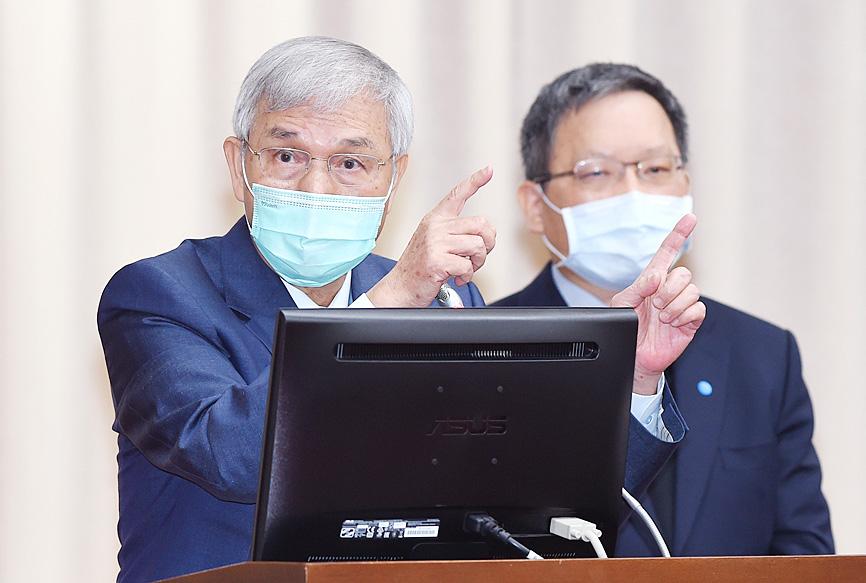

The central bank would not consider raising the interest rate unless inflationary pressures become uncontrollable, although it would consider further tightening credit to cool the property market, Governor Yang Chin-long (楊金龍) told a meeting of the legislature’s Finance Committee yesterday.

Yang said that consumer prices, interest rate decisions by major economies and the local responses to COVID-19 would guide the central bank’s policymaking.

The chance of rate hikes by the US Federal Reserve in the first half of next year stands at 50 percent after consumer prices in the US climbed by more than 5 percent for five straight months, Yang said.

Photo: Liao Cheng-hui, Taipei Times

The Fed has stood by its view that consumer price index (CPI) readings would slow in the second half of next year, although pressure is building for tightening measures, said Yang, who has taken cues from the Fed and described inflation at home and abroad as transitory.

Taiwan’s consumer prices grew 1.82 percent in the first 10 months and would not exceed the 2 percent alert level for the remainder of the year, Yang said, citing data from the Directorate-General of Budget, Accounting and Statistics.

Most research bodies expect the inflationary gauge in Taiwan to ease below 1.5 percent next year, while GDP growth would hover around 3 percent, affirming stable consumer prices, Yang said.

The forecasts show that neither inflation nor stagflation is a problem for Taiwan, although CPI values would remain relatively high in the first quarter of next year due partly to the low base effect, he said.

Consumer prices picked up this year after stalling last year, which affected some people, Yang said.

The pace of CPI gains is less noticeable if judging from two-year averages or over longer terms, the governor said.

However, Yang said the central bank would closely monitor existing credit controls to see if they are strong enough to induce a soft landing for the local housing market.

The governor said he saw both economic fundamentals and speculation underpinning current housing price rises.

The government has stiffened loan-to-value ratios for purchases of multiple homes, land financing, second-home mortgages in popular locations and income taxes from short-term property transactions, he said.

Those measures should help stem property inflation, the governor said, adding that the central bank would proactively review its policies and introduce stricter measures whenever necessary.

EARLY TALKS: Measures under consideration include convincing allies to match US curbs, further restricting exports of AI chips or GPUs, and blocking Chinese investments US President Donald Trump’s administration is sketching out tougher versions of US semiconductor curbs and pressuring key allies to escalate their restrictions on China’s chip industry, an early indication the new US president plans to expand efforts that began under former US president Joe Biden to limit Beijing’s technological prowess. Trump officials recently met with their Japanese and Dutch counterparts about restricting Tokyo Electron Ltd and ASML Holding NV engineers from maintaining semiconductor gear in China, people familiar with the matter said. The aim, which was also a priority for Biden, is to see key allies match China curbs the US

The popular Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) arbitrage trade might soon see a change in dynamics that could affect the trading of the US listing versus the local one. And for anyone who wants to monetize the elevated premium, Goldman Sachs Group Inc highlights potential trades. A note from the bank’s sales desk published on Friday said that demand for TSMC’s Taipei-traded stock could rise as Taiwan’s regulator is considering an amendment to local exchange-traded funds’ (ETFs) ownership. The changes, which could come in the first half of this year, could push up the current 30 percent single-stock weight limit

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

‘SACRED MOUNTAIN’: The chipmaker can form joint ventures abroad, except in China, but like other firms, it needs government approval for large investments Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) needs government permission for any overseas joint ventures (JVs), but there are no restrictions on making the most advanced chips overseas other than for China, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. US media have said that TSMC, the world’s largest contract chipmaker and a major supplier to companies such as Apple Inc and Nvidia Corp, has been in talks for a stake in Intel Corp. Neither company has confirmed the talks, but US President Donald Trump has accused Taiwan of taking away the US’ semiconductor business and said he wants the industry back