Large chip companies so far predict limited supply chain disruption from the Russia-Ukraine crisis, thanks to raw material stockpiling and diversified procurement, but some industry sources worry about the longer-term effects.

The crisis has hit stocks of tech companies that source or sell globally on fears of further disruptions on the back of a year-long shortage of semiconductor chips.

Ukraine supplies more than 90 percent of US semiconductor-grade neon, critical for lasers used in chipmaking.

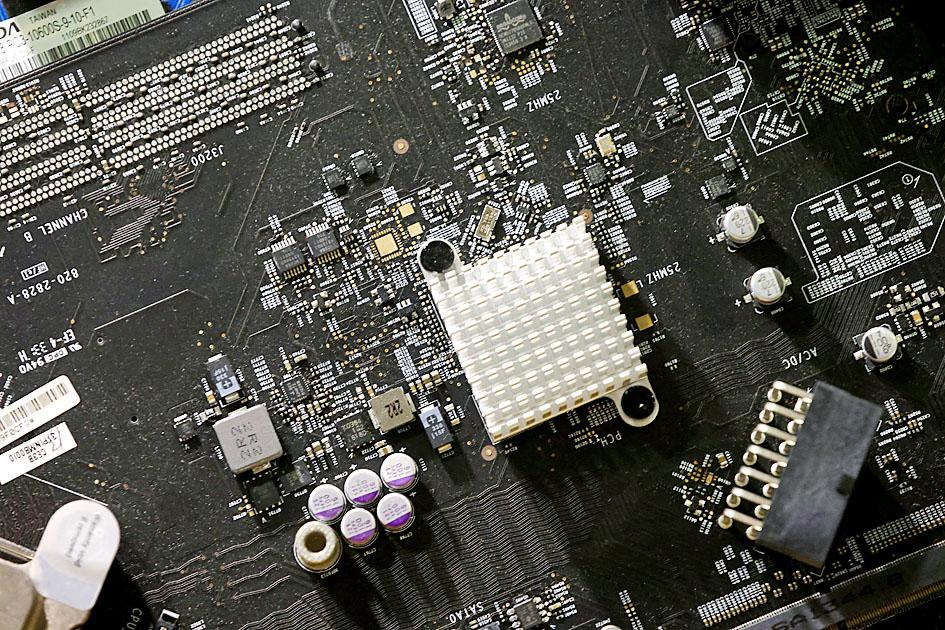

Photo: Reuters

The gas, a byproduct of Russian steel manufacturing, is purified in Ukraine, market research firm Techcet said.

Thirty-five percent of US palladium, used in sensors and memory, among other applications, is sourced from Russia.

“The chipmakers are not feeling any direct impact, but the companies that supply them with materials for semiconductor fabrication buy gases, including neon and palladium, from Russia and Ukraine,” said a Japanese chip industry source who spoke on condition of anonymity. “The availability of those materials is already tight, so any further pressure on supplies could push up prices. That in turn could knock on to higher chip prices.”

Companies are better prepared than in the past few years, due to other disruptions and conflicts, reducing some of the pain.

The White House has warned the chip industry to diversify its supply chain in case Russia retaliates against threatened US export curbs by blocking access to key materials, Reuters reported earlier this month, citing people familiar with the matter.

Ahead of the invasion, the West sanctioned Russia’s Nord Stream 2 pipeline and some Russian banks, and imposed curbs on a number of senior Russian officials.

More sanctions could come in the form of Cold War-like curbs on technology, followed by Russian retaliation on exports.

ASML Holding NV, a key Dutch supplier to chipmakers including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Samsung Electronics Co and Intel Corp on Wednesday said it is examining alternative sources for neon.

Most chipmakers are in wait-and-watch mode and in communication before yesterday’s escalation projected confidence about their supply chains, which they have diversified in the wake of US-China trade tensions, the COVID-19 pandemic and Japan’s diplomatic spat with South Korea.

Some companies started diversifying away from Russia and Ukraine after Moscow annexed Crimea in 2014, which triggered a huge increase in neon prices.

South Korean memorychip maker SK Hynix Inc CEO Lee Seok-hee told reporters last week that the company had “secured a lot” of chip materials, and that “there’s no need to worry.”

Intel said it does not anticipate any impact, while GlobalFoundries Inc said it does not anticipate a direct risk and has flexibility to seek sources outside Russia or Ukraine, as did Taiwanese chipmaker United Microelectronics Corp (聯電).

TSMC, the world’s largest contract chipmaker declined to comment “at the moment.”

Taiwanese chip testing and packaging firm ASE Technology Holding Co (日月光投控) said that its material supply remains stable “at this point.”

The Ministry of Economic Affairs said in a statement that it had checked the nation’s semiconductor supply chain and found no direct impact on materials or production activities.

“Russia is not, at the moment, one of the Taiwanese foundry industry’s major markets,” TrendForce Corp (集邦科技) senior analyst Joanne Chiao (喬安) said.

Amid rumors that the government is considering restricting the export of strategic goods to Russia, Taiwan Institute of Economic Research (台灣經濟研究院) researcher Arisa Liu (劉佩真) said that there is unlikely to be substantial effects on local semiconductor firms, given that most of their orders come from the US, Europe, Japan and South Korea.

Liu added that Russia was only the 35th largest exporter of Taiwanese semiconductor products, according to export data from January to November last year.

Taiwan mainly receives orders for mixed-signal ICs, optical amplifiers, DRAM, transistors and CPUs from Russia, she added.

Malaysian chipmaker Unisem Bhd, whose customers include Apple Inc, said it expects no impact on chip production from a raw materials perspective, as the materials it needs are not sourced from Russia, and its machines are mainly from domestic suppliers or from the US, Japan, South Korea and Singapore.

Malaysia has emerged as an important link in the chip production chain, and accounts for 13 percent of global chip assembly testing and packaging.

Japan’s Ibiden Co, which makes packaging substrates for chips, said that it had enough materials, but the situation could change with sanctions, when asked about supplies of neon and other gases from Russia.

“We are a little concerned,” a spokesperson said.

The company would buy material elsewhere and keep in close contact with suppliers to tackle any disruptions, she added.

Additional reporting by CNA

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors