong foreign-currency liquidity totaling US$691.4 billion, a healthy trade surplus, low foreign debt and high foreign-currency deposits of US$270 billion, Yang said.

He attributed the capital outflows to repeated rate hikes by the US Federal Reserve, saying foreign investors are adjusting their asset portfolios for better returns.

The fund outflows have caused the New Taiwan dollar to fall sharply against the US dollar, as demand for the greenback soared.

The situation is manageable, as the bank had about NT$549 billion in foreign-exchange reserves as of June 30, more than sufficient to prevent the NT dollar overshooting and avoid a financial crisis, Yang said.

Taiwan’s central bank spent NT$8.25 billion to prop up the local currency in the first six months of this year, Yang said.

The NT dollar has plunged more than 15 percent since the beginning of this year. It closed at NT$31.847 against the greenback yesterday.

The central bank is closely monitoring foreign capital movements and overseas fund managers are required to report large remittances to the bank beforehand, Yang said.

However, they are still free to move their funds, he said.

Taiwan weathered the Third Taiwan Strait Crisis in 1995 and the global financial crisis in 2008 without capital controls, Yang said.

No similar measures were taken when China launched military drills around Taiwan last month, he added.

Asked when the central bank would stop raising key interest rates, Yang said that it depends on the inflation rate.

If the consumer price index improves to a manageable level of 2.95 percent this year and falls below 2 percent next year or below the 1.88 percent forecast by the central bank, it might “consider pausing” rates hikes, Yang said.

As there are greater macroeconomic uncertainties, the bank is closely monitoring all economic data and collecting information for its directors to make a decision in their next policy meeting in December, he said.

CHIP WAR: Tariffs on Taiwanese chips would prompt companies to move their factories, but not necessarily to the US, unleashing a ‘global cross-sector tariff war’ US President Donald Trump would “shoot himself in the foot” if he follows through on his recent pledge to impose higher tariffs on Taiwanese and other foreign semiconductors entering the US, analysts said. Trump’s plans to raise tariffs on chips manufactured in Taiwan to as high as 100 percent would backfire, macroeconomist Henry Wu (吳嘉隆) said. He would “shoot himself in the foot,” Wu said on Saturday, as such economic measures would lead Taiwanese chip suppliers to pass on additional costs to their US clients and consumers, and ultimately cause another wave of inflation. Trump has claimed that Taiwan took up to

A start-up in Mexico is trying to help get a handle on one coastal city’s plastic waste problem by converting it into gasoline, diesel and other fuels. With less than 10 percent of the world’s plastics being recycled, Petgas’ idea is that rather than letting discarded plastic become waste, it can become productive again as fuel. Petgas developed a machine in the port city of Boca del Rio that uses pyrolysis, a thermodynamic process that heats plastics in the absence of oxygen, breaking it down to produce gasoline, diesel, kerosene, paraffin and coke. Petgas chief technology officer Carlos Parraguirre Diaz said that in

SUPPORT: The government said it would help firms deal with supply disruptions, after Trump signed orders imposing tariffs of 25 percent on imports from Canada and Mexico The government pledged to help companies with operations in Mexico, such as iPhone assembler Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), shift production lines and investment if needed to deal with higher US tariffs. The Ministry of Economic Affairs yesterday announced measures to help local firms cope with the US tariff increases on Canada, Mexico, China and other potential areas. The ministry said that it would establish an investment and trade service center in the US to help Taiwanese firms assess the investment environment in different US states, plan supply chain relocation strategies and

Japan intends to closely monitor the impact on its currency of US President Donald Trump’s new tariffs and is worried about the international fallout from the trade imposts, Japanese Minister of Finance Katsunobu Kato said. “We need to carefully see how the exchange rate and other factors will be affected and what form US monetary policy will take in the future,” Kato said yesterday in an interview with Fuji Television. Japan is very concerned about how the tariffs might impact the global economy, he added. Kato spoke as nations and firms brace for potential repercussions after Trump unleashed the first salvo of