Taiwan would emerge unscathed from China’s retaliatory actions to protest US House of Representatives Speaker Nancy Pelosi’s visit to Taipei, top monetary and financial officials said yesterday.

Central bank Governor Yang Chin-long (楊金龍) shrugged off unease over potential instability in the foreign exchange and stock markets after foreign portfolio funds trimmed their holdings of local shares for two straight days amid Beijing’s threats of retaliation.

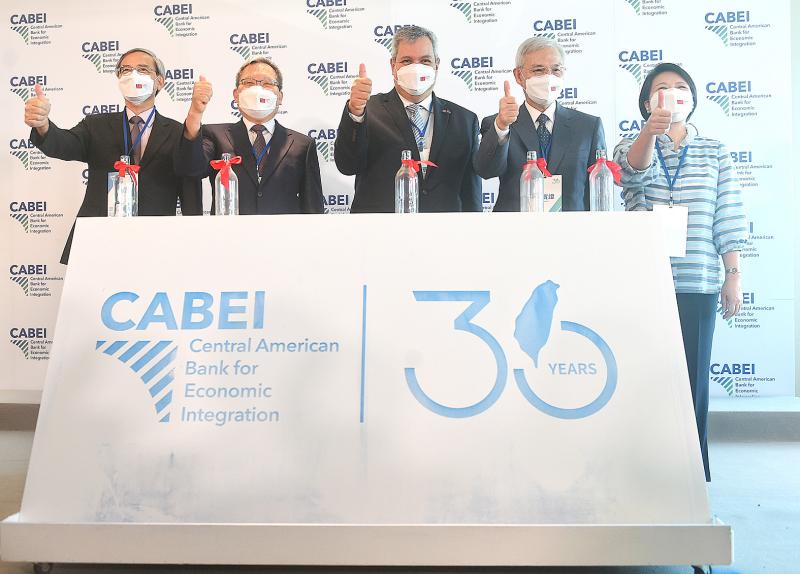

“There is no need to worry,” Yang said on the sidelines of an event to celebrate the first anniversary of the opening of Central American Bank for Economic Integration’s (CABEI) Taipei office and the 30th anniversary of Taiwan becoming a member of CABEI.

Photo: Chang Chia-ming, Taipei Times

Taiwan has sufficient foreign exchange reserves to rein in unexpected and abnormal developments, Yang said when asked to comment on the currency market.

The New Taiwan dollar yesterday closed up 0.06 percent at NT$29.990 versus the US dollar in Taipei trading amid a normal trading volume of US$926 million.

Yang said the recent selling of local shares by foreign institutional players was “typical” for this time of the year.

Foreign portfolio managers tend to wire cash dividends abroad in August, putting depreciation pressure on the NT dollar.

Minister of Finance Su Jain-rong (蘇建榮) said China’s ban on imports of citrus fruit and two types of fish from Taiwan would have a very limited effect on the nation’s overall export figures.

China’s customs agency on Monday night imposed temporary import bans on more than 100 Taiwanese food brands, including I-Mei Foods Co (義美食品), Wei Chuan Foods Corp (味全食品) and Kuo Yuan Ye Foods Co (郭元益食品).

China and Hong Kong accounted for 25 percent of processed food exports in the first six months of this year, down from 43 percent in previous years, as local suppliers expanded export markets, Su told reporters at the CABEI event.

Processed food bound for the two markets amounted to US$240 million a year, or only 0.1 percent of total exports, Su said.

Similarly, China’s suspension of natural sand exports to Taiwan would cause little inconvenience, as local construction projects rely mostly on domestically sourced sand, Su said, adding that most China-sourced sand is sea sand that cannot be used in construction projects.

The American Chamber of Commerce in Taiwan said in a statement that it appreciated the extra support and interest from US officials in backing Taiwan.

While official visits carry important symbolic meaning, the chamber’s 71-year history has demonstrated how the peaceful pursuit of commerce contributes to prosperity and innovation on a regional and global level, the chamber said.

“We believe that further investment in the US-Taiwan economic relationship remains the best course to ensure the continuation of this progress,” it said.

The US and Taiwan are uniquely equipped to tackle challenges and opportunities, from public health, semiconductors, digital, and supply chain resilience to the development of sustainable sources of energy and talent, it said.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

New vehicle sales in Taiwan plunged about 37 percent sequentially last month as the long Lunar New Year holiday and 228 Peace Memorial Day holiday cut short the number of working days, along with the lingering uncertainty over import tax cuts on US vehicles, market researcher U-Car said in a report yesterday. New car sales last month totaled 22,043, slumping from 35,073 units in January and down 19.89 percent from 37,515 in February last year, U-Car data showed. Sales of imported luxury cars, led by Mercedes-Benz, plummeted about 45 percent to 3,109 units last month from 5,663 units in the previous month,