The central bank said its recent discussions about shortening mortgage periods would not affect first-time home buyers or urban renewal projects, but would be aimed at corporate buyers and multiple home owners, who are already subject to selective credit controls.

The central bank made the clarification in a statement on Saturday to calm fears that it would shorten mortgages from 30 years to 20 years during its June policy meeting in another bid to cool the housing market.

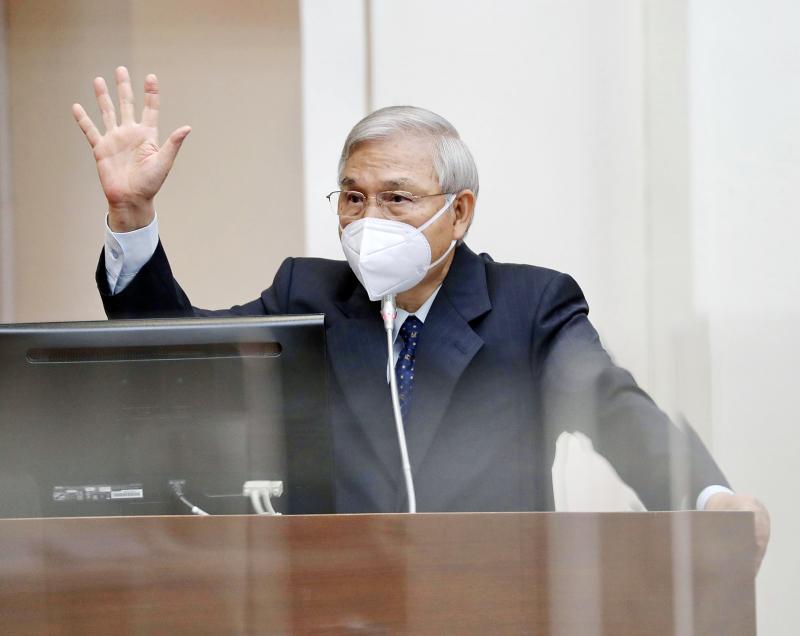

Central bank Governor Yang Chin-long (楊金龍) had told a meeting of the legislature’s Finance Committee on Thursday that there was still room for improvement regarding efforts to regulate real-estate financing, especially in areas with evident price hikes.

Photo: CNA

“House loans remain high, though stable,” Yang told lawmakers, adding that he was considering further selective credit controls, such as tightening mortgage terms and lowering loan-to-value ratios.

Property analysts said the proposed measures, if realized, would hit young first-home buyers the hardest, as their monthly mortgage payments could inflate significantly and many might default, wreaking havoc on the nation’s financial system.

People with 30-year mortgages of NT$10 million (US$335,412) would have to pay NT$49,413 per month, up from NT$35,724 at present, if they are switched to a 20-year mortgage scheme with an annual interest rate of 1.75 percent, senior property broker Lee Tung-rong (李同榮) said.

Shortening mortgage periods is a policy tool under consideration that would not apply to first-time home buyers, who have been excluded from its previous four macro-prudential measures, the central bank said.

Fresh selective credit controls, if deemed necessary at the board meeting on June 16, would only target corporate buyers, houses in hotspots and people who have third home mortgages, the central bank said.

Hotspots refer to the six special municipalities: Taipei, New Taipei City, Taoyuan, Taichung, Tainan and Kaohsiung, as well as Hsinchu City and Hsinchu County.

The central bank has banned grace periods for home purchases in those areas and is considering whether to cut their loan-to-value ratios, Yang said.

Lower loan-to-value ratios proved effective in cooling property fever years ago, he said, adding that stricter mortgages would also make home owners more cautious when planning their finances.

Several board members at the central bank’s March meeting said that housing price hikes bolster inflationary pressures, and the popular belief that owning real estate is the best defense against inflation suggests a need for policy intervention before it is too late.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors