The Office of the US Trade Representative (USTR) recognized Taiwan’s efforts to enhance trade secret protections, while citing online piracy as an ongoing concern, in an annual report released on Wednesday.

This year’s “Special 301” report, which monitors intellectual property (IP) protection and enforcement among US trading partners, was the second to be published under US President Joe Biden’s administration by US Trade Representative Katherine Tai (戴琪).

In the report, the USTR identified Taiwan, along with the EU and Chile, as partners that have recently strengthened or are working to strengthen their trade secret regimes.

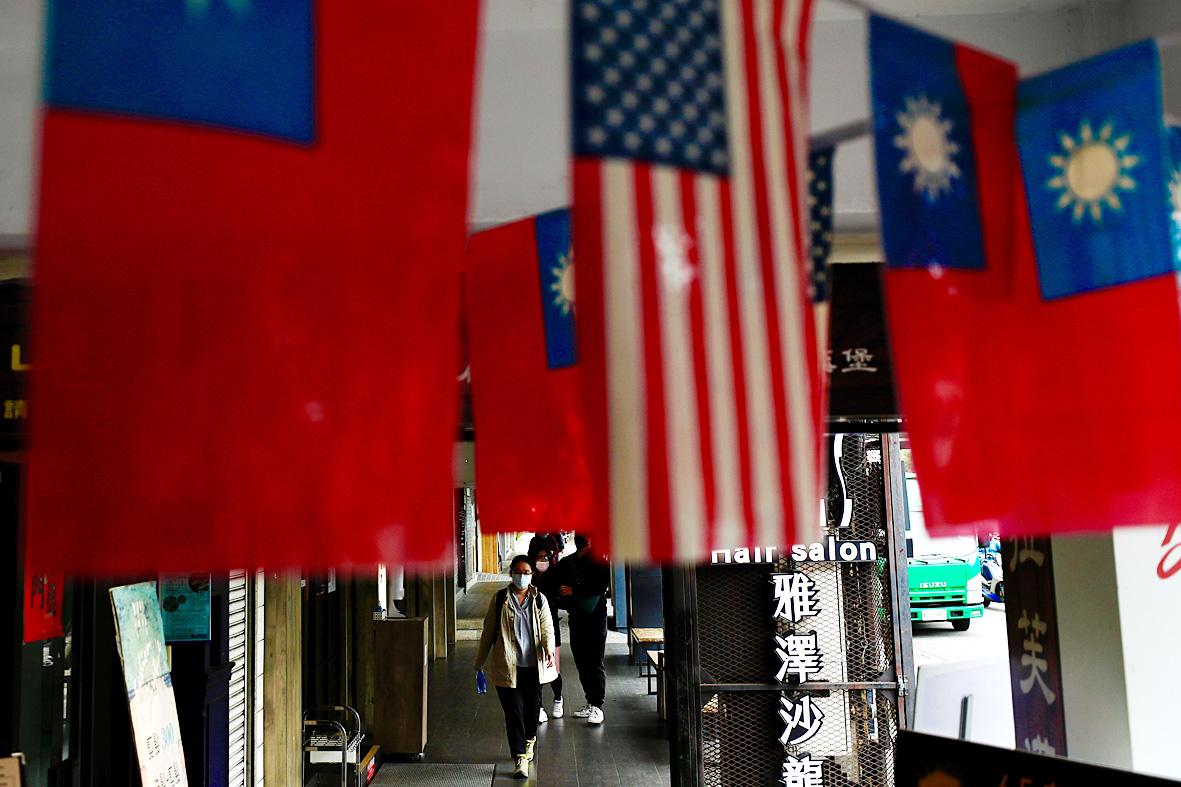

Photo: Ritchie Bo. Tongo, EPA-EFE

While the report did not cite any specific examples, the legislature has amended a range of intellectual property laws as part of its bid to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership trade pact.

The US and Taiwan also met under the Trade and Investment Framework Agreement framework in June last year to discuss “developments related to the enforcement of trade secrets protections, copyright legislation and digital piracy,” the report said.

However, the report identified Taiwan as one of 16 markets with “notable” levels of streaming content piracy through illicit streaming devices and illicit Internet protocol television service apps.

In addition to Taiwan, the other markets included China, Hong Kong, Indonesia, Singapore, Canada and Brazil.

China was also named as a manufacturing hub for piracy devices.

The USTR maintained China’s place on a “priority watch list” — along with Argentina, Chile, India, Indonesia, Russia and Venezuela — of countries with major deficiencies in their IP protections.

Although China passed a number of legal reforms last year to strengthen such protections, it has yet to address issues such as weak enforcement channels, and a lack of transparency and judicial independence, the report said.

The USTR also urged China to provide “a level playing field” in the area of IP protections, to refrain from requiring or pressuring technology transfers to Chinese companies, and to open to foreign investment and “embrace open and market-oriented policies.”

Washington will continue to monitor Beijing’s progress in implementing its commitments under the “phase one” trade agreement that the two countries signed in January 2020, the report said.

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his

ADVERSARIES: The new list includes 11 entities in China and one in Taiwan, which is a local branch of Chinese cloud computing firm Inspur Group The US added dozens of entities to a trade blacklist on Tuesday, the US Department of Commerce said, in part to disrupt Beijing’s artificial intelligence (AI) and advanced computing capabilities. The action affects 80 entities from countries including China, the United Arab Emirates and Iran, with the commerce department citing their “activities contrary to US national security and foreign policy.” Those added to the “entity list” are restricted from obtaining US items and technologies without government authorization. “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives,” US Secretary of Commerce Howard Lutnick said. The entities

Minister of Finance Chuang Tsui-yun (莊翠雲) yesterday told lawmakers that she “would not speculate,” but a “response plan” has been prepared in case Taiwan is targeted by US President Donald Trump’s reciprocal tariffs, which are to be announced on Wednesday next week. The Trump administration, including US Secretary of the Treasury Scott Bessent, has said that much of the proposed reciprocal tariffs would focus on the 15 countries that have the highest trade surpluses with the US. Bessent has referred to those countries as the “dirty 15,” but has not named them. Last year, Taiwan’s US$73.9 billion trade surplus with the US

Prices of gasoline and diesel products at domestic gas stations are to fall NT$0.2 and NT$0.1 per liter respectively this week, even though international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices continued rising last week, as the US Energy Information Administration reported a larger-than-expected drop in US commercial crude oil inventories, CPC said in a statement. Based on the company’s floating oil price formula, the cost of crude oil rose 2.38 percent last week from a week earlier, it said. News that US President Donald Trump plans a “secondary