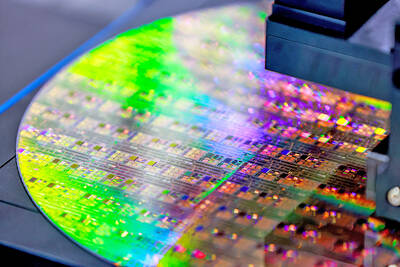

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, has bought almost all green power produced and traded by certified enterprises in the country, the Bureau of Standards, Metrology and Inspection said yesterday.

To promote renewable energy development, the bureau established the National Renewable Energy Certification Center in 2017.

The bureau issued its first certificate in May 2017 and as of this month, it had issued 1.06 million certificates to enterprise power producers, enabling them to trade their power on a green energy transaction mechanism, which was inaugurated in 2020, or retain the electricity for self-use.

The 1.06 million certificates were issued for the production of 1.06 billion kilowatt-hours of electricity via renewable sources, cutting carbon emissions by 534,000 tonnes, the bureau said.

About 910,000 certificates have been traded on the transaction platform as of this month, with TSMC purchasing almost 900,000 certificates.

As for the remaining 150,000 certificates, the green power produced was for self-use, with TSMC also securing more than 7,100 certificates for green power which it generated for its own use.

Local enterprises like TSMC are keen to utilize green power as they incorporate environmental, social and governance (ESG) concepts into their core business operations.

The platform has encouraged many enterprises in a wide range of industries, such as energy, electronics, financial and biotech, to produce green power to transact or for self-use, a move that should raise the amount of green power used to generate electricity, the bureau said.

Some commercial buildings have also started producing green power by installing solar panels on their roofs, it added.

In addition to its large purchase of green power in Taiwan, TSMC has sold “green bonds” on the local market.

Green bonds, promoted by Taiwan’s capital markets and financial authorities, are aimed at encouraging companies to act in an environmentally responsible way, with the proceeds going to eco-friendly projects, said the Taipei Exchange (TPEx), which runs the local bond market.

Data compiled by the TPEx showed that TSMC has issued five tranches of green bonds in Taiwan, with an outstanding value of NT$17.4 billion (US$624 million).

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional

Pegatron Corp (和碩), a key assembler of Apple Inc’s iPhones, on Thursday reported a 12.3 percent year-on-year decline in revenue for last quarter to NT$257.86 billion (US$8.44 billion), but it expects revenue to improve in the second half on traditional holiday demand. The fourth quarter is usually the peak season for its communications products, a company official said on condition of anonymity. As Apple released its new iPhone 17 series early last month, sales in the communications segment rose sequentially last month, the official said. Shipments to Apple have been stable and in line with earlier expectations, they said. Pegatron shipped 2.4 million notebook