Oil notched a weekly gain as traders weighed a global supply deficit, a potential ban on Russian oil from the EU and China’s latest COVID-19 lockdowns.

West Texas Intermediate (WTI) crude for May delivery on Friday gained US$2.70 to settle at US$106.95 per barrel, rising 8.8 percent for the week.

The June contract for the global benchmark Brent crude on Friday added US$2.92 to settle at US$111.70 per barrel. The contract rose 8.7 percent weekly.

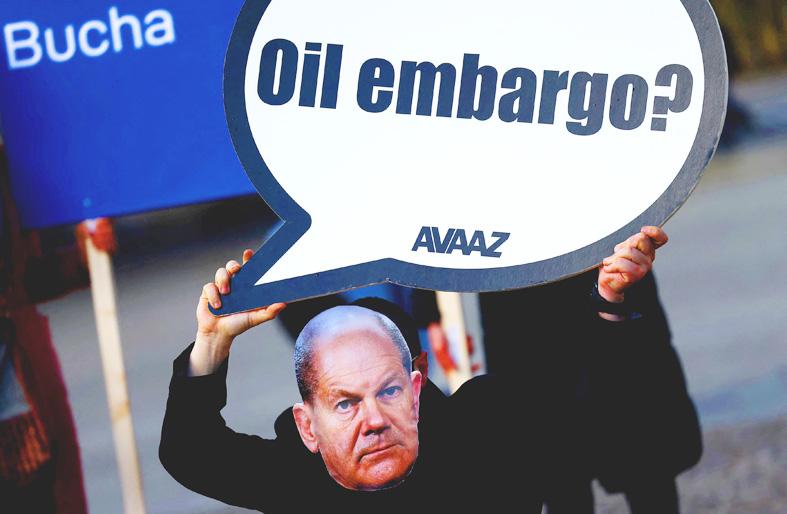

Photo: Reuters

Oil rallied on Thursday afternoon after a report that the EU is moving toward adopting a phased-in ban on Russian oil.

Russian President Vladimir Putin earlier this week vowed to continue the invasion of Ukraine, pointing to a prolonged disruption of Russia’s energy exports.

Additionally, the International Energy Agency said in a report that OPEC+ members provided only 10 percent of their promised supply increases last month.

In the US, crude stockpiles jumped more than 9 million barrels last week, with over one-third of the build attributed to the shift of strategic oil reserves to commercial inventories. At the same time, most stocks of refined products fell, prompting a spike in so-called crack spreads — the rough profit from turning crude into fuel.

“Traders realize a good portion of that came from the strategic reserve, which now sets [sic] at 20 year inventory lows,” BOK Financial Corp senior vice president of trading Dennis Kissler said. “Crude storage remains 60.45 million barrels below the five-year average which should keep the buyers active on extreme sell offs.”

The oil market has seen a tumultuous period of trading since Russia invaded its neighbor in late February. A recent reserve release by the US and its allies, along with a virus resurgence in China, has weighed on prices in the past few weeks.

Yet there are some signs of easing COVID-19 restrictions and China’s central bank is expected to take measures to help bolster a faltering economy.

“Government energy intervention, the perceived self-shunning of Russian crude and the erratic buying patterns in recent weeks have all altered the near-term path,” RBC Capital Markets analyst Mike Tran said.

Trading looks “volatile and sloppy over the near term as the market digests the onslaught of 240 million barrels of crude unleashed from strategic reserves.”

To be sure, the market is still in the grips of a liquidity crunch sparked by surging volatility after a spike toward US$140. Open interest in WTI futures fell to the lowest since 2016 on Wednesday, while traders are using options strategies as a way of effectively raising cash in the face of limited sources of capital.

Elsewhere, Kazakhstan expects its main oil-export route via Russia to restore full operations late this month, the country’s energy minister said.

The nation said it remains concerned about the possible impact of Western sanctions or shipping issues on the flow of crude.

Additional reporting by staff writer

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his

ADVERSARIES: The new list includes 11 entities in China and one in Taiwan, which is a local branch of Chinese cloud computing firm Inspur Group The US added dozens of entities to a trade blacklist on Tuesday, the US Department of Commerce said, in part to disrupt Beijing’s artificial intelligence (AI) and advanced computing capabilities. The action affects 80 entities from countries including China, the United Arab Emirates and Iran, with the commerce department citing their “activities contrary to US national security and foreign policy.” Those added to the “entity list” are restricted from obtaining US items and technologies without government authorization. “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives,” US Secretary of Commerce Howard Lutnick said. The entities

Minister of Finance Chuang Tsui-yun (莊翠雲) yesterday told lawmakers that she “would not speculate,” but a “response plan” has been prepared in case Taiwan is targeted by US President Donald Trump’s reciprocal tariffs, which are to be announced on Wednesday next week. The Trump administration, including US Secretary of the Treasury Scott Bessent, has said that much of the proposed reciprocal tariffs would focus on the 15 countries that have the highest trade surpluses with the US. Bessent has referred to those countries as the “dirty 15,” but has not named them. Last year, Taiwan’s US$73.9 billion trade surplus with the US

Prices of gasoline and diesel products at domestic gas stations are to fall NT$0.2 and NT$0.1 per liter respectively this week, even though international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices continued rising last week, as the US Energy Information Administration reported a larger-than-expected drop in US commercial crude oil inventories, CPC said in a statement. Based on the company’s floating oil price formula, the cost of crude oil rose 2.38 percent last week from a week earlier, it said. News that US President Donald Trump plans a “secondary