Taiwan is racing to set up specialized “chip schools” that run year-round to train its next generation of semiconductor engineers and cement its dominance of the crucial industry.

The plans, championed by President Tsai Ing-wen (蔡英文), come as chip companies plow billions of dollars into capacity expansion to make the “brains” that power everything from smartphones to fighter jets, amid a global shortage. Chip giant Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) alone this year is to spend up to US$44 billion and hire more than 8,000 employees.

Jack Sun (孫元成), who retired as TSMC’s chief technology officer in 2018 and became dean of one of the new semiconductor graduate schools last year, said that chip companies need a lot more and better talent to compete on the global stage.

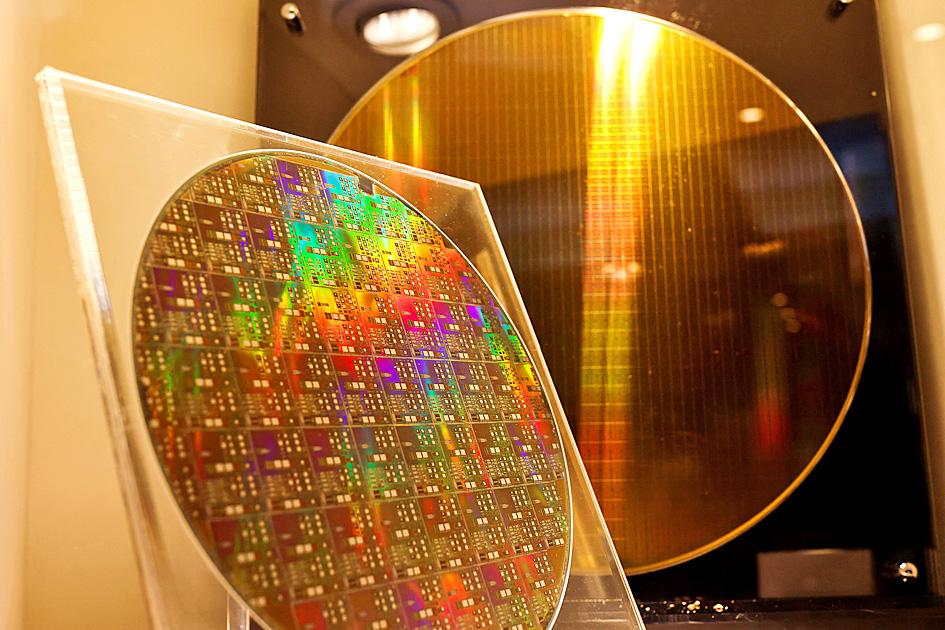

Photo: Ann Wang, Reuters

“Indeed, I’m devoting some of my golden years to talent development,” Sun said with a laugh, before pointing out that his former TSMC colleague Burn Lin (林本堅) is older and the dean of another chip school.

Sun and Lin, industry heavyweights turned educators, embody the government’s strategy of strengthening industry-academia ties to remain a critical node in the global chip supply chain.

“In the cultivation of semiconductor talent, we are racing against time,” Tsai said in December at the unveiling of National Tsing Hua University’s College of Semiconductor Research.

The government has partnered with leading chip companies to pay for the schools. The first four were established at top universities last year, each with a quota of about 100 master’s and doctorate students, and another has been approved, the Ministry of Education said.

“I specifically requested these schools stay open year-round, without winter and summer breaks, so that we can quickly produce talent,” Tsai said at another unveiling.

The chip talent shortage is a top concern for the nation, which considers the industry critical to economic growth and national security, especially as China steps up military pressure on Taiwan.

Even before the global chip shortage, companies worried that a talent crunch could hobble the booming industry, said Terry Tsao (曹世綸), president of the SEMI Taiwan industry group.

In September 2019, Tsao and about 20 Taiwanese and foreign chip executives met with Tsai and urged the government to address the issue.

“Everyone thinks this is the top priority,” Tsao said.

As countries pledge billions for domestic chip production and companies scramble to build new plants, the need for people to design, manufacture and test chips has intensified.

In the fourth quarter of last year, there were nearly 34,000 chip industry job openings per month on average on 104 Job Bank (104人力銀行), a popular recruitment platform, about 50 percent more than a year earlier, according to data provided by the job bank.

Although demand for workers has soared, Taiwan — with one of the world’s lowest birthrates — has been producing fewer engineers over the past decade. Even fewer are enrolling in the doctoral programs that best prepare engineers to develop breakthrough technologies.

Competing over a limited pool, Taiwanese companies have rolled out higher wages, longer parental leave, billboard ads and scholarships to poach engineers from other firms and recruit fresh talent from campuses.

Taiwan can no longer sustain local industry’s needs, and foreign competition would further affect its long-term research and development (R&D) talent growth, said chip designer MediaTek Inc (聯發科), which this year plans to recruit more than 2,000 R&D employees and double its number of summer interns to lock in talent earlier.

Companies are also looking abroad. United Microelectronics Corp (聯電), which plans to recruit more than 1,500 new employees in Taiwan this year, said it is expanding its overseas recruitment channels.

In May last year, the government passed a regulation to make it easier for schools and companies to collaborate in key fields of national interest, paving the way for chip schools.

The looser rules allow the schools to bring in corporate funding and increase faculty pay.

Beyond funding, companies would help design curricula, send executives to give talks, and provide chip experts to teach courses and advise research projects.

As chip technology develops rapidly, “there is a gap between what you study and what you need to use at the company,” said Su Yan-kuin (蘇炎坤), dean of the chip school at National Cheng Kung University, in his office, while workers assembled beams next door.

“We work closely with industry, connecting industry and academia, thus narrowing the gap,” Su said.

Lin Chun-yu, 24, an incoming doctorate student at Su’s school, would receive NT$40,000 per month, a stipend doctorate students in Taiwan do not typically receive.

“Close collaboration with the industry now will be very helpful for my studies and for employment,” he said.

While some are concerned that a singular focus on semiconductors will come at the cost of other industries, others say such costs are necessary.

“It will create imbalances in the ecosystem,” said Yeh Wen-kuan (葉文冠), director-general of the Taiwan Semiconductor Research Institute (台灣半導體研究中心), about the chip schools attracting students from other fields.

“But there’s no other choice right now,” he added. “Taiwan’s lifeblood, you have to first hold on to it. If you don’t hold on to it, how can you let Taiwan’s economy progress?”

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

STILL HOPEFUL: Delayed payment of NT$5.35 billion from an Indian server client sent its earnings plunging last year, but the firm expects a gradual pickup ahead Asustek Computer Inc (華碩), the world’s No. 5 PC vendor, yesterday reported an 87 percent slump in net profit for last year, dragged by a massive overdue payment from an Indian cloud service provider. The Indian customer has delayed payment totaling NT$5.35 billion (US$162.7 million), Asustek chief financial officer Nick Wu (吳長榮) told an online earnings conference. Asustek shipped servers to India between April and June last year. The customer told Asustek that it is launching multiple fundraising projects and expected to repay the debt in the short term, Wu said. The Indian customer accounted for less than 10 percent to Asustek’s

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would