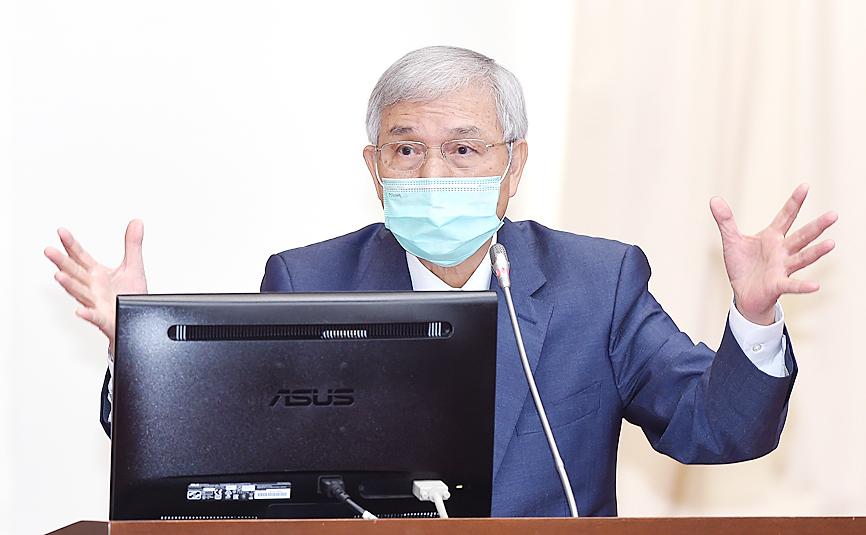

Raising interest rates before other economies would cause a surge in incoming funds and create chaos in the nation’s foreign-exchange market, central bank Governor Yang Chin-long (楊金龍) said yesterday.

Overseas funds could also invest in Taiwan’s overheated real-estate market and raise home prices further, Yang said at a meeting of the legislature’s Finance Committee when asked by Chinese Nationalist Party (KMT) Legislator William Tseng (曾銘宗) about a possible rate hike and its likely effects.

Yang said the central bank is closely monitoring how other central banks adjust their monetary policies, because acting alone could pose problems.

Photo: Liao Cheng-hui, Taipei Times

“Taiwan’s stock market remains sound, so if the central bank raises key interest rates by 25 basis points, it would not put much pressure on stocks,” Yang said.

The TAIEX closed down 14.77 points, or 0.08 percent, at 17,803.54 yesterday, after moving in a narrow range throughout the session. The benchmark index has risen 20.95 since the beginning of this year, Taiwan Stock Exchange data showed.

“But a rate hike in Taiwan before other countries act could send the New Taiwan dollar higher against the greenback due to large fund inflows,” he said.

Yang also raised concerns that the heavy influx of funds after a rate increase would boost liquidity in the domestic real-estate market, as soaring home prices have sparked outcries from younger Taiwanese who say they cannot afford to buy a home.

To rein in residential property prices, Yang said the central bank could consider introducing more select credit control measures in the next policymaking meeting.

Three separate rounds of credit control measures targeting institutional and retail home buyers have taken effect since the end of last year, mostly to lower the home loan-to-value ratio to prevent speculation, with mixed results.

Yang said the average home loan-to-value ratio for corporate buyers was lowered to 39 percent, from 64 percent before the measures were put in place, and the same ratio targeting buyers with at least three homes was also lowered.

The central bank has also increased inspections of loans extended by banks operating in Taiwan, including foreign banks, to the property market, urging banks to abide by the regulations to extend mortgages.

The central bank has carried out 51 rounds of inspections of the local banking industry so far this year, Yang said.

The central bank is to hold its next quarterly policymaking meeting on Dec. 16.

PROTECTION: The investigation, which takes aim at exporters such as Canada, Germany and Brazil, came days after Trump unveiled tariff hikes on steel and aluminum products US President Donald Trump on Saturday ordered a probe into potential tariffs on lumber imports — a move threatening to stoke trade tensions — while also pushing for a domestic supply boost. Trump signed an executive order instructing US Secretary of Commerce Howard Lutnick to begin an investigation “to determine the effects on the national security of imports of timber, lumber and their derivative products.” The study might result in new tariffs being imposed, which would pile on top of existing levies. The investigation takes aim at exporters like Canada, Germany and Brazil, with White House officials earlier accusing these economies of

Teleperformance SE, the largest call-center operator in the world, is rolling out an artificial intelligence (AI) system that softens English-speaking Indian workers’ accents in real time in a move the company claims would make them more understandable. The technology, called accent translation, coupled with background noise cancelation, is being deployed in call centers in India, where workers provide customer support to some of Teleperformance’s international clients. The company provides outsourced customer support and content moderation to global companies including Apple Inc, ByteDance Ltd’s (字節跳動) TikTok and Samsung Electronics Co Ltd. “When you have an Indian agent on the line, sometimes it’s hard

‘SACRED MOUNTAIN’: The chipmaker can form joint ventures abroad, except in China, but like other firms, it needs government approval for large investments Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) needs government permission for any overseas joint ventures (JVs), but there are no restrictions on making the most advanced chips overseas other than for China, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. US media have said that TSMC, the world’s largest contract chipmaker and a major supplier to companies such as Apple Inc and Nvidia Corp, has been in talks for a stake in Intel Corp. Neither company has confirmed the talks, but US President Donald Trump has accused Taiwan of taking away the US’ semiconductor business and said he wants the industry back

PROBE CONTINUES: Those accused falsely represented that the chips would not be transferred to a person other than the authorized end users, court papers said Singapore charged three men with fraud in a case local media have linked to the movement of Nvidia’s advanced chips from the city-state to Chinese artificial intelligence (AI) firm DeepSeek (深度求索). The US is investigating if DeepSeek, the Chinese company whose AI model’s performance rocked the tech world in January, has been using US chips that are not allowed to be shipped to China, Reuters reported earlier. The Singapore case is part of a broader police investigation of 22 individuals and companies suspected of false representation, amid concerns that organized AI chip smuggling to China has been tracked out of nations such