Central bank Governor Yang Chin-long (楊金龍) yesterday said there is still room for credit tightening to cool metropolitan Taipei’s property market, adding that mortgage restrictions for those buying a second property are potential options.

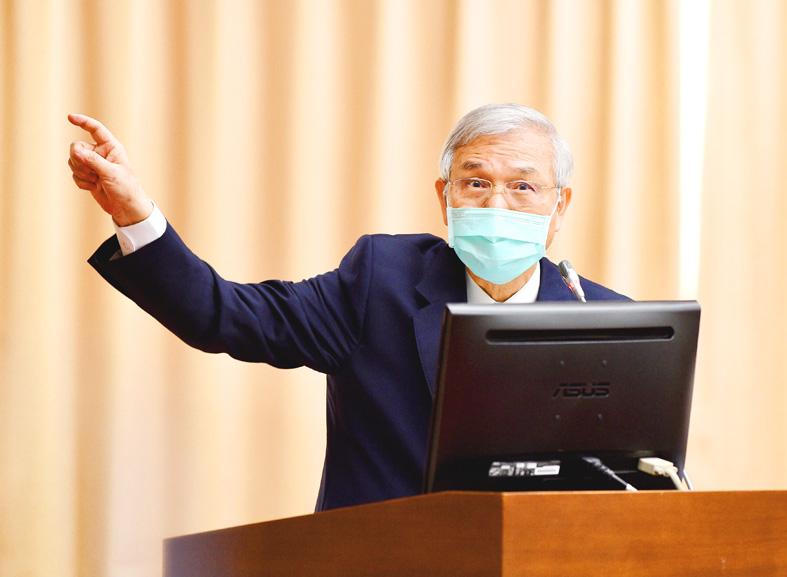

Yang’s statements came at a question-and-answer session at the legislature in Taipei focused on potential economic repercussions from the US Federal Reserve’s expected interest rate increases and inflation pressure caused by Russia’s invasion of Ukraine.

“There is still room for the central bank to improve its policy measures to cool down the property fever,” Yang told lawmakers on the Finance Committee, after some of them had called existing credit controls ineffective.

Photo: Peter Lo, Taipei Times

Lawmakers said that Taiwan should learn a lesson from South Korea, where real estate becoming increasingly unaffordable led to the opposition candidate winning Wednesday’s presidential election.

Yang said that second-home mortgage restrictions imposed in 2010 proved successful to curb housing price increases in metropolitan Taipei.

Reimposing the measure would be discussed at the central bank’s quarterly policy meeting on Thursday next week, he added.

Housing prices surged due in part to Taiwan’s strong economy, Yang said, denying that fund inflows and property speculation are the main factors.

The central bank is seeking to induce a soft landing for housing prices, Yang said.

Measures to rein in the housing market should not be used to fight inflation, as they would prove costly after interest rates have been raised, he said.

Yang said he doubted that Russia would soon be bankrupt due to economic sanctions, including oil embargos and its credit ratings being downgraded.

Russia has foreign exchange reserves of more than US$600 billion and about US$400 billion in privately owned foreign currency-denominated assets, Yang said.

Russia has cut its US dollar reserves from more than 40 percent of overall foreign currency reserves in 2014 to about 10 percent, Yang said.

Moscow has raised its Chinese yuan, cryptocurrency and gold reserves, which could give it a buffer, as China is not participating in international sanctions, he added.

Yang said Taiwanese companies have limited exposure in Russia, as trade between the countries is mainly handled by foreign banks, such as HSBC Holdings PLC and Citibank Inc.

Nickel prices have surged to more than US$100,000 per tonne, but as Taiwan’s current nickel reserves would last more than one year, minting costs would remain stable, Yang said, adding that recycled coins could also be used for minting new ones.

Global monetary policymakers could moderate the pace of rate increases to ease the economic effects of Russia invasion of Ukraine, Yang said.

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not