The shares of major producers of Ajinomoto Build-up Film (ABF) substrate underperformed compared with the broader market last week, as investors expected a dimmer outlook for the industry in the second half of this year.

The continued narrowing of the gap between supply and demand is likely to slow manufacturers’ earnings later this year and next year, analysts said, adding that investors are closely watching the effects of rising electronic product inventory on the ABF substrate sector’s supply-and-demand dynamics.

“We expect ABF substrate suppliers to see gradually weakening earnings growth in the second half of 2022 and in 2023, given weak sales for some electronic products, along with assemblers’ record-high inventories,” Yuanta Securities Investment Consulting Co (元大投顧) analysts led by Hope Liu (劉思良) said in a note on Thursday.

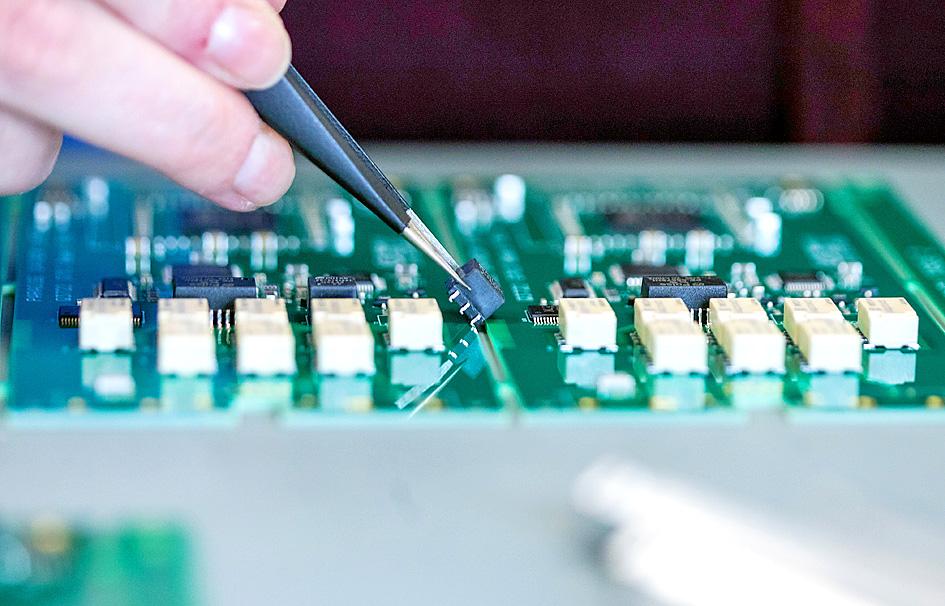

Photo: Bloomberg

Other negative factors also include “weakening consumption in various countries amid strong consumer price growth and [major Austrian supplier] AT&S’s 70 percent capacity expansion, scheduled for 2023,” they said.

Major ABF substrate makers in Taiwan include Unimicron Technology Corp (欣興電子), Nan Ya Printed Circuit Board Corp (南亞電路板) and Kinsus Interconnect Technology Corp (景碩科技).

Unimicron shares last week dropped 19.61 percent, while Kinsus fell 11.9 percent and Nan Ya PCB retreated by 13.42 percent, compared with the TAIEX’s 4.97 percent decline.

Yuanta analysts said that Unimicron began high-end substrate production at its Yangmei plant in Taoyuan this quarter, which is expected to increase its capacity by 20 to 30 percent from last year, while Kinsus began machine installation at its new plant in Yangmei, as it aims to expand its capacity by 40 to 50 percent this year.

Nan Ya PCB also expects capacity expansion of 20 to 30 percent this year, driven by mass production at its Jinxing plant in Taoyuan, in addition to the ramping up its Shulin plant in New Taipei City and its Kunshan plant in China, they said.

Increased output by global semiconductor companies against weak PC chip sales and the easing of networking chip shortages, as well as rising inventory at Taiwanese electronics assemblers, would pose concerns for ABF substrate producers in the second half of the year, the note said.

Yuanta estimates that PC chip applications account for 50 to 55 percent of ABF substrate demand, and an anticipated PC sales decline of 8 percent this year would be the key uncertainty in supply and demand for ABF substrate producers.

“We forecast ABF substrate demand growth to drop to 14 percent this year versus an annual growth of 20 percent in 2021, before recovering to 22 percent in 2023,” Yuanta analysts said.

“With AT&S dominating 14 percent of the market and its 70 percent capacity expansion scheduled for 2023, coupled with continued capacity expansion from various suppliers, we expect ABF substrate makers to see a narrowing supply-demand gap in the medium term,” they added.

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

GREAT SUCCESS: Republican Senator Todd Young expressed surprise at Trump’s comments and said he expects the administration to keep the program running US lawmakers who helped secure billions of dollars in subsidies for domestic semiconductor manufacturing rejected US President Donald Trump’s call to revoke the 2022 CHIPS and Science Act, signaling that any repeal effort in the US Congress would fall short. US Senate Minority Leader Chuck Schumer, who negotiated the law, on Wednesday said that Trump’s demand would fail, while a top Republican proponent, US Senator Todd Young, expressed surprise at the president’s comments and said he expects the administration to keep the program running. The CHIPS Act is “essential for America leading the world in tech, leading the world in AI [artificial

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would