The Ministry of Finance on Friday welcomed any opportunity to negotiate an income tax agreement with the US involving the reduction of double taxation.

However, the ministry said negotiations would not commence until both sides shared “similar ideas” on the matter.

The ministry’s remarks came one week after two US senators presented a draft resolution urging the administration of US President Joe Biden to begin negotiating such an accord with Taiwan.

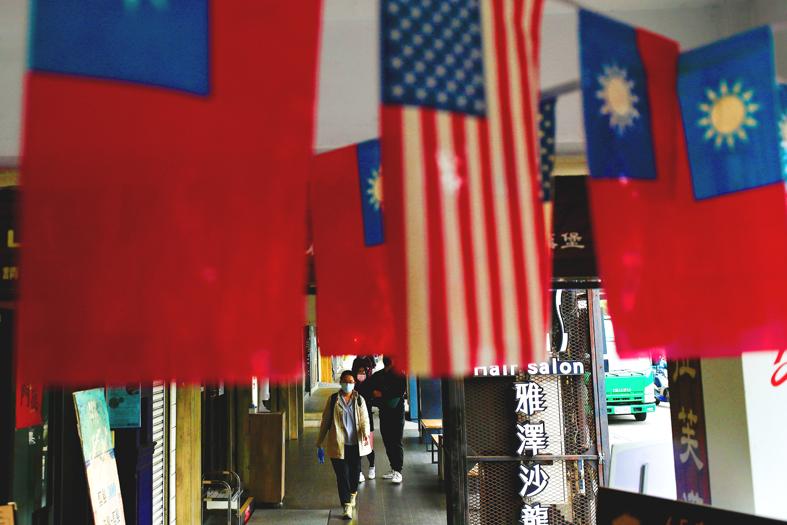

Photo: Ritchie B. Tongo, EPA-EFE

According to the proposed resolution, an income tax agreement between Taiwan and the US “could boost bilateral trade and investment by reducing double taxation, and increasing economic efficiency and integration.”

A ministry official said that Taiwan and the US previously signed taxation-related deals, including a transportation income tax agreement in 1988.

However, the two countries have not entered into a comprehensive reciprocal tax treaty that includes the reduction or elimination of double taxation on individuals and businesses with operations in each other’s countries, the official said, speaking on condition of anonymity.

Taiwan has income tax agreements with 34 countries, including Canada, France, India, Japan and Canada.

On July 21, US senators Chris Van Hollen and Ben Sasse introduced a resolution in the US Congress, urging the Biden administration to begin negotiating an income tax agreement with Taiwan.

“For decades, Taiwan has been a key economic partner of the United States. Yet, right now Taiwanese and US businesses are double-taxed due to the lack of a formal joint tax agreement,” Van Hollen said in a news statement on July 22.

“It’s common sense we’d negotiate a tax agreement that can benefit both US and Taiwanese companies doing business in each other’s country,” Sasse said.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received