The US Department of the Treasury has halted US dollar debt payments from Russian government accounts at US financial institutions as the country’s troops stand accused of committing war crimes in Ukraine.

The Treasury’s Office of Foreign Assets Control will no longer permit any US dollar payments to be made from Russian government accounts at US financial institutions, said a spokesperson for the department who discussed details of the decision on condition of anonymity.

The move is designed to force Russia into choosing among three unappealing options, the person said: Draining the US dollar reserves it holds in its own country, spending new revenue it collects, or going into default.

Photo: Reuters

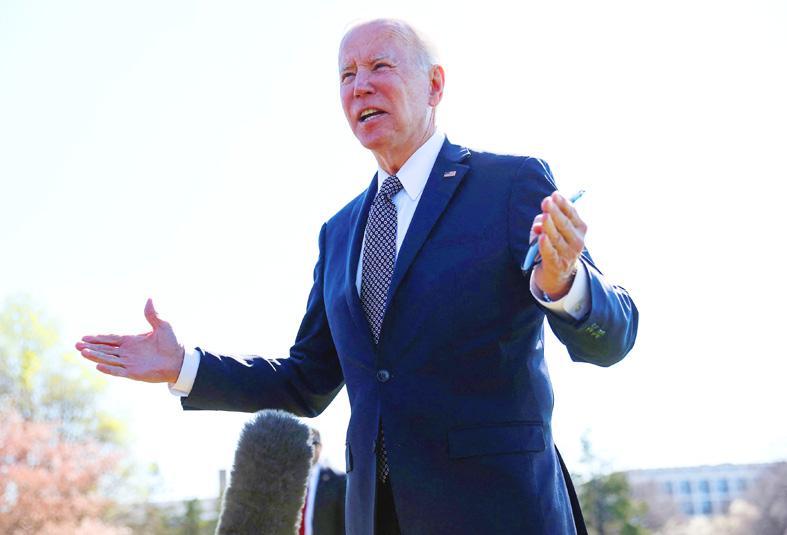

The policy change comes as a payment on the country’s sovereign debt was due on Monday and is intended to further ratchet up pressure on Russian President Vladimir Putin to give up his invasion of Ukraine. It follows accusations over the weekend that Russian troops massacred civilians in Bucha and other Ukrainian towns.

The department issued a general license on March 2 that allows people in the US to receive bond payments from the central bank of Russia through May 25. Russia can still receive payments for oil and gas, as sanctions imposed on the country by the US and its allies exclude energy transactions, an exception that is set to hand Putin a US$321 billion windfall this year if the commodities continue flowing.

Russia’s central bank last week said that its foreign currency and gold reserves plunged to just US$604.4 billion as of March 25, the lowest level since August last year.

It marks a US$38.8 billion plunge since a February peak, underscoring the drain for Russia since it began the invasion.

The war prompted sweeping sanctions and handcuffed the central bank after the seizure of an estimated two-thirds of its reserves. Although central bank Governor Elvira Nabiullina has acknowledged that the curbs imposed on the Bank of Russia meant it could not intervene in the market, she has said it sold foreign currency to support the ruble on Feb. 24, when the invasion began, and the following day.

Russia has been working in the past few years to remove the US dollar’s hold over its economy and financial markets, which means it has hacked its holdings of US Treasuries and taken US dollar assets from its sovereign wealth fund.

Despite warnings from credit-rating companies and others, Putin’s government has so far stayed current on its foreign debt obligations — many of which have been relatively small when compared to the nation’s full debt load. A once-US$2 billion bond that matured on Monday served as the most recent debt stress test, although Russia was able to buy back about three-quarters of the outstanding amount in rubles before the note came due.

Up next will be payments on May 27 for interest owed on sovereign US dollar and euro notes due in 2026 and 2036, data compiled by Bloomberg show.

The department has said that no decision has yet been made regarding the May 25 expiration of the general license allowing US persons to receive debt payments from the Russian central bank.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received