Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said that three new plants in Kaohsiung, Japan and the US would start production in 2024, as it accelerates its capacity expansion to cope with growing semiconductor demand.

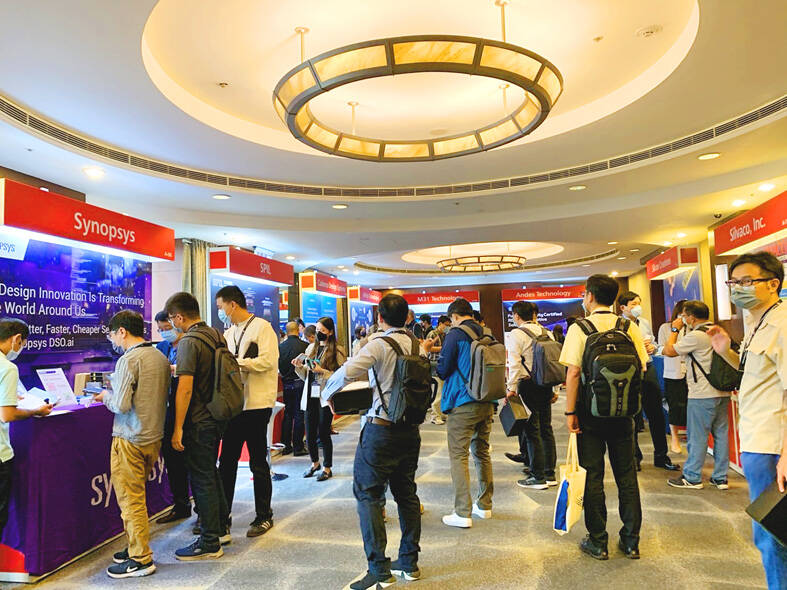

Apart from the two fabs that are under construction in Arizona and in Kumamoto, Japan, the world’s biggest contract chipmaker plans to start building a new fab in Kaohsiung in the second half of this year, TSMC vice president Y.L. Wang (王英郎) said at the firm’s annual technology symposium in Hsinchu.

The Kaohsiung fab, dubbed Fab 22, would produce 7-nanometer and 28-nanometer chips once it begins operations in 2024, Wang said.

Photo: Grace Hung, Taipei Times

The Arizona fab is to make 5-nanometer chips and the Kumamoto fab is to produce chips using specialty process technologies, he said.

To satisfy customer demand, TSMC is not only increasing leading-edge technology capacity, but also mature-node technologies, Wang said.

TSMC expects its advanced technology capacity to expand at a compound annual growth rate of 70 percent from 2018 to this year, thanks to robust demand for chips used in smartphones and high-performance computing devices such as servers, Wang said.

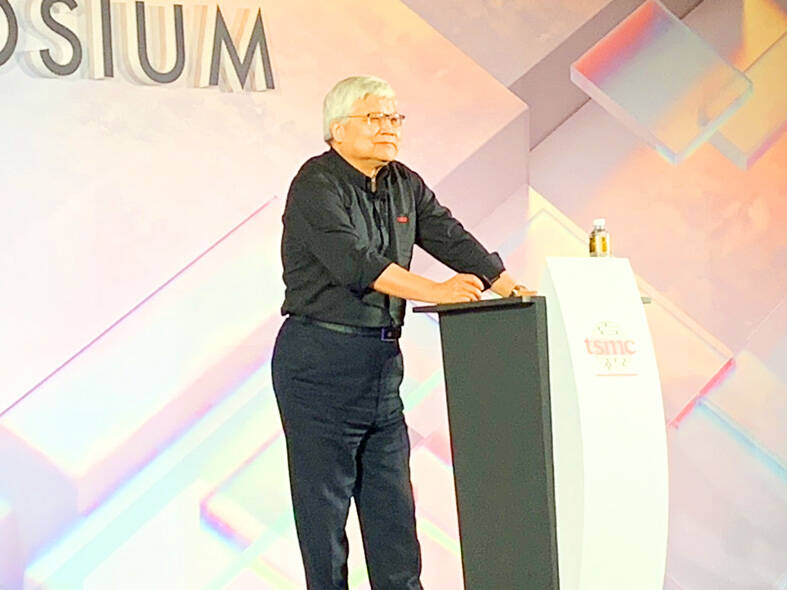

.Photo: Grace Hung, Taipei Times

This year alone, the company’s 5-nanometer chip capacity would more than quadruple from two years earlier, he said.

On top of that, TSMC plans to produce 3-nanometer chips in the second half of this year, Wang said, adding that 3-nanometer capacity is expected to increase rapidly at its Tainan fabs to cope with customer demand.

Because of substantial customer demand for 3-nanometer chips, the company’s engineering capacity is tight, TSMC chief executive officer C.C. Wei (魏哲家) said at the symposium.

The chipmaker plans to produce next-generation 2-nanometer chips at new factories in Hsinchu, Wang said.

TSMC is also stepping up its efforts to expand specialty technology capacity to meet rising demand for image sensors and radio frequency chips, Wang said.

Capital investment for specialty technologies would grow about 4.5-fold compared with the average outlay over the past three years, he said.

That would boost the capacity contribution from specialty technologies to about 63 percent of total wafer capacity this year, compared with 45 percent in 2018, he said.

The chipmaker has been expanding capacity faster in the past few years with an average of six factories built each year from 2018 to this year, compared with two factories from 2017 to 2019, Wang said.

However, TSMC said that chip manufacturing costs are rising rapidly, as China, Japan, the EU and the US are pushing to localize chip manufacturing to boost the resilience of their chip supply amid geopolitical tensions.

It is going to be costly if manufacturers reverse the globalization that has created economic benefits, Wei said.

In addition, TSMC has been making chips using specialty technologies at existing factories without the burden of depreciation and amortization costs, he said.

To make enough specialty technology chips to meet rising demand for vehicle chips and other applications, TSMC is building new factories, but would charge more for the chips due to depreciation and amortization costs, as well as the high cost of equipment tools, he said.

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his

ADVERSARIES: The new list includes 11 entities in China and one in Taiwan, which is a local branch of Chinese cloud computing firm Inspur Group The US added dozens of entities to a trade blacklist on Tuesday, the US Department of Commerce said, in part to disrupt Beijing’s artificial intelligence (AI) and advanced computing capabilities. The action affects 80 entities from countries including China, the United Arab Emirates and Iran, with the commerce department citing their “activities contrary to US national security and foreign policy.” Those added to the “entity list” are restricted from obtaining US items and technologies without government authorization. “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives,” US Secretary of Commerce Howard Lutnick said. The entities

Minister of Finance Chuang Tsui-yun (莊翠雲) yesterday told lawmakers that she “would not speculate,” but a “response plan” has been prepared in case Taiwan is targeted by US President Donald Trump’s reciprocal tariffs, which are to be announced on Wednesday next week. The Trump administration, including US Secretary of the Treasury Scott Bessent, has said that much of the proposed reciprocal tariffs would focus on the 15 countries that have the highest trade surpluses with the US. Bessent has referred to those countries as the “dirty 15,” but has not named them. Last year, Taiwan’s US$73.9 billion trade surplus with the US

Prices of gasoline and diesel products at domestic gas stations are to fall NT$0.2 and NT$0.1 per liter respectively this week, even though international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices continued rising last week, as the US Energy Information Administration reported a larger-than-expected drop in US commercial crude oil inventories, CPC said in a statement. Based on the company’s floating oil price formula, the cost of crude oil rose 2.38 percent last week from a week earlier, it said. News that US President Donald Trump plans a “secondary