Shares yesterday slipped in Europe after gains in most Asian markets following a surge on Wall Street fueled by hopes that the US Federal Reserve might slow its pace of inflation-fighting interest rate hikes.

The Fed raised its main interest rate by 75 basis points as expected, and reiterated inflation control as its priority.

However, it dropped guidance on the size of its next rate hike, and said that “at some point” it would be appropriate to slow down.

Photo: AFP

Analysts cautioned that the initial joy, which sent New York’s three main indices soaring, could be short-lived as the global economy continues to face several headwinds, and inflation would likely not come down quickly.

The TAIEX closed down 29.69 points, or 0.2 percent, at 14,891.90, but Shanghai, Tokyo, Sydney, Seoul, Singapore, Mumbai, Manila, Jakarta and Wellington were in positive territory.

Hong Kong slipped 0.2 percent to 20,622.68, as its de facto central bank followed the Fed in lifting rates owing to its currency peg.

European shares came off session highs after a slew of downbeat corporate earnings.

There is growing concern that the sharp rise in rates is bearing down on the world’s top economy and could send it into a recession.

US Federal Reserve Chairman Jerome Powell said he did not consider that to be the case, as “there are too many areas of the economy that are performing too well,” adding, however, that growth was slowing.

Central bank officials would not provide any guidance on their next move, instead taking each decision on a meeting-to-meeting basis, Powell said.

While another “unusually large increase could be appropriate” in September and officials “wouldn’t hesitate” to lift by 1 percentage point, markets took heart from the suggestion that the bank was ready to take its foot off the gas toward the end of the year, he said.

The prospect of a slower pace of rate hikes weighed on the US dollar against most other currencies, and yesterday it hit its lowest level against the yen since July 6.

However, there was a warning that the positive mood might not last.

“This market move is the victory of hope over experience,” BlackRock Inc strategist Jeffrey Rosenberg said. “I’d be a little bit cautious.”

Citigroup Inc analysts Andrew Hollenhorst and Veronica Clark said in a statement that traders appeared to be misjudging Powell’s remarks.

“We read Chair Powell’s press conference as more hawkish than the market’s interpretation,” they said, adding that inflation readings excluding food and energy will “push the Fed to hike more aggressively than they or markets anticipate.”

Second-quarter growth data in the US were to be released yesterday. After a 1.6 percent contraction in the previous three months, another negative reading could put the economy into a technical recession.

Yesterday’s phone call between US President Joe Biden and Chinese President Xi Jinping (習近平) was also high on the agenda of what investors were watching, as the world’s superpowers tried to navigate a period of rising tensions. A trade dispute between the US and China was one of the main areas of focus.

Additional reporting by AP and Reuters

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

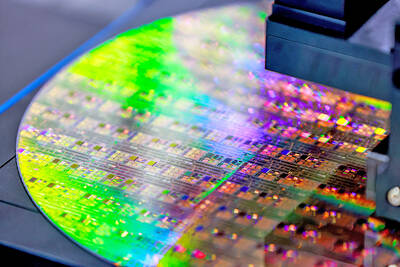

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional

Pegatron Corp (和碩), a key assembler of Apple Inc’s iPhones, on Thursday reported a 12.3 percent year-on-year decline in revenue for last quarter to NT$257.86 billion (US$8.44 billion), but it expects revenue to improve in the second half on traditional holiday demand. The fourth quarter is usually the peak season for its communications products, a company official said on condition of anonymity. As Apple released its new iPhone 17 series early last month, sales in the communications segment rose sequentially last month, the official said. Shipments to Apple have been stable and in line with earlier expectations, they said. Pegatron shipped 2.4 million notebook