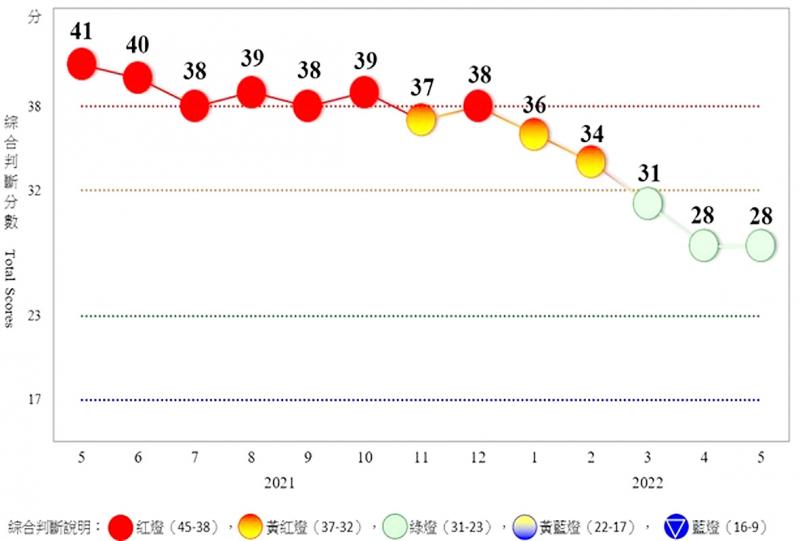

Taiwan’s business climate monitor last month signaled green for a third consecutive month, indicating steady growth, after global inflation and China’s COVID-19 controls had weighed on earlier readings, the National Development Council said yesterday.

The total score of nine constituent readings held steady at 28.

However, challenges loom ahead for exports, which have fared well so far, council research director Wu Ming-huei (吳明蕙) said.

Photo courtesy of the National Development Council

The council uses a five-color system to depict the nation’s economic state, with “green” indicating steady growth, “red” suggesting a boom and “blue” signaling a recession. Dual colors indicate a shift to a stronger or weaker state.

Exports account for 60 to 70 percent of the nation’s GDP, as Taiwan is home to the world’s largest suppliers of chips used in smartphones, laptops, autos, and high-performance computing and Internet of Things applications.

Critical economic barometers such as exports, industrial production and export orders have shown signs of a slowdown, but remain in expansion territory, Wu said.

China’s virus controls have disrupted supply chain flows while the Ukraine war has been pushing up international energy and raw material prices — incidents over which Taiwanese firms do not have any control, he said.

Rising inflationary pressures worldwide have taken a toll on global demand for smartphones, laptops, TVs and vehicles.

Domestic demand, on the other hand, might soon come out of the woods, as local semiconductor companies press ahead with capacity expansion plans, which would shore up private investment, Wu said.

The government’s travel subsidies are to take effect next month, by which time the number of locally transmitted COVID-19 cases is expected to have fallen significantly, allowing business activity to recover, he said.

The index of leading indicators, which seeks to project the economic scene in the coming six months, fell 0.7 percent to 99.03, the council said, as almost all sub-indices fell, with the exception of the reading on new construction floor spaces.

The index of coincident indicators, which reflects the current economic situation, shrank 0.56 percent to 100.64, dragged by almost all components except for the gauge on exports, it said.

The gauge on retail sales last month rose from a year earlier, because the government did not tighten social distancing measures this year, as it seeks to live with COVID-19, similar to other countries, Wu said.

MULTIFACETED: A task force has analyzed possible scenarios and created responses to assist domestic industries in dealing with US tariffs, the economics minister said The Executive Yuan is tomorrow to announce countermeasures to US President Donald Trump’s planned reciprocal tariffs, although the details of the plan would not be made public until Monday next week, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. The Cabinet established an economic and trade task force in November last year to deal with US trade and tariff related issues, Kuo told reporters outside the legislature in Taipei. The task force has been analyzing and evaluating all kinds of scenarios to identify suitable responses and determine how best to assist domestic industries in managing the effects of Trump’s tariffs, he

TIGHT-LIPPED: UMC said it had no merger plans at the moment, after Nikkei Asia reported that the firm and GlobalFoundries were considering restarting merger talks United Microelectronics Corp (UMC, 聯電), the world’s No. 4 contract chipmaker, yesterday launched a new US$5 billion 12-inch chip factory in Singapore as part of its latest effort to diversify its manufacturing footprint amid growing geopolitical risks. The new factory, adjacent to UMC’s existing Singapore fab in the Pasir Res Wafer Fab Park, is scheduled to enter volume production next year, utilizing mature 22-nanometer and 28-nanometer process technologies, UMC said in a statement. The company plans to invest US$5 billion during the first phase of the new fab, which would have an installed capacity of 30,000 12-inch wafers per month, it said. The

Taiwan’s official purchasing managers’ index (PMI) last month rose 0.2 percentage points to 54.2, in a second consecutive month of expansion, thanks to front-loading demand intended to avoid potential US tariff hikes, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. While short-term demand appeared robust, uncertainties rose due to US President Donald Trump’s unpredictable trade policy, CIER president Lien Hsien-ming (連賢明) told a news conference in Taipei. Taiwan’s economy this year would be characterized by high-level fluctuations and the volatility would be wilder than most expect, Lien said Demand for electronics, particularly semiconductors, continues to benefit from US technology giants’ effort

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his