The industrial production index last month expanded 1.12 percent year-on-year to 135.9, mainly driven by strong chips demand from the world’s major smartphone vendors and rising adoption of emerging technologies, the Ministry of Economic Affairs said yesterday.

Last month's increase represented the 30th consecutive month of annual rise, the ministry said. On a monthly basis, the index edged up 0.08 percent, it said.

The manufacturing production index, a major contributor to industrial production, expanded 1.03 percent from a year earlier to 136.88, but the index contracted 0.49 percent month-on-month due to depressed demand for petrochemicals, base metals and machine tools, offsetting growth in chips and high-end computers, the ministry said.

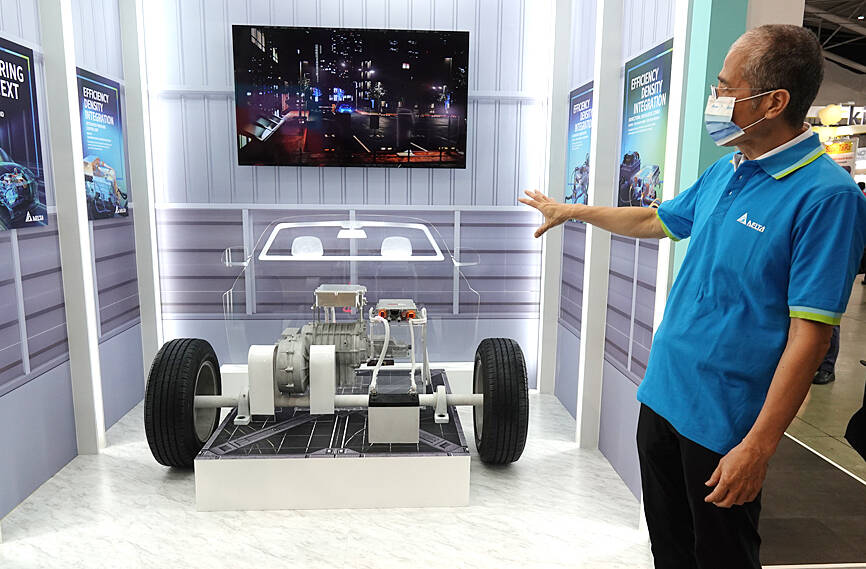

Photo: CNA

The ministry is cautious about the prospects of the manufacturing industry in the remainder of this year, if the macroeconomic environment does not improve and soaring inflation continues harming demand.

As a result, the manufacturing production index might dip 0.5 percent year-on-year to 137.4 this month in the worst-case scenario, dragged by persistent weakness in traditional industries, or rise 2.4 percent at best, the ministry said.

“We are still looking at positive growth in August,” Department of Statistics Deputy Director-General Huang Wei-jie (黃偉傑) said by telephone. “Traditional industries are expected to report further declines this month as rising inflation continues putting pressure on demand.”

On the positive side, inventory buildup demand for semiconductors and electronics is rising ahead of new launches by global brands, the ministry said.

For the third quarter, the manufacturing production index is expected to be flat or to grow by a single-digit percentage, Huang said.

The downside risk is higher next quarter, due to a higher comparison base in the fourth quarter last year when demand for local goods jumped after the US, China and European countries reopened their economies after the COVID-19 pandemic stabilized, he said.

Production of electronic components last month rose 0.64 percent month-on-month, or 9.26 percent year-on-year, supported by the semiconductor sub-index, which increased 1.35 percent month-on-month and 21.89 percent year-on-year.

The growth was fueled by robust demand for chips for automobiles and high-performance computing devices, such as servers and networking applications.

Displays and related products slumped 7.92 percent month-on-month and 41.92 percent year-on-year due to weak TV and tablet sales.

The production of computers and optical products slid 0.54 percent month-on-month, but rose 12.2 percent year-on-year.

The growth was driven by higher demand for data centers and high-end notebook computers, the ministry said, adding that local manufacturers are expanding capacity in response to rising demand.

Production in the petrochemicals sector last month shrank 6.53 percent month-on-month and 18.36 percent year-on-year, as customers became conservative about placing orders after entering an inventory digestion cycle.

To cope with falling demand, local manufacturers shut down some facilities for annual maintenance.

The production of basic metals dropped 8.23 percent month-on-month and 19.55 percent year-on-year due to sluggish demand for steel as customers had excessive inventories.

Production in the machinery sector fell 3.86 percent month-on-month and 6.71 percent year-on-year as customers were cautious about investing in new manufacturing equipment due to the slowing global economy, but increased demand from semiconductor companies helped cushion the negative effects.

The production of vehicles and auto components increased 7.23 percent month-on-month and 7.16 percent year-on-year due to annual promotions during Ghost Month and easing component shortages.

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

STILL HOPEFUL: Delayed payment of NT$5.35 billion from an Indian server client sent its earnings plunging last year, but the firm expects a gradual pickup ahead Asustek Computer Inc (華碩), the world’s No. 5 PC vendor, yesterday reported an 87 percent slump in net profit for last year, dragged by a massive overdue payment from an Indian cloud service provider. The Indian customer has delayed payment totaling NT$5.35 billion (US$162.7 million), Asustek chief financial officer Nick Wu (吳長榮) told an online earnings conference. Asustek shipped servers to India between April and June last year. The customer told Asustek that it is launching multiple fundraising projects and expected to repay the debt in the short term, Wu said. The Indian customer accounted for less than 10 percent to Asustek’s

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would