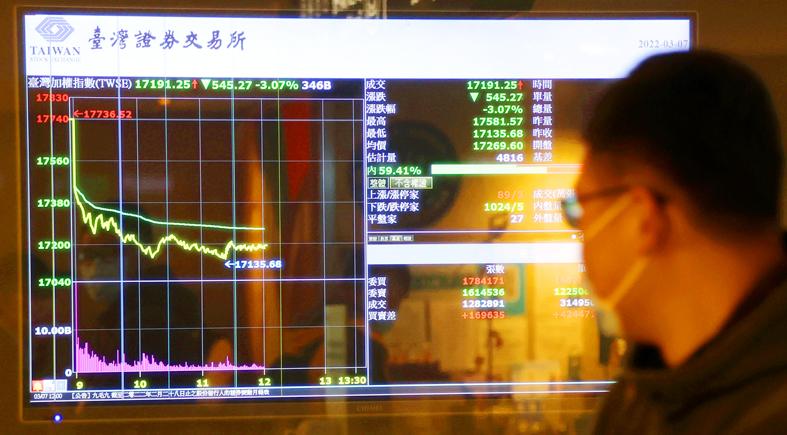

The TAIEX yesterday tumbled 3.15 percent, or 557.83 points, to 17,178.69, while the New Taiwan dollar fell 0.48 percent against the US dollar to NT$28.25, an 11-month low, dragged by capital flight as the US threatened more drastic sanctions against Russia and oil prices skyrocketed, traders said.

Turnover on the main board was NT$456.783 billion (US$16.17 billion), the highest in more than seven months, Taiwan Stock Exchange (TWSE) data showed, while transaction volume hit a 13-year-high of US$2.533 billion on the Taipei Forex Inc during the session.

Minister of Finance Su Jain-rong (蘇建榮) and TWSE officials called for calm amid escalating tensions between Russia and Ukraine, saying that the local board, although pummeled by panic sell-offs, remained healthy in light of active trading and strong economic bellwethers.

Photo: CNA

The ministry is today to release trade data for last month and exports are expected to have grown, despite Lunar New Year holiday disruptions, Su said.

The state-run National Stabilization Fund is closely monitoring the local board and would intervene whenever it sees fit, Su said.

He dismissed claims that the NT$500 billion fund would stay on the sidelines unless the TAIEX slumps below the 10-year moving average.

“There is no need for preconditions to activate the fund,” Su said.

Foreign investors continued to move funds out of Taiwan yesterday, with portfolio managers cutting holdings in local shares by NT$82.24 billion, the second-largest in history and compared with net sales of NT$63.44 billion last week, TWSE data showed.

Mutual funds increased net positions by NT$7.63 billion yesterday, while proprietary traders offloaded NT$3.68 billion of shares, exchange data showed.

Technology heavyweights were again hit by concerns over energy sanctions, with contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) coming into focus as investors unloaded liquid stocks with relatively high valuations.

TSMC lost 3.19 percent to close at NT$576. TSMC’s downturn contributed more than 150 points to the TAIEX’s decline yesterday, and led the electronics sector to drop 3.49 percent and the semiconductor sub-index to lose 3.65 percent.

Amid rising crude prices, Formosa Petrochemical Corp (台塑石化) appeared resilient compared with tech stocks, ending the day unchanged at NT$100.5, while stocks in the steel industry performed better than expected, which traders attributed to expectations that the Western sanctions on Russia would reduce the global steel supply and improve the pricing power of suppliers elsewhere.

The financial sector faced heavy selling, falling 2.74 percent to add pressure to the broader market, traders said.

State-run First Securities Investment Trust Co (第一金投信) said the TAIEX would remain weak in next three months, as it has fallen below the yearly moving average.

The latest panic sell-offs came after the US threatened to impose an oil embargo on Russia and international crude prices soared to near US$140 per barrel, fueling concerns that inflation would erode corporate profits, First Securities said.

Technology shares bore the brunt, as they have higher price evaluations and could be further affected by shortages of component raw materials, a significant portion of which is controlled by Russia, First Securities said.

Investors tend to seek safety in the US dollar in times of global turmoil, dealers said.

TWSE said that the war in Ukraine has little bearing on Taiwan, whose economy is expected to grow by more than 4 percent this year on top of a 6.28 percent pickup last year.

Listed companies in January reported an 8.92 percent increase in cumulative revenue, and would soon distribute cash and stock dividends in line with last year’s impressive earnings, the exchange said.

Additional reporting by CNA

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not

TARIFF CONCERNS: The chipmaker cited global uncertainty from US tariffs and a weakening economic outlook, but said its Singapore expansion remains on track Vanguard International Semiconductor Corp (世界先進), a foundry service provider specializing in producing power management and display driver chips, yesterday withdrew its full-year revenue projection of moderate growth for this year, as escalating US tariff tensions raised uncertainty and concern about a potential economic recession. The Hsinchu-based chipmaker in February said revenues this year would grow mildly from last year based on improving supply chain inventory levels and market demand. At the time, it also anticipated gradual quarter revenue growth. However, the US’ sweeping tariff policy has upended the industry’s supply chains and weakened economic prospects for the world economy, it said. “Now