The US government’s plan to widen the scope of its restrictions on the sale of US-made IC chips and production equipment to China would have only a limited effect on Taiwan’s semiconductor industry, Taiwan Institute of Economic Research (TIER, 台灣經濟研究院) economist Arisa Liu (劉佩真) said yesterday.

Liu, a Taiwan Industry Economics Database researcher at the institute, said the planned restrictions would force Chinese chipmakers to shift their focus to mature technologies, as they would likely face difficulty obtaining equipment required for the production of advanced chips.

China’s increased focus on mature processes would not hurt Taiwan, as Taiwanese chipmakers are competitive in the field and have achieved high yield rates, she said.

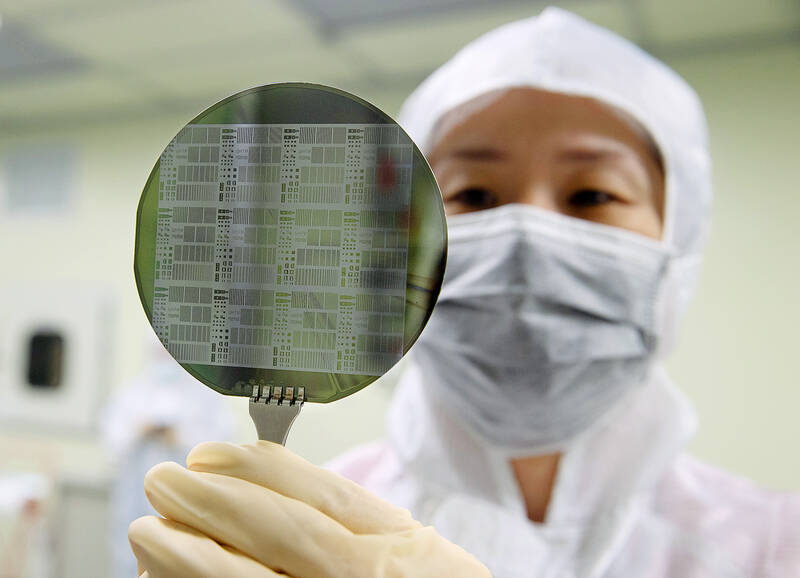

Photo: CNA

The nation’s semiconductor industry would not be pressured by more Chinese chipmakers using mature processes, Liu added.

Her comments followed a Reuters report on Monday that Washington would next month broaden the scope of its restrictions on US exports of semiconductor production equipment to Chinese firms that manufacture advanced chips using sub-14-nanometer processes.

The restrictions would apply to KLA Corp, Lam Research Corp and Applied Materials Inc, it said.

The companies would need to obtain permission from the US Department of Commerce before exporting advanced chip production equipment to China, the report said.

Pegatron Corp (和碩) chairman Tung Tzu-hsien (童子賢) said the planned curbs are an extension of the trade dispute between Washington and Beijing.

The planned restrictions would not cause the kind of shock that rattled the markets in July 2018, when the administration of then-US president Donald Trump imposed tariffs of up to 25 percent on US$34 billion of Chinese imports, sparking the dispute, Tung said.

The commerce department last month sent letters to US IC designers Nvidia Corp and Advanced Micro Devices Inc (AMD), ordering them to halt shipments of artificial intelligence (AI) chips to China without government permission, the Reuters report said.

Liu said the ban would have a limited effect on Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), as Nvidia and AMD sell products other than AI chips to their Chinese customers.

TSMC was similarly unaffected by the sanctions Washington placed on China’s Huawei Technologies Co (華為) on Sept. 15, 2020, she said.

The chipmaker achieved this by adopting flexible sales strategies and the void left by the missing Huawei orders was quickly filled by other customers, Liu said.

Taiwan will prioritize the development of silicon photonics by taking advantage of its strength in the semiconductor industry to build another shield to protect the local economy, National Development Council (NDC) Minister Paul Liu (劉鏡清) said yesterday. Speaking at a meeting of the legislature’s Economics Committee, Liu said Taiwan already has the artificial intelligence (AI) industry as a shield, after the semiconductor industry, to safeguard the country, and is looking at new unique fields to build more economic shields. While Taiwan will further strengthen its existing shields, over the longer term, the country is determined to focus on such potential segments as

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors