Sales in the computer and information technology (IT) services industry reached a record high of NT$453.4 billion (US$15.7 billion) last year amid a boom in people working from home and remote education due to the COVID-19 pandemic, the Ministry of Economic Affairs said last week.

Industry revenue last year rose 12.4 percent from a year earlier, Department of Statistics data showed.

The growth was its highest since 2008, the data showed.

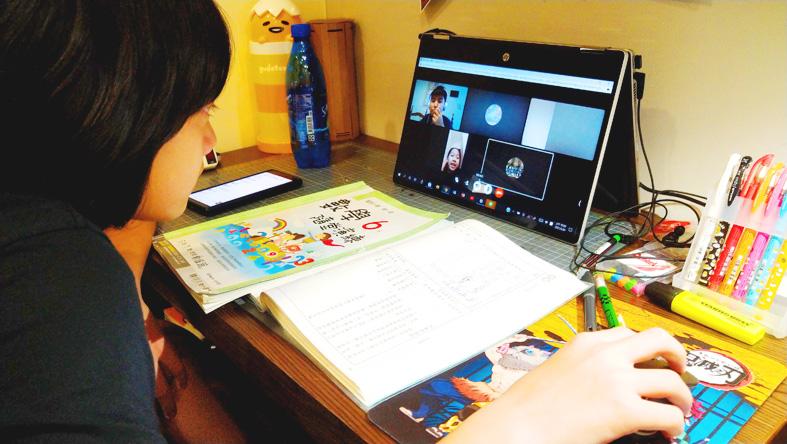

Photo: Lai Hsiao-tung, Taipei Times

With growing demand for emerging technologies such as 5G applications, high-performance computing and Internet of Things devices, and cloud technology-based data processing services, many enterprises have sought more hardware and software to address cybersecurity concerns, the ministry said on Tuesday.

Computer programming design, consulting and related services were the industry’s major sales growth drivers, with revenue reaching a high of NT$341.4 billion, up 11.8 percent from a year earlier, as businesses sought to build storage networks and enhance their data protection, the ministry said.

The ministry added that the IT services segment posted NT$112 billion in revenue, also a record high, up 14.1 percent from a year earlier, largely due to intensive promotions by online auction site operators and social media platforms.

The number of workers in the industry rose 3 percent from a year earlier to 119,000, overcoming an average 0.1 percent decline in the service sector as a whole, the ministry said.

The average regular wage in the industry rose 3.5 percent to NT$69,000, also beating the service industry’s average of NT$45,000, it added.

To many, Tatu City on the outskirts of Nairobi looks like a success. The first city entirely built by a private company to be operational in east Africa, with about 25,000 people living and working there, it accounts for about two-thirds of all foreign investment in Kenya. Its low-tax status has attracted more than 100 businesses including Heineken, coffee brand Dormans, and the biggest call-center and cold-chain transport firms in the region. However, to some local politicians, Tatu City has looked more like a target for extortion. A parade of governors have demanded land worth millions of dollars in exchange

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) revenue jumped 48 percent last month, underscoring how electronics firms scrambled to acquire essential components before global tariffs took effect. The main chipmaker for Apple Inc and Nvidia Corp reported monthly sales of NT$349.6 billion (US$11.6 billion). That compares with the average analysts’ estimate for a 38 percent rise in second-quarter revenue. US President Donald Trump’s trade war is prompting economists to retool GDP forecasts worldwide, casting doubt over the outlook for everything from iPhone demand to computing and datacenter construction. However, TSMC — a barometer for global tech spending given its central role in the

An Indonesian animated movie is smashing regional box office records and could be set for wider success as it prepares to open beyond the Southeast Asian archipelago’s silver screens. Jumbo — a film based on the adventures of main character, Don, a large orphaned Indonesian boy facing bullying at school — last month became the highest-grossing Southeast Asian animated film, raking in more than US$8 million. Released at the end of March to coincide with the Eid holidays after the Islamic fasting month of Ramadan, the movie has hit 8 million ticket sales, the third-highest in Indonesian cinema history, Film