State-owned Life Insurance Corp of India (LIC) slumped on its market debut yesterday following the country’s biggest-ever initial public offering (IPO), opening 7 percent below the offer price.

Indian Prime Minister Narendra Modi’s government raised US$2.7 billion by selling 3.5 percent of LIC as his administration seeks to privatize state assets to plug a gaping budget deficit.

However, it was forced to cut back the offer from a planned 5 percent after markets turned volatile following Russia’s invasion of Ukraine and China’s COVID-19 lockdowns.

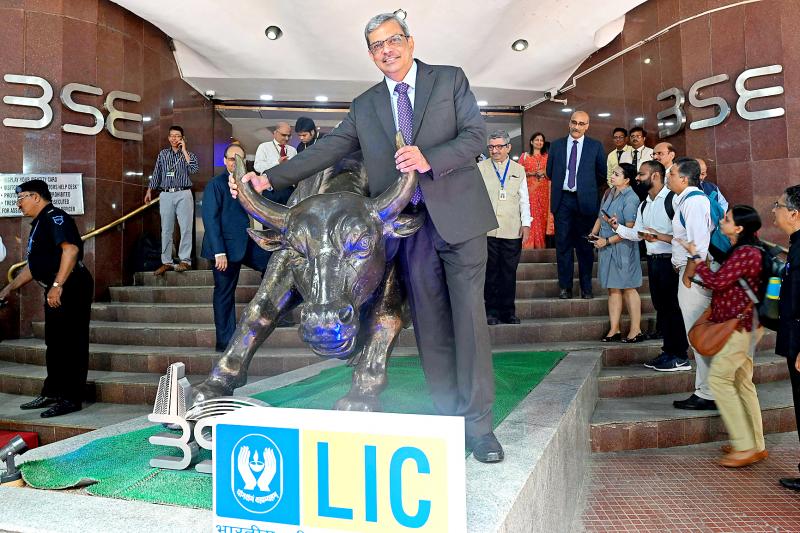

Photo: AFP

The offer price of 949 rupees had valued LIC at US$77 billion, but it opened yesterday on Mumbai’s exchange trading 7 percent lower. The share price fall expanded to 9.4 percent before recovering slightly.

The muted debut could test the appetite of new shareholders for further flotations of nationalized companies as Modi seeks to sell off state assets to plug an estimated 16.6 trillion rupee (US$213.5 billion) fiscal deficit.

The IPO saw enthusiastic participation from small investors and was oversubscribed nearly three times during the six-day application period.

However, foreign investors have withdrawn a net 1.71 trillion rupees from Indian equities so far this year, stock exchange data showed, as the US monetary policy tightening further roiled sentiment.

Founded in 1956 by nationalizing and combining more than 240 firms, LIC was for decades synonymous with life insurance in post-independence India, until the entry of private companies in 2000.

It continues to lead the pack with a 61 percent share of the market in India, with its army of 1.3 million “LIC agents” giving it huge reach, particularly in remote rural areas.

However, LIC’s market share has slid steadily in the face of competition from net-savvy private insurers offering specialized products.

The firm said in its regulatory filing that “there can be no assurance that our corporation will not lose further market share” to private companies.

The IPO followed a years-long effort by bankers and bureaucrats to appraise the mammoth insurer and prepare it for listing.

LIC is also India’s largest asset manager, with 39.55 trillion rupees under management as of Sept. 30, including significant stakes in Indian blue chips such as Reliance and Infosys.

LIC’s real-estate assets include vast offices at prime urban sites, including a 15-story office in Chennai that was once the country’s tallest building.

The firm is also believed to own a large collection of rare and valuable artwork that includes paintings by MF Husain — known as the Pablo Picasso of India — although the value of these holdings has not been made public.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors