Taiwan’s market share in advanced industries relative to its size is more than double the world average, driven almost solely by its dominance in computers and electronics, a report issued on Wednesday by a Washington-based research institute showed.

The report by the Information Technology and Innovation Foundation measured the performance of 10 leading economies across seven key sectors in the years 1995, 2006 and 2018.

The sectors included pharmaceuticals; medicinal, chemical and botanical products; electrical equipment; machinery and equipment; motor vehicle equipment; other transport equipment; computer, electronic and optical products; and information technology and information services.

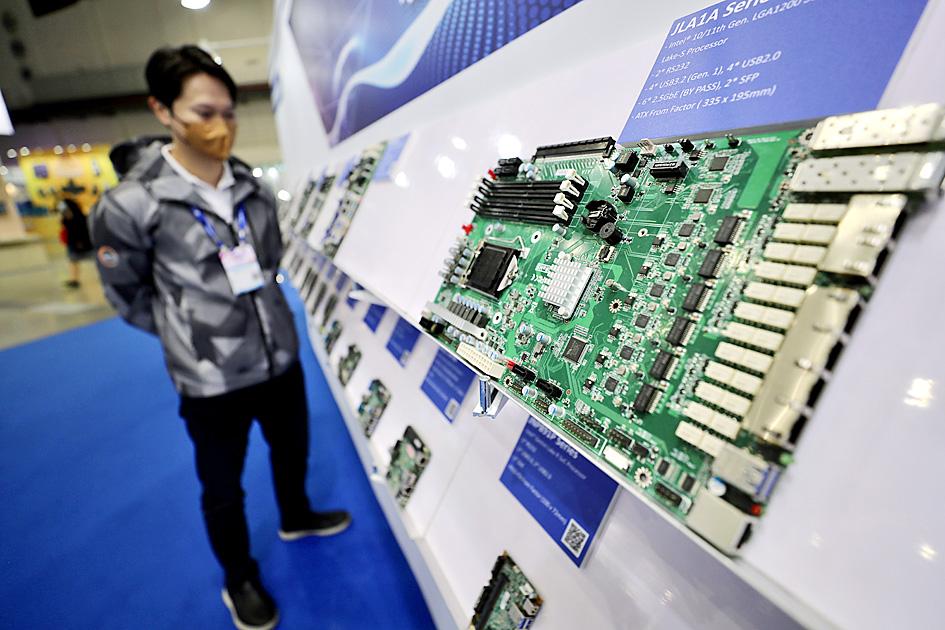

Photo: Ritchie B. Tongo, EPA-EFE

It found that in 2018, Taiwan’s market share in the industries relative to its size was 219 percent higher than the global average, followed by South Korea at 206 percent.

By contrast, Germany’s relative share of the global market in those sectors was 74 percent higher than the global average, Japan’s was 43 percent higher and China’s 34 percent higher, while the US finished below the global average.

In terms of performance, the report said that Taiwan’s global share of advanced industrial production sectors had declined slightly over the past 25 years, slipping in six of the seven industry categories.

However, in one industry category — computers, electronics and optics — Taiwan’s global share grew by 1.3 percentage points, largely due to the performance of companies such as Taiwan Semiconductor Manufacturing Co (台積電) and Hon Hai Precision Industry Co (鴻海精密).

Overall, Taiwan’s advanced industrial output was “the least diversified” of the countries in the study, with almost nine times more computer and electronics production as a share of its economy than the global average, the report said.

“Because of this, advanced industries make up more than twice the share of its economy as the global average,” despite Taiwan’s weakness in industries such as pharmaceuticals and automobiles, it said.

More broadly, the report aimed to highlight the US’ relatively weak position in a range of advanced industries that are strategically important for economic and national security.

Compared with China, whose share of global output in the industries grew from less than 4 percent in 1995 to 21.5 percent in 2018, the US’ market share fell from 24 percent to 22.5 percent, the report said.

Calling the findings “an urgent wake-up call,” it urged the US government to launch an economic “moon shot” initiative aimed at increasing its relative level of advanced industry concentration by 20 percentage points over the next decade.

Micron Memory Taiwan Co (台灣美光), a subsidiary of US memorychip maker Micron Technology Inc, has been granted a NT$4.7 billion (US$149.5 million) subsidy under the Ministry of Economic Affairs A+ Corporate Innovation and R&D Enhancement program, the ministry said yesterday. The US memorychip maker’s program aims to back the development of high-performance and high-bandwidth memory chips with a total budget of NT$11.75 billion, the ministry said. Aside from the government funding, Micron is to inject the remaining investment of NT$7.06 billion as the company applied to participate the government’s Global Innovation Partnership Program to deepen technology cooperation, a ministry official told the

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s leading advanced chipmaker, officially began volume production of its 2-nanometer chips in the fourth quarter of this year, according to a recent update on the company’s Web site. The low-key announcement confirms that TSMC, the go-to chipmaker for artificial intelligence (AI) hardware providers Nvidia Corp and iPhone maker Apple Inc, met its original roadmap for the next-generation technology. Production is currently centered at Fab 22 in Kaohsiung, utilizing the company’s first-generation nanosheet transistor technology. The new architecture achieves “full-node strides in performance and power consumption,” TSMC said. The company described the 2nm process as

POTENTIAL demand: Tesla’s chance of reclaiming its leadership in EVs seems uncertain, but breakthrough in full self-driving could help boost sales, an analyst said Chinese auto giant BYD Co (比亞迪) is poised to surpass Tesla Inc as the world’s biggest electric vehicle (EV) company in annual sales. The two groups are expected to soon publish their final figures for this year, and based on sales data so far this year, there is almost no chance the US company led by CEO Elon Musk would retain its leadership position. As of the end of last month, BYD, which also produces hybrid vehicles, had sold 2.07 million EVs. Tesla, for its part, had sold 1.22 million by the end of September. Tesla’s September figures included a one-time boost in

Shares in Taiwan closed at a new high yesterday, the first trading day of the new year, as contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) continued to break records amid an artificial intelligence (AI) boom, dealers said. The TAIEX closed up 386.21 points, or 1.33 percent, at 29,349.81, with turnover totaling NT$648.844 billion (US$20.65 billion). “Judging from a stronger Taiwan dollar against the US dollar, I think foreign institutional investors returned from the holidays and brought funds into the local market,” Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺) said. “Foreign investors just rebuilt their positions with TSMC as their top target,