From Albert Einstein’s notes to a record-breaking Frida Kahlo to a 6.6 million euro (US$6.79 million) triceratops — auction houses have lately seen a string of record-breaking items going under the hammer and through the roof.

Valuations are becoming hard to judge.

On Wednesday, the Einstein manuscript went for 11.3 million euros in Paris, five times its expected price.

Photo: AFP

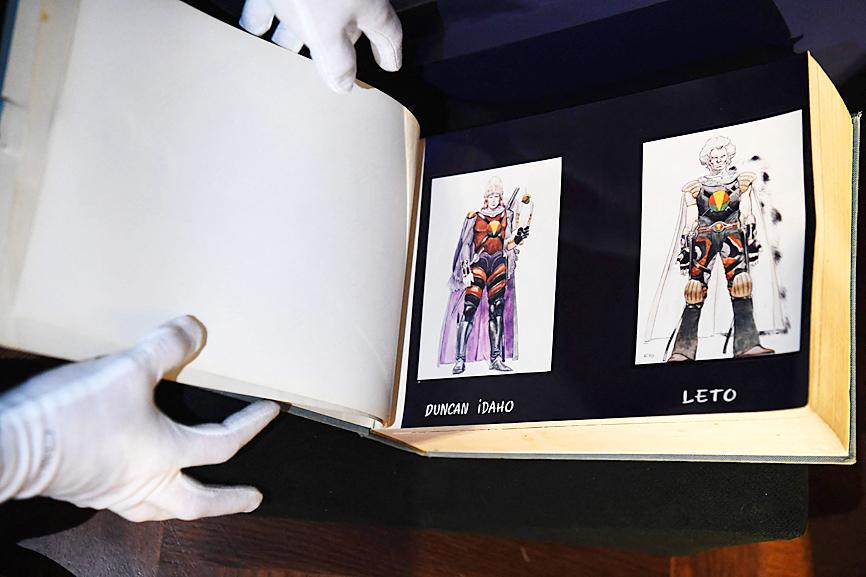

That came just days after a storyboard for the failed 1970s film version of Dune sparked a bidding war that pushed the price 100 times above the valuation to 2.7 million euros.

NEW INTEREST

Market watcher Artprice credits a transition to online sales for sparking new levels of interest, particularly in the US and Asia.

“The auction houses were very behind the times, but COVID forced them to modernize and the result is that online sales have been spectacular and have attracted a new audience,” Artprice founder Thierry Ehrmann said.

Many dynamics are changing, he said, giving the example of 30-somethings who prefer to collect art than buy their first home.

After an initial freeze as the COVID-19 pandemic took hold last year, online auctions exploded later in the year as millions hunted for new ways to kill time and spend money during lockdowns.

With stock markets soaring in the pandemic, the rich got significantly richer, while struggling to find ways to spend it. This has helped push the old masters to new heights. This month alone in New York, a Van Gogh went for US$71.3 million and a Kahlo self-portrait set a new record for the Mexican artist’s work at nearly US$35 million.

However, it has also created a hunger for almost anything collectable, from Michael Jordan sneakers (US$1.5 million), to an original copy of the US constitution (US$43 million) to an 800,000 euro bottle of Burgundy wine.

“At a time when many art fairs can’t happen in person and online viewing rooms are awful, auctions have become a predominant form of selling,” Anna Brady, art markets reporter for The Arts Newspaper, said on its podcast.

Brady highlighted the infusion of cash from a new source: crypto-millionaires. They have expanded from an initial focus on digital art — such as the mind-boggling US$69 million paid for a JPG file by one of its pioneers, Beeple, in March — into more traditional tastes.

Crypto “whale” Justin Sun has bought works by Pablo Picasso and Andy Warhol this year, and paid US$78.4 million for Alberto Giacometti’s The Nose sculpture this month.

Sun then triggered a lot of harrumphing among stuffed shirts of the art world by boasting about his purchase on Twitter — breaching their traditional codes of secrecy and discretion in a way that suggests an even more competitive market to come.

BUBBLE?

Is it all a bubble? It is a question that has been raised before, especially in the 1980s when the art market looked in danger of overheating under the pressure of a new generation of yuppies trying to flash their cash.

However, despite several cooling-off periods — including the 2008 financial crash and a sharp drop between 2015 and 2019 — the overall trend has been skyward.

Artprice says the contemporary art market has grown from US$103 million in 2000 to US$2.7 billion today.

“Buying and re-selling has become much more natural: to refine one’s collection, or following a divorce, or because our tastes have changed,” Ehrmann said.

Deloitte estimated last year that the uber-rich own US$1.45 trillion of art and collectables.

For these people, Ehrmann said, “there’s no longer a psychological barrier to paying more than a million dollars for something online.”

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

GREAT SUCCESS: Republican Senator Todd Young expressed surprise at Trump’s comments and said he expects the administration to keep the program running US lawmakers who helped secure billions of dollars in subsidies for domestic semiconductor manufacturing rejected US President Donald Trump’s call to revoke the 2022 CHIPS and Science Act, signaling that any repeal effort in the US Congress would fall short. US Senate Minority Leader Chuck Schumer, who negotiated the law, on Wednesday said that Trump’s demand would fail, while a top Republican proponent, US Senator Todd Young, expressed surprise at the president’s comments and said he expects the administration to keep the program running. The CHIPS Act is “essential for America leading the world in tech, leading the world in AI [artificial

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would