Taiwan took the top spot in global semiconductor equipment spending in the second quarter of this year, up from third place the previous quarter, with the country’s manufacturers keen to invest in expansion, global semiconductor trade association SEMI said on Wednesday.

Taiwanese firms spent US$6.68 billion buying semiconductor equipment from the April to June period, up 37 percent from a quarter earlier, SEMI data showed.

Second-quarter spending was also up 32 percent from a year earlier, the data showed.

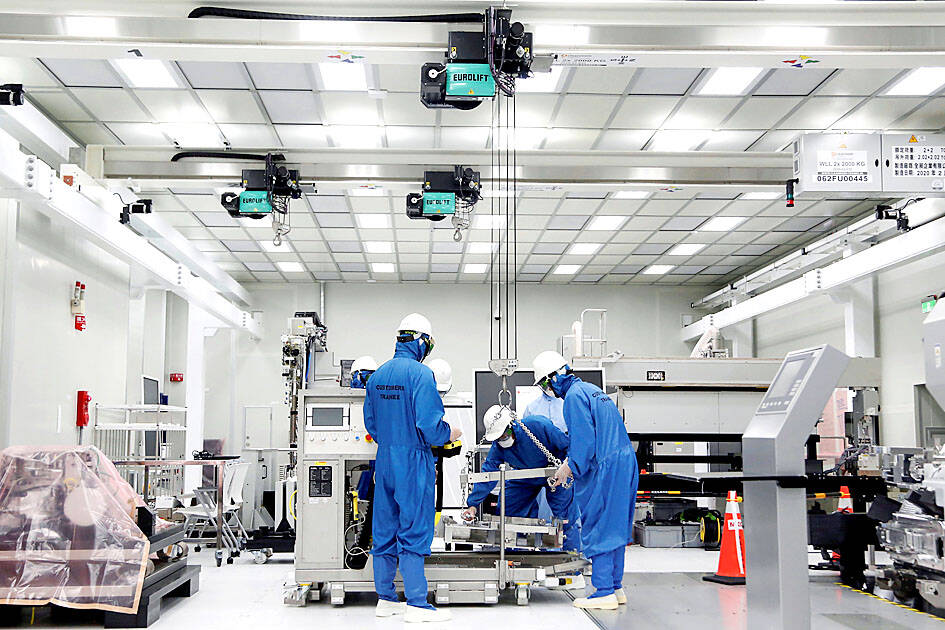

Photo: Ann Wang, Reuters

Although the second quarter is traditionally a slow season in the global semiconductor industry, many Taiwanese firms poured funds into expanding production and upgrading technology to maintain a lead over industry peers, analysts said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, was one of the biggest investors in equipment to develop advanced processes, they said.

TSMC plans to spend about US$40 billion in capital expenditure this year as it is about to start using a 3 nanometer process this year, while it is also developing a more sophisticated 2 nanometer process.

As demand for TSMC’s 7 nanometer and 5 nanometer processes remain solid for emerging technologies such as high-performance computing devices, 5G applications and automotive electronics, TSMC needed more capacity, analysts said.

Full capacity utilization is expected to continue until the end of the year, TSMC said.

China spent US$6.56 billion buying semiconductor equipment in the second quarter, down 13 percent from the previous quarter, and also down 20 percent from a year earlier, to take the second spot, falling from first place in the first quarter, SEMI data showed.

Analysts said the fall was largely a result of a ban imposed by the US government on selling certain types of semiconductor equipment to China, while that country’s “zero COVID” policy also hurt demand.

South Korea placed third after buying US$5.78 billion worth of semiconductor equipment, up 12 percent from the previous quarter, but down 13 percent from a year earlier, falling from the second spot in the first quarter, the data showed.

In the second quarter, global semiconductor equipment spending totaled US$26.43 billion, up 7 percent from a quarter earlier and up 6 percent from a year earlier, SEMI said.

Because pure foundry operators such as TSMC are raising production capacity, semiconductor equipment spending is expected to grow this year, said SEMI Taiwan president Terry Tsao (曹世綸), who is also the group’s global chief marketing officer.

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

Taiwan will prioritize the development of silicon photonics by taking advantage of its strength in the semiconductor industry to build another shield to protect the local economy, National Development Council (NDC) Minister Paul Liu (劉鏡清) said yesterday. Speaking at a meeting of the legislature’s Economics Committee, Liu said Taiwan already has the artificial intelligence (AI) industry as a shield, after the semiconductor industry, to safeguard the country, and is looking at new unique fields to build more economic shields. While Taiwan will further strengthen its existing shields, over the longer term, the country is determined to focus on such potential segments as

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced