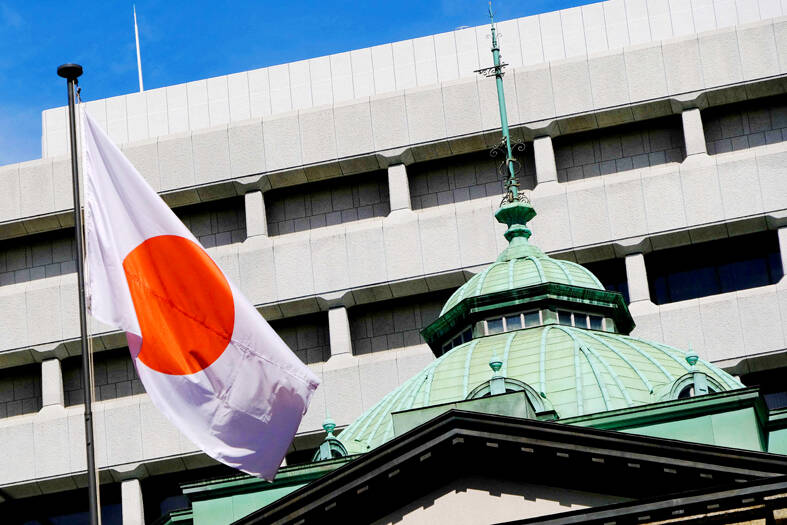

The Bank of Japan (BOJ) continued to stand by its ultra-low interest rates as it further isolated itself from a global wave of policy tightening, fueling a slide in the yen to a fresh 24-year low and ramped-up warnings of possible intervention.

Within hours of the US Federal Reserve’s latest rate hike, BOJ Governor Haruhiko Kuroda and his fellow board members kept the bank’s yield curve control program and its asset purchases unchanged yesterday as had been widely expected.

The decision still pushed the yen to as weak as ¥145.37 against the US dollar, prompting a stronger warning from Japan’s top currency official.

Photo: AFP

“We could do a stealth intervention, and even though I’m not in a position to comment on whether an intervention was done or not, honestly speaking, we haven’t done it yet,” Japanese Vice Minister of Finance for International Affairs Masato Kanda said after the yen had pared back some of the lost ground.

The yen’s descent brings it within striking distance of the ¥146.78 level where the authorities last stepped in to prop it up in 1998.

Hedge funds have been adding to bearish bets on the currency, which has tumbled more than 20 percent this year, with Goldman Sachs Group Inc warning it could decline to ¥155.

Kanda’s remarks came after the BOJ decision showed Kuroda’s determination to stand his ground, even at the cost of further falls in Japan’s currency and more bond buying to defend a cap on bond yields.

The governor has repeatedly signaled that there is a long way to go before policy in Japan can be normalized. In sharp contrast with the Fed’s aggressive rate increases, the BOJ’s forward guidance is flagging the possibility of rates going lower, not higher.

Kuroda has so far clearly ruled out the policy adjustments to stop the yen’s slide. He has repeatedly said the economy needs monetary stimulus until higher wage gains can make the cost-push inflation sustainable.

That means the BOJ is sticking with its short-term interest rate of minus-0.1 percent and its cap on long-term bond yields. In the past week, the central bank has spent about ¥2.9 trillion (US$20.3 billion) on fixed-rate purchases of bonds to defend the 0.25 percent cap.

While daily purchases have been required again after a lull of more than two months, that amount is less than half the ¥7.5 trillion the central bank forked out on purchases in the five days up to its June decision.

Semiconductor shares in China surged yesterday after Reuters reported the US had ordered chipmaking giant Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to halt shipments of advanced chips to Chinese customers, which investors believe could accelerate Beijing’s self-reliance efforts. TSMC yesterday started to suspend shipments of certain sophisticated chips to some Chinese clients after receiving a letter from the US Department of Commerce imposing export restrictions on those products, Reuters reported on Sunday, citing an unnamed source. The US imposed export restrictions on TSMC’s 7-nanometer or more advanced designs, Reuters reported. Investors figured that would encourage authorities to support China’s industry and bought shares

FLEXIBLE: Taiwan can develop its own ground station equipment, and has highly competitive manufacturers and suppliers with diversified production, the MOEA said The Ministry of Economic Affairs (MOEA) yesterday disputed reports that suppliers to US-based Space Exploration Technologies Corp (SpaceX) had been asked to move production out of Taiwan. Reuters had reported on Tuesday last week that Elon Musk-owned SpaceX had asked their manufacturers to produce outside of Taiwan given geopolitical risks and that at least one Taiwanese supplier had been pushed to relocate production to Vietnam. SpaceX’s requests place a renewed focus on the contentious relationship Musk has had with Taiwan, especially after he said last year that Taiwan is an “integral part” of China, sparking sharp criticism from Taiwanese authorities. The ministry said

CHANGING JAPAN: Nvidia-powered AI services over cellular networks ‘will result in an artificial intelligence grid that runs across Japan,’ Nvidia’s Jensen Huang said Softbank Group Corp would be the first to build a supercomputer with chips using Nvidia Corp’s new Blackwell design, a demonstration of the Japanese company’s ambitions to catch up on artificial intelligence (AI). The group’s telecom unit, Softbank Corp, plans to build Japan’s most powerful AI supercomputer to support local services, it said. That computer would be based on Nvidia’s DGX B200 product, which combines computer processors with so-called AI accelerator chips. A follow-up effort will feature Grace Blackwell, a more advanced version, the company said. The announcement indicates that Softbank Group, which until early 2019 owned 4.9 percent of Nvidia, has secured a

TECH SECURITY: The deal assures that ‘some of the most sought-after technology on the planet’ returns to the US, US Secretary of Commerce Gina Raimondo said The administration of US President Joe Biden finalized its CHIPS Act incentive awards for Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), marking a major milestone for a program meant to bring semiconductor production back to US soil. TSMC would get US$6.6 billion in grants as part of the contract, the US Department of Commerce said in a statement yesterday. Though the amount was disclosed earlier this year as part of a preliminary agreement, the deal is now legally binding — making it the first major CHIPS Act award to reach this stage. The chipmaker, which is also taking up to US$5 billion