Shares of silicon wafer supplier Formosa Sumco Technology Corp (台勝科) outperformed the broader market last week, reflecting investors’ expectation that its gross margin is likely to expand in the coming quarters as prices continue to climb, analysts said.

Formosa Sumco, which was founded by Japan-based Komatsu Ltd and Taiwan’s Formosa Plastics Group (FPG, 台塑集團) in 1995, focuses on producing 8-inch and 12-inch wafers. The company has a monthly capacity of about 330,000 8-inch wafers and 300,000 12-inch wafers at the FPG complex in Yunlin County’s Mailiao Township (麥寮).

Shares of Formosa Sumco on Friday closed 5.39 percent higher at NT$244.5 in Taipei trading.

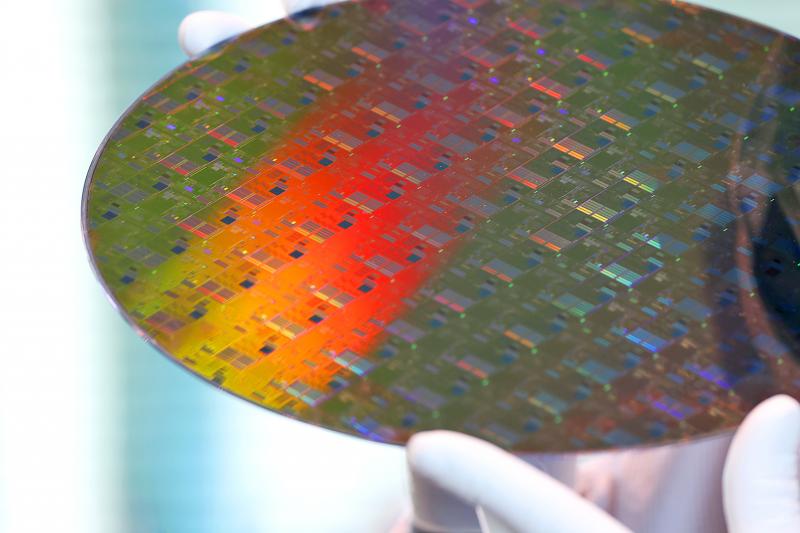

Photo: Bloomberg

Last week, they rose 3.16 percent, compared with the broader market’s 0.68 percent rise, Taiwan Stock Exchange data showed.

After limited gross margin expansion in the second quarter of last year, the company on May 10 reported gross margin of 36.3 percent in the first quarter of this year, up 14.07 percentage points from the previous quarter and 15.89 percentage points higher than a year earlier, due to price increases and favorable foreign-exchange rates.

First-quarter revenue grew 17.58 percent quarterly and 26.6 percent annually to NT$3.74 billion (US$126.8 million), driven by a 15 percent increase in average selling prices amid agreement renewals, with long-term agreements accounting for more than 50 percent of total agreements.

Net profit increased 160 percent from the previous quarter and 207 percent from a year earlier to NT$1 billion, with earnings per share of NT$2.58, the highest in the past 12 quarters, Formosa Sumco data showed.

The company is scheduled to hold an earnings conference on Thursday to elaborate on its first-quarter financial results and provide guidance for the upcoming quarters.

“We expect sales and gross margin to rise quarterly going forward, driven by rising spot prices, price negotiations for half-year agreements in the third quarter, and an additional 12-inch capacity of 5 to 10 percent as new capacity ramps up in the second half of the year,” Yuanta Securities Investment Consulting Co (元大投顧) said in a note on Thursday.

In addition to the 12-inch brownfield capacity expansion plan in the second half of the year, Yuanta said that Formosa Sumco is planning a greenfield expansion plan with a US$1 billion investment, as the company aims to add new 12-inch capacity of 100,000 pieces at the Mailiao complex by 2024.

The new capacity is to adopt Sumco Corp’s technology and focus on production of epitaxial silicon wafers, it added.

With capacity expanding more slowly at major suppliers than at foundry companies, Yuanta said that silicon wafer shortages would be the worst next year, while supply and demand would become more balanced in 2025 at the earliest.

The rising content value of end products and larger memory consumption driven by data centers would also boost demand for silicon wafers, Yuanta said.

As a result, the sector’s upcycle would likely continue from this year to 2024, allowing major wafer suppliers such as Formosa Sumco, GlobalWafers Inc (環球晶圓) and Wafer Works Corp (合晶科技) to continue raising prices and see their gross margin expand further, Yuanta said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said that its investment plan in Arizona is going according to schedule, following a local media report claiming that the company is planning to break ground on its third wafer fab in the US in June. In a statement, TSMC said it does not comment on market speculation, but that its investments in Arizona are proceeding well. TSMC is investing more than US$65 billion in Arizona to build three advanced wafer fabs. The first one has started production using the 4-nanometer (nm) process, while the second one would start mass production using the

A TAIWAN DEAL: TSMC is in early talks to fully operate Intel’s US semiconductor factories in a deal first raised by Trump officials, but Intel’s interest is uncertain Broadcom Inc has had informal talks with its advisers about making a bid for Intel Corp’s chip-design and marketing business, the Wall Street Journal reported, citing people familiar with the matter. Nothing has been submitted to Intel and Broadcom could decide not to pursue a deal, according to the Journal. Bloomberg News earlier reported that Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is in early talks for a controlling stake in Intel’s factories at the request of officials at US President Donald Trump’s administration, as the president looks to boost US manufacturing and maintain the country’s leadership in critical technologies. Trump officials raised the

‘SILVER LINING’: Although the news caused TSMC to fall on the local market, an analyst said that as tariffs are not set to go into effect until April, there is still time for negotiations US President Donald Trump on Tuesday said that he would likely impose tariffs on semiconductor, automobile and pharmaceutical imports of about 25 percent, with an announcement coming as soon as April 2 in a move that would represent a dramatic widening of the US leader’s trade war. “I probably will tell you that on April 2, but it’ll be in the neighborhood of 25 percent,” Trump told reporters at his Mar-a-Lago club when asked about his plan for auto tariffs. Asked about similar levies on pharmaceutical drugs and semiconductors, the president said that “it’ll be 25 percent and higher, and it’ll

CHIP BOOM: Revenue for the semiconductor industry is set to reach US$1 trillion by 2032, opening up opportunities for the chip pacakging and testing company, it said ASE Technology Holding Co (日月光投控), the world’s largest provider of outsourced semiconductor assembly and test (OSAT) services, yesterday launched a new advanced manufacturing facility in Penang, Malaysia, aiming to meet growing demand for emerging technologies such as generative artificial intelligence (AI) applications. The US$300 million facility is a critical step in expanding ASE’s global footprint, offering an alternative for customers from the US, Europe, Japan, South Korea and China to assemble and test chips outside of Taiwan amid efforts to diversify supply chains. The plant, the company’s fifth in Malaysia, is part of a strategic expansion plan that would more than triple